No matches

We couldn't find any matches for "".

Double check your spelling or try a different search term.

Still can't find what you're looking for? Check out our featured articles.

Featured Articles

The long game for crypto

AI needs crypto — especially now

TABLE OF CONTENTS

(1) The design challenge of web3 decentralization- (1) The design challenge of web3 decentralization

- Technical decentralization

- Economic decentralization

- Legal decentralization

- (2) How the components of web3 systems can be used to achieve decentralization

- Blockchain networks and smart contract protocols

- Digital assets

- Decentralized governance

- (3) Models of decentralization in practice

- Full decentralization: How to decentralize DeFi and other simple applications

- Open decentralization: How to decentralize complex web3 applications

- Open decentralization: How to decentralize projects with IP (and third-party resources)

- Open decentralization: How to decentralize NFT projects

- Open decentralization: How to decentralize tokenization protocols

Tags

The promise of decentralization has been heavily discussed and debated, from why it matters to the bigger question of who will control the software that powers the internet. These questions are critical, because as we have seen, when control is held in the hands of a very few, encroachments on personal freedom, choice, and privacy are inherent. “Don’t be evil” is very different than “can’t be evil” when a CEO decides one course or another.

But decentralizing the internet has been hard to do. When contrasted against the well-established efficiency and stability of centralized systems, decentralized systems have struggled to keep pace. Now, however, the emerging technology of crypto and web3 — specifically, programmable blockchains, composable smart contracts, and digital assets — makes it possible for decentralized systems to achieve unprecedented levels of coordination and operational functionality. This evolution enables new forms of governance and organizations, community-owned-and-operated networks and services, robust economies, and countless other innovations.

We’ve already seen specific categories such as decentralized finance (“DeFi”) and core infrastructure projects take off, and will soon see decentralized versions of existing web2 categories like social media, video games, music, and marketplaces. The success of these systems will depend on their ability to deliver the actual benefits of decentralization, including more equitable ownership among stakeholders, reduced censorship, and greater diversity. But the more familiar models of decentralization used for DeFi won’t necessarily work for these more complex systems (that is, those with more UI features, richer client experiences, centralized products or services, or licensed IP).

So, I thought it would be useful to share specific models and principles of decentralization gleaned from the past several years of working closely with crypto founders, to guide web3 builders tackling what decentralization means in practice, across several use cases. Depending on where you are in your web3 journey, I welcome you to read the full piece below; read the more comprehensive paper that this piece is based on (which includes additional background and details); or jump ahead directly to:

- a framework for understanding the design challenge of web3 decentralization;

- a summary of how builders can use the novel components of web3 systems to achieve decentralization;

- an analysis of several models of decentralization and how they apply in practice.

(1) The design challenge of web3 decentralization

Decentralization can be thought of as a single design challenge that spans three different, but interrelated elements: technical, economic, and legal. Understanding the differences in these elements is key to designing web3 systems because design decisions with respect to one affects the others.

Technical decentralization

Technical decentralization relates primarily to the security and structural mechanisms of web3 systems. The core innovation behind programmable blockchains is that they can support technical decentralization by providing a permissionless, trustless, and verifiable ecosystem in which value can be transferred — and, more importantly, upon which web3 products and services can be built.

This means that products and services can be deployed and run without requiring trusted, centralized intermediaries to operate (or pull the rug out from under) them, opening a vast world of possibilities. For these reasons, technical decentralization acts as the foundation upon which the other two types of decentralization can occur: economic and legal.

Economic decentralization

Economic decentralization relates to the economies of web3 systems. The advent of programmable blockchains (such as Ethereum, Solana, and Avalanche) and digital assets (such as ETH, SOL, and AVAX) unlocked the ability of open source and decentralized systems to finally have their own decentralized economies (i.e., autonomous free-market economies).

This is a critical breakthrough. The open source and decentralized protocols of previous generations of technology like web1 (such as http, smtp, ftp, etc.) stagnated because they lacked the ability to incentivize ongoing development and/ or further investment of critical resources back into their systems. This left fertile ground for the centralized companies of web2 to emerge and succeed as they were able to leverage their efficiency and resources to build products and services that surpassed those of web1. But this centralization also led to countless examples of user rights abuses, de-platforming, and aggressive take-rates.

Now, the technology underpinning web3 makes it possible for far more sophisticated open source and decentralized systems to be created — and enables decentralized economies to form around them — which will enable the products and services of web3 to compete with and eventually surpass those of web2.

Builders of web3 systems can facilitate the formation of decentralized economies through careful design decisions that lead to their systems accruing “value” — whether information, economic value, voting power, or other form — from a broad array of sources, and distributing that value equitably among system stakeholders according to their contributions. In order to achieve this, web3 systems need to vest meaningful power, control, and ownership to system stakeholders (via airdrops, other token distributions, decentralized governance, etc.). This in turn encourages stakeholders to contribute meaningful value, because they have agency over how their contributions are treated and rewarded.

The ongoing balancing of incentives among the stakeholders — developers, contributors, and consumers — can then drive further contributions of value to the overall system, to the benefit of all. In other words: all the benefits of modern network effects, but without the pitfalls of centralized control and captive economies.

Legal decentralization

Legal decentralization relates to the legality of web3 systems. In this piece, I focus primarily on U.S. securities laws, which dictate how and whether web3 systems may make use of their own native digital assets. While there is no codified standard of “legal decentralization,” a first-principles analysis of U.S. securities laws, case law, and SEC guidance (including the SEC’s definitive guidance from April 2019) can help us formulate a practical standard.

To start, U.S. securities laws are generally intended to create a “level playing field” for securities transactions by limiting the ability of those with more information from taking advantage of others with less information. This is the principle of information asymmetry, and U.S. securities laws typically seek to eliminate asymmetry in certain securities transactions by applying disclosure requirements. The principle plays a role in the Howey test, the subjective test that determines whether U.S. securities laws should apply to a digital assets transaction where there is (1) an investment of money (2) in a common enterprise (3) with a reasonable expectation of profit (4) primarily based upon the managerial efforts of others. The fourth prong seeks to address information asymmetry on the basis of the belief that where there is a reliance on “managerial efforts”, the risk of information asymmetry (of the managers versus outsiders) is likely high, and therefore the application of securities laws may be necessary.

Based on the above and SEC guidance, we can surmise that if a web3 system can (a) eliminate the potential for significant information asymmetries to arise and (b) eliminate reliance on essential managerial efforts of others to drive the success or failure of that enterprise, then the system may be “sufficiently decentralized” such that the application of U.S. securities laws to its digital assets shouldn’t be necessary. For purposes of this piece, I refer to these systems as being legally decentralized. Admittedly, the legal decentralization threshold will not be capable of being met by most businesses, but as I outline below, the novel components of web3 systems uniquely position them to meet such a threshold.

Collectively, these three separate aspects of decentralization — technical, economic, legal — must be viewed holistically, as a single design challenge, because design decisions with respect to one will affect another. In general, the interplay between technical, economic, and legal is primarily additive, not subtractive — developments in one create more possibilities in the others. For example: Decentralized economies help drive systems towards legal decentralization by prioritizing decentralized ownership among stakeholders, value accretion from decentralized sources, and value distribution to decentralized stakeholders. All of these decrease the risk of information asymmetries and the need to rely on managerial efforts of individuals.

For more background on legal and economic decentralization and how these aspects fit together, see the full paper.

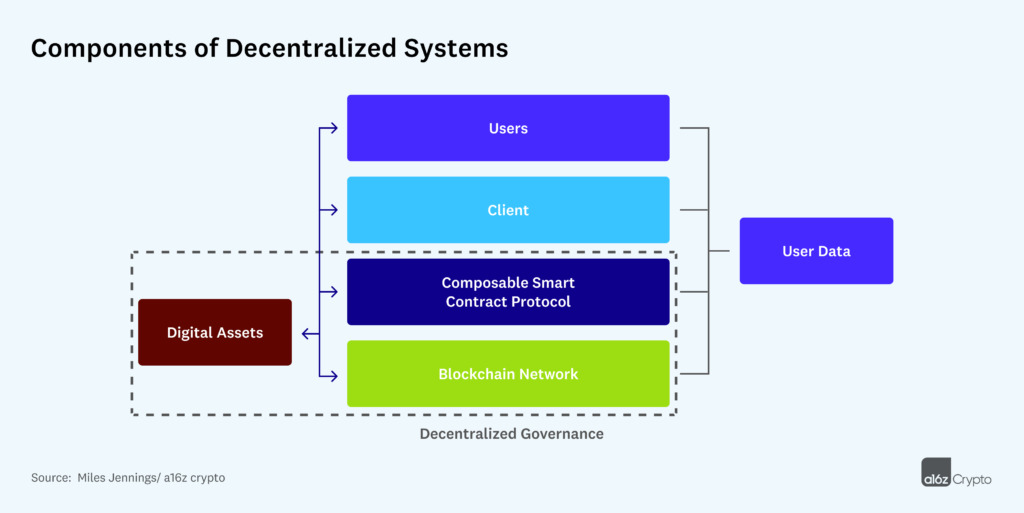

(2) How the components of web3 systems can be used to achieve decentralization

When web3 systems are designed well, decentralization becomes a virtuous, not vicious circle. Now that we have a framework for the design challenge of decentralization, let’s quickly review how builders can use the below novel components of web3 systems to drive decentralization in practice:

Blockchain networks and smart contract protocols

At a fundamental level, blockchain networks and smart contract protocols enable technical decentralization. But they can also be designed in a manner that promotes both economic and legal decentralization as well, including:

- by enabling transparency — for example, anyone can currently view where the most digital assets have been deposited, and where the most fees are being earned in Ethereum’s DeFi ecosystem;

- by being open-source public goods — anyone is free to use and test functionality to ensure safety, foster decentralized economies, more;

- by allowing data portability, mobility, and interoperability — users retain control of their data, purchases, and content across web3 products and services;

- by prioritizing composability — elements can be programmed to interact with each other, making these programs like building blocks that anyone can use.

Collectively, these features reduce the risk of information asymmetry, reduce the importance of any web3 system’s proprietary technology, and increase the importance of the system’s network of contributors and consumers relative to its developers.

In other words: These features shift the system’s value from its tech stack, to its network. As networks are more open and diffuse than proprietary systems, this shift highlights why web3 systems are better positioned than web2 systems to achieve decentralization.

Digital assets

The decentralized economies of web3 systems are driven by a combination of two types of incentives:

- Intrinsic incentives, which trigger a third-party’s innate desire to participate in such systems based on the system’s underlying characteristics, such as user base, network effects, technology, etc.

- Extrinsic incentives, such as digital asset distributions, revenue sharing, etc.

Of these, digital assets are the most critical tool web3 builders have to facilitate the formation and ongoing functioning of their decentralized economies because they enable the balancing of incentives among developers, contributors, and consumers.

When properly designed, digital asset distributions therefore have the potential to drive a “flywheel” of network effects where the overall system becomes more valuable to more users as more people participate in the network. But unlike the locked-in network effects of web2, web3 digital assets empower users to shape their own experience and benefit from their contributions.

Successful user acquisition and retention can significantly improve the intrinsic incentives of web3 systems for developers and contributors, driving greater value by such parties to the systems, which ultimately attracts more users, and so on. Ethereum’s growth over the last two years is a prime example of this: From the start of 2020 to the start of 2022, the amount of digital assets deposited in Ethereum’s DeFi protocols grew from just over $600 million to just over $150 billion. But this isn’t a narrative about the amount and their monetary value — rather, it shows how developer activity yielded products and services that attracted users, which then attracted more developers and additional products and services, which in turn led to further user growth.

In addition to potentially creating such a flywheel, the network effects of web3 systems can also provide builders a moat against competitors copying and redeploying their infrastructure, which is all open source. How so? Because for systems with strong network effects, replication alone is unlikely to incentivize users to switch to the new system.

Again, this highlights that the true value of a web3 system will be in its network of stakeholders — not in its tech stack, a closed or proprietary system, or other classic moats.

Decentralized governance

The vast majority of blockchain networks and smart contract-based protocols have decentralized governance administered by a decentralized autonomous organization (“DAO”). Decentralized governance and DAOs provide many benefits along each of the three decentralization criteria already discussed, including that they:

- Make web3 systems more secure, by distributing technical control over such systems to decentralized groups — thereby limiting the ability of any single party to take control of the system’s governance.

- Provide stakeholders with meaningful representation in decisions and ensure long-term incentive alignment among stakeholders. This feature, along with the enhanced security, helps make decentralized governance more effective — allowing it to contribute to the overall health and sustainability of the decentralized economies of web3 systems.

- Support legal decentralization by reducing stakeholder reliance on the managerial efforts of any individual or group — thereby reducing the risk of potential information asymmetries.

In designing decentralized governance for any web3 system, we can borrow some insights from the several different models that have already been developed and implemented across the DeFi sector. For example:

SubDAOs. To streamline decision making, several DAOs empower subDAOs with tailored authority regarding certain categories of actions, such as legal, finance, development, etc.

Governance minimization. To increase the dependability of DeFi protocols, and overcome challenges with DAO participation rates, some have called to minimize the ultimate number of decisions that DAOs are required to make, or to alternatively create a hierarchical structure in which more significant decisions require higher voting quorums.

Incentivize participation. To ensure effective DAO governance, some DAOs incentivize active participation, including the compensation of delegates. Note that while grant programs have not worked as well here, retroactive awards programs can be very effective because they defer the assessment and awarding of contributions until after the value has been delivered. They can also help spur competition and an open marketplace if designed well.

Progressive decentralization. To protect against malicious attacks, many DAOs use “progressive decentralization”, where greater control is handed from the developer company to the community as the safety of the protocol/ network increases.

Ultimately, web3 builders should be careful not to vest too much power in the hands of insiders. Instead, significant control should be given to the community. Where there are imbalances in power, web3 builders should look to delegate programs to help diffuse it.

In striking this balance, web3 builders should also look to instill safeguards against malicious attacks, including potential manipulation of decentralized governance for profit. While the use of off-chain governance mechanisms and multisigs (where control requires multiple multi-signature holders, each with their own keys, to authorize an action) have been common safeguards used for this purpose, they have recently been subject to significant criticism, including their potential to undermine decentralization.

For more examples of how all of the above components can be designed to enhance decentralization, and a discussion of further best practices, see the full paper.

(3) Models of decentralization in practice

Let’s now look at how the technical-economic-legal framework I shared earlier applies to several different models of decentralization in practice. These models include “full” decentralization (where every component of a system is decentralized) to “open” decentralization (where independent third parties all participate in a shared decentralized system). I have also included models for specific applications of open decentralization, such as NFTs projects and tokenization protocols.

Full decentralization: How to decentralize DeFi and other simple applications

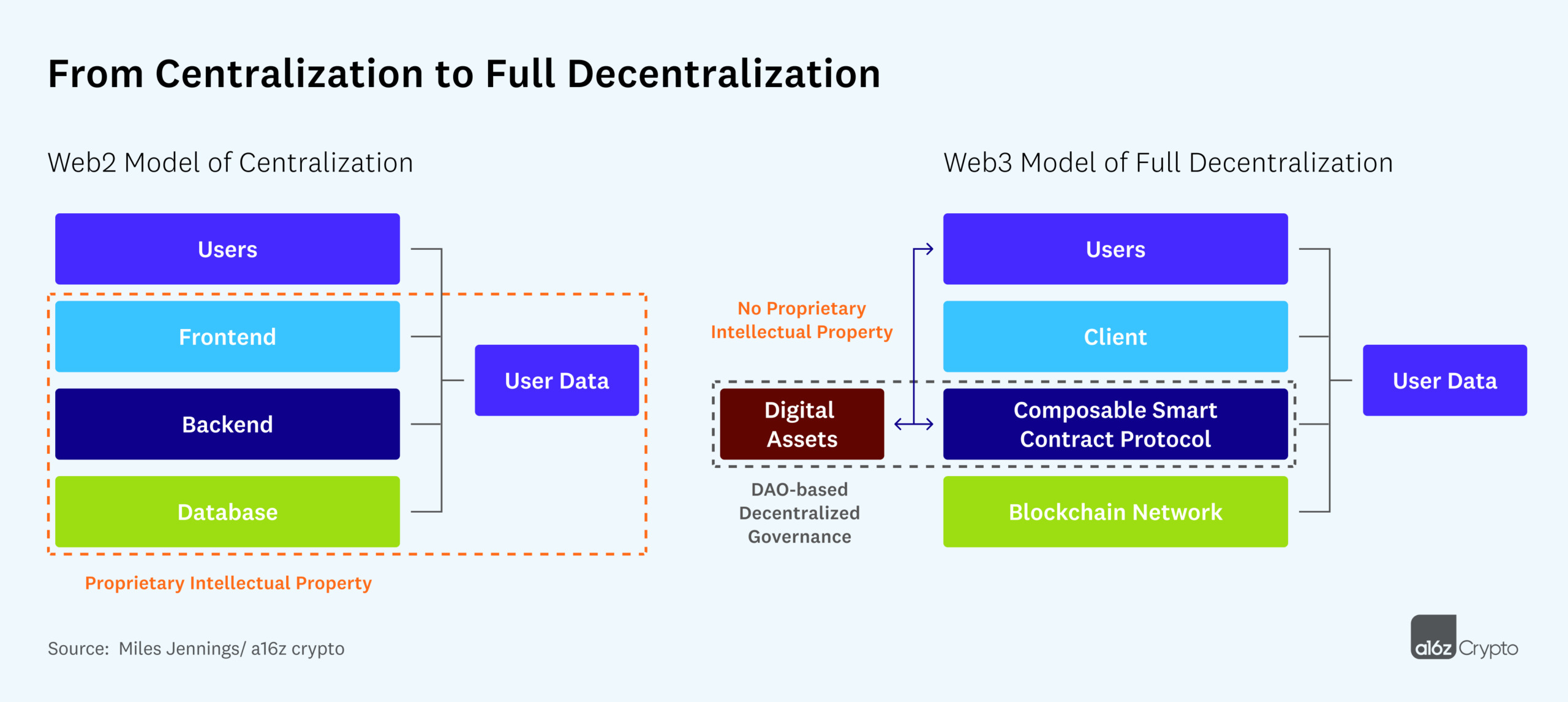

Full decentralization is currently the most common model of decentralization within the DeFi sector. As reflected in the images below, the shift from a centralized model (as in web2) to a decentralized model (as in web3) involves:

- deploying an open-source smart contract protocol to a decentralized and programmable blockchain network to form the core infrastructure layer of the web3 system — the smart contract protocol provides an execution layer for all of the components of the backend that can be deployed on-chain (i.e., payments, messaging, etc.);

- operating a “client” layer in a decentralized manner — the client represents all of the system’s software that operates off-chain, and acts as a gateway to the smart contract protocol (clients can range from being simple frontend websites to complex applications);

- adding digital assets distributions — this could be an airdrop to contributors and consumers; issuances to insiders (employees, advisors, and stockholders of the developer company); the allocation of digital assets to an explicit incentivization scheme (such as liquidity mining in DeFi); and the formation of a treasury controlled by the DAO, to be used in connection with any future incentivization;

- launching DAO governance of the smart contract protocol and DAO treasury; and

- ensuring users own and retain their own data (currently a huge contention in web2 systems).

This full decentralization model assumes that the web3 system is a novel smart contract protocol deployed to an existing programmable blockchain network. “Users” here denotes both consumers and contributors.

For web3 systems that use this model, the decentralization of the blockchain network and smart contract protocol is achieved primarily as a result of the technical decentralization of those layers, and by launching decentralized governance in the form of a DAO that takes control of the smart-contract protocol from the developer company that created the system. Deploying the smart contract protocol to a public blockchain and launching its DAO results in transparency as well as greater safety and security for the system, and it means that no individual or group controls the system.

The decentralization of the client layer then happens in a few different ways. Within DeFi, where most clients are just simple frontend websites that provide a gateway to the underlying smart contract protocol (that is, they allow users to interact with the protocol), most developer companies make their client/ website open source, and host it on a decentralized file system (such as IPFS). With the client/ website open source, third parties that are independent from the developer company often end up hosting their own clients/ websites providing access to the same underlying protocol. In addition, independent third parties often build gateways to the protocol into their own aggregators and dashboards. This means that gateways to the protocol are always available, regardless of whether the developer company’s client/ website is maintained.

The above steps mostly eliminate the potential for information asymmetries — the impetus for much of the U.S. securities laws — because (1) information about the protocol and its operations are transparently available on a public blockchain ledger, and (2) the managerial efforts of the developer company that launched the protocol are no longer critical to the success or failure of such protocol.

And since the blockchain and smart contract layers are operational and not controlled by any group or entity, the system has full redundancy and is no longer reliant on the developer company. DeFi primitives are a great example of this because they require little to no ongoing development to continue providing users with utility. As a result, protocols implementing this decentralization model could be considered legally decentralized, even without a fully functioning decentralized economy.

Limitations of full decentralization

Although the full decentralization model has been successfully used in DeFi, its simplicity could make it unsuitable for more complex web3 systems. Builders should be aware of and plan for these factors, which can introduce complexity:

Complex clients. The decentralization of clients within DeFi is somewhat straightforward given their relative simplicity — very little incentivization is necessary to get third parties to build independent and simple gateways (mostly in the form of websites) to such protocols. However, as web3 products and services become increasingly complex, with computationally expensive/ resource-intensive client layers built on top of underlying smart contract protocols, the decentralization of the client becomes more complicated. For example, consider the difference in complexity of the clients/ websites that provide access to the Uniswap and Compound protocols, as compared to hypothetical web3 social media clients, which would need the full-featured functionality of web2 applications like Twitter and Instagram. Such complexity could reduce the pool of third parties that are willing to build and/ or host alternative clients, or that are willing to integrate access to the protocol layer within their own systems without explicit incentivization.

Significant improvements required. Similarly, systems that require significant improvements post-digital asset launch may find it difficult to make those improvements in a decentralized manner. For example, in DeFi, many protocols have struggled to successfully use explicit token incentives to drive ongoing meaningful development of their smart contract protocols.

Ongoing operations. Developer companies may intend to undertake significant operations to enhance the value of their web3 system post-launch of their digital asset. This could undercut the system’s decentralization if additional contributions of value don’t also come from independent third parties. Furthermore, as governance tokens alone do not typically confer any rights to future products and services that a developer company may produce, developer companies should take care not to give token holders the impression that any such relationship exists.

Retention of exclusive rights. If the original developer company (or others) retain exclusive rights to any intellectual property used in the system, it may undercut the system’s full decentralization. For instance, if developers of complex clients for web3 social media wanted to keep such clients proprietary, full decentralization could be unachievable.

Each of these limitations can be overcome by web3 systems that are able to stimulate significant economic decentralization, creating functioning decentralized economies. If a decentralized group of developers, contributors, and consumers builds and receives significant value — thereby diluting the importance of the original developer to the overall system — it moves the system from a full decentralization model to an open decentralization model.

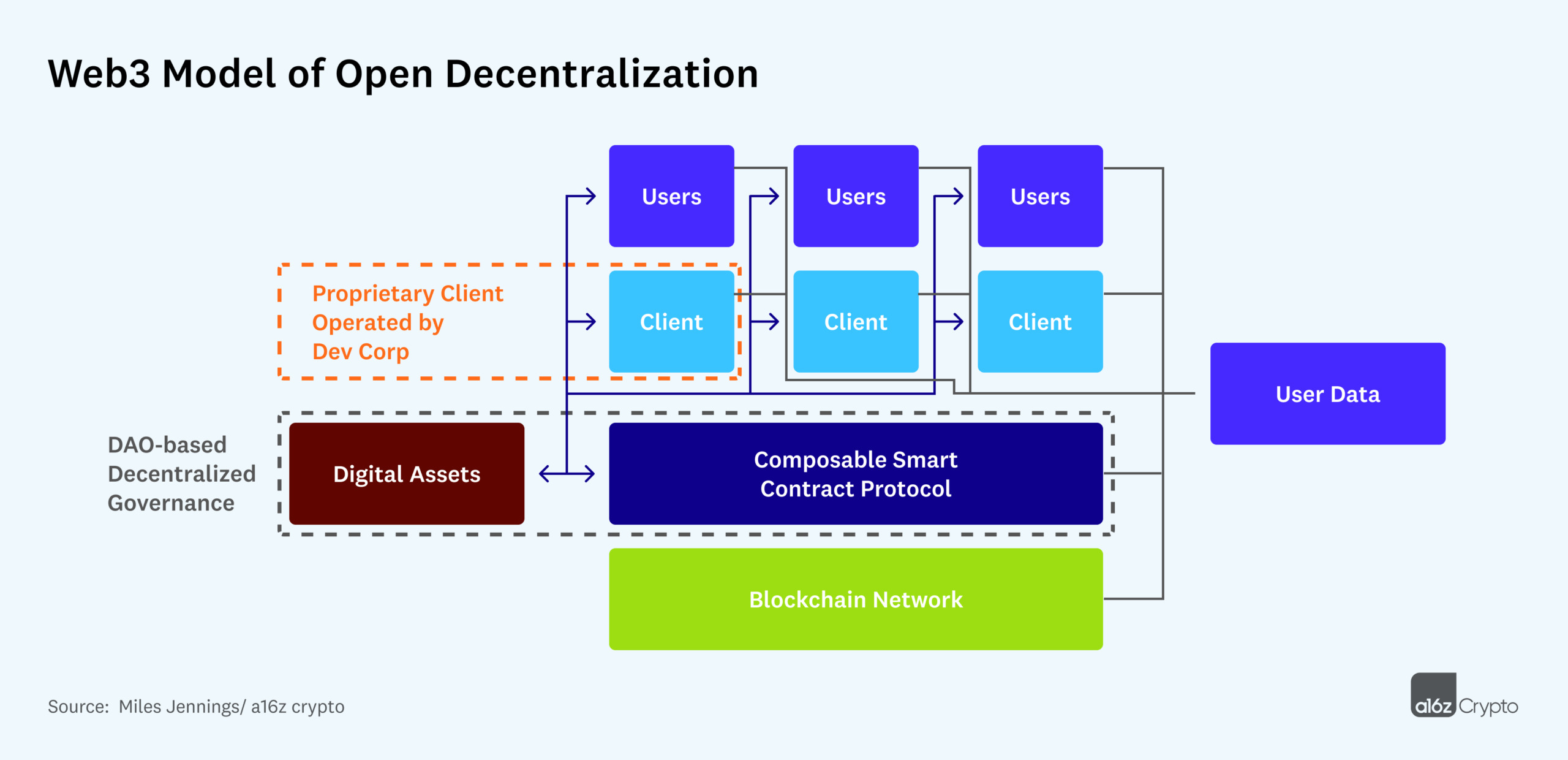

Open decentralization: How to decentralize complex web3 applications

As with the full decentralization model, the open decentralization model includes a decentralized blockchain and smart contract protocol layer, digital assets, and a DAO.

But unlike the full decentralization model, an open decentralization model would also have independent developers building and operating several clients (which may be centralized) on top of a shared smart contract protocol layer. For instance, think of potentially rich and complex clients for web3 social media that have functionality similar to web2 applications like Twitter and Instagram, but that all use a shared smart contract protocol rather than separate proprietary backend systems.

This model assumes that the web3 system is a novel smart contract protocol deployed to an existing programmable blockchain network. “Users” here denotes both consumers and contributors.

In this open decentralization model, all of the clients would utilize the digital assets of the underlying smart contract protocol, and their creation and operation would be incentivized as follows:

- Initial Incentives. Initial development could be incentivized through explicit and implicit incentives, including awards of digital assets from the DAO-controlled treasury of the smart contract protocol; the network effects of the protocol; and the fact that such developers could retain intellectual property rights of their respective clients.

- Ongoing Incentives. Ongoing maintenance and continued development could be similarly incentivized, with digital asset-based incentives being awarded automatically based on performance metrics established by the DAO. One example of this in DeFi is Liquity Protocol, which rewards the hosts of independent frontend websites that provide access to the protocol with awards tied to the economic activity driven by such frontend websites to the protocol. In more complex web3 systems, we would expect to see the prevalence of such awards increase significantly. For example, in a decentralized social media ecosystem, a client’s user engagement could be measured and rewarded via tokens. Finally, in addition to incentives from the protocol, the operators of clients would be incentivized by any financial returns they are able to generate through their own proprietary clients.

Builders seeking to decentralize their web3 systems via the open decentralization model will need to design their incentive mechanisms and their decentralized governance models to be “client agnostic” to encourage participation by many actors. In addition, they will need to ensure no significant imbalances of power accrue to a single client in a manner that would enable it to dominate the entire ecosystem. If such imbalances could easily occur, then the builders of these clients could view the web3 system unfavorably and be less willing to invest their time and resources in it. In some ways, such a system would have similar centralization and control problems as web2 systems.

Builders using the open decentralization model should also prioritize transparency, open-source technology, data portability, and composability to further reduce the risk of power over their systems becoming concentrated in the hands of developers. These features remove information asymmetry, lower the barrier to entry for competing developers, and permit users to switch between clients — all of which fosters a more open and decentralized ecosystem, where users are not subjected to the constraints or burdens applied by any one client. (This is a huge obstacle in current web2 systems, where user data is siloed in each captive web2 system.)

Finally, in order for the decentralized economy of the system to be truly resilient, the success or failure of the entire web3 system should not be dependent on any individual or group, including any individual client. If this condition, along with the economic decentralization conditions set forth above, are met with respect to a web3 system, then the risk of significant information asymmetries arising in such a system would be significantly reduced, making it legally decentralized.

It may at first be counterintuitive to suggest that builders should prioritize the above design decisions because they effectively incentivize their own competition. But doing so will help lead to the formation of a functional decentralized economy built on shared infrastructure, which will in turn lead to a far more expansive and richer ecosystem than any individual company would be capable of building alone.

In other words: these actions grow the entire pie rather than prioritize one slice of it.

Web3 versions of web2

To see how the principles play out in practice, let’s apply the open decentralization model to create simplified web3 versions of familiar web2 applications. The promise of web3 goes beyond merely disintermediating known features and applications, as it makes entirely new things possible; but I’ll focus on some simple examples for the purposes of illustration.

Web3 gaming could entail a system with multiple games implementing a shared smart contract protocol and governance token; having separate in-game currencies and NFTs; and enabling both players and contributors to earn digital assets. These assets would also be portable across the ecosystem. The games driving the most use could then earn the greatest percentage of the governance tokens distributed by the system’s DAO, leading game creators to in turn fund additional development of their games.

Web3 social media could entail a system with multiple iterations of social media services and messaging services, each built as a separate client upon the same open-source smart contract protocol. Since the protocol would share a native governance token: consumers would earn tokens based on use, contributors would earn tokens based on the content they create, and clients would earn tokens based on various metrics established by the DAO.

Web3 marketplaces could entail a system where a collection of smart contracts and clients to coordinate service providers, as well as facilitate their interactions and scheduling with customers. Developers could then build white-label versions of those clients, enabling providers to offer many different levels of customized services or products. Clients and service providers would all earn the same governance token based on their contributions to the system. There are a growing number of examples of how web3 businesses are already using tokenomics to create and capture long-term value.

Ultimately, the open infrastructure — made up by the blockchain network and smart contract protocol in this model — provides a rich environment for a variety of specialized products and services to be built on top of its layers. By utilizing this shared infrastructure, builders can build web3 products and services at a fraction of the cost of building centralized web2 applications from scratch.

Progressive open decentralization

One challenge resulting from the interplay between economic decentralization and legal decentralization in the open decentralization model is that it often results in a chicken-or-the-egg paradox: True economic decentralization may necessitate the use of digital assets (i.e., legal decentralization), but the use of digital assets necessitates economic and, consequently, legal decentralization. This problem is particularly acute in models of open decentralization, which require fully functioning decentralized economies (as compared to DeFi protocols using models of full decentralization, which don’t necessarily require economic decentralization).

While there are many ways to approach this problem from a technical and practical perspective, web3 systems can utilize a process of progressive decentralization and take precautions with respect to digital assets distributions prior to achieving full decentralization. These precautions include, among other things, limiting transferability and limiting issuances and listings in the United States until such time as the system is fully decentralized.

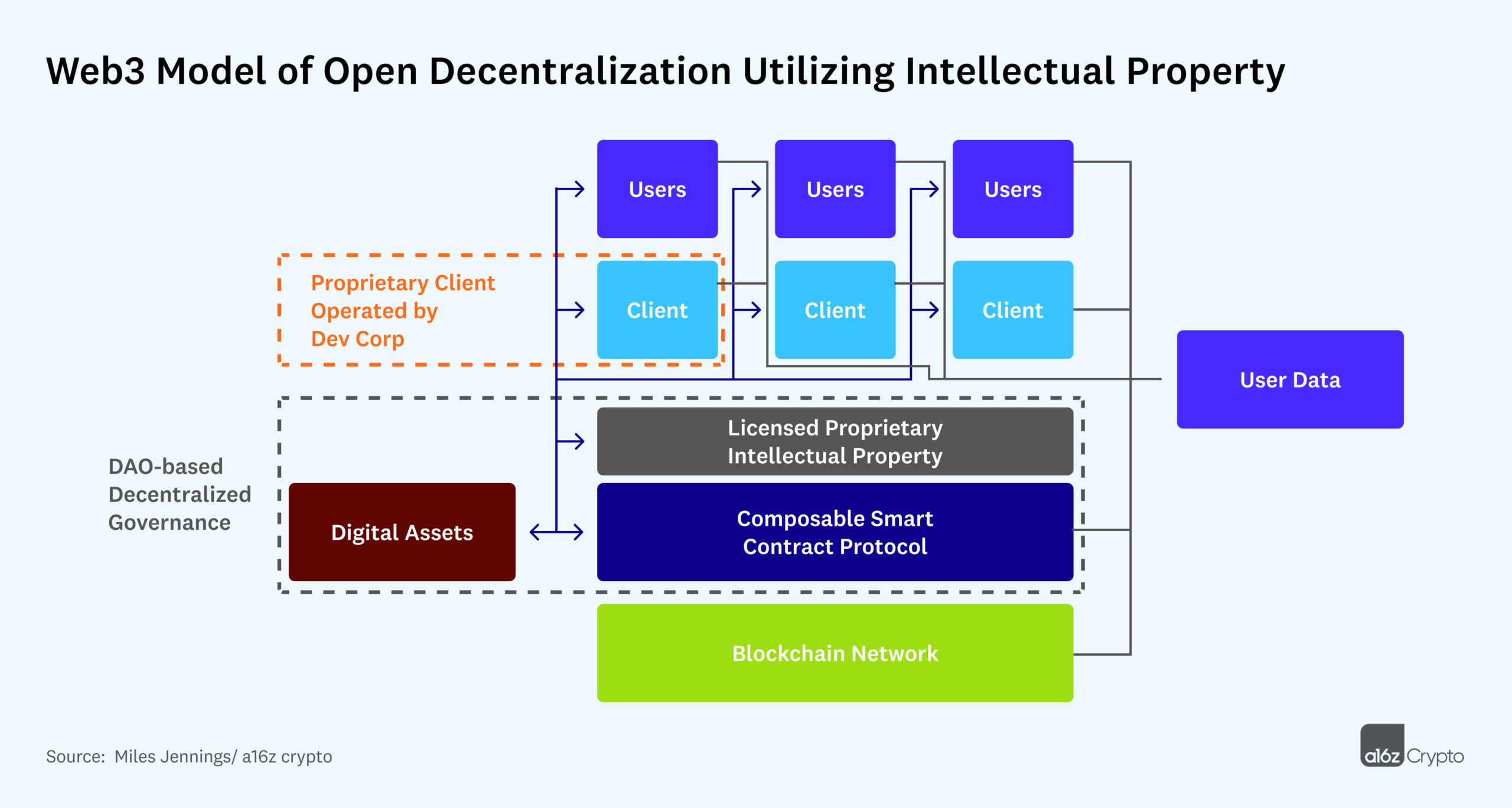

Open decentralization: How to decentralize projects with IP (and third-party resources)

An iteration of the open decentralized model that is worth further exploration is one where a third party contributes a resource to the web3 system, with the intention that the system clients use it for their products and services.

This could take the form of licensing intellectual property (a video game engine, a data asset, a marketplace, etc.), as well as an array of services (including regulatory compliance, marketing and business development) that anyone in the ecosystem could use for or incorporate into their own client. The below model reflects intellectual property being contributed to the web3 system:

The introduction of proprietary intellectual property may appear to revert some of the system’s decentralized economy back to an owner-controlled web2 economy, especially if developers/ operators of the clients are unwilling to subject their products and services to the whims and control of the intellectual property owner.

However, such risk could be mitigated through the contractual terms of the license (through irrevocable/ perpetual duration, rights to modify/ improve, and so on). An important consideration in this regard would be what services and ongoing maintenance of intellectual property is required, and whether such services and maintenance (if at all) could be provided by independent third parties — because greater reliance on a single third-party owner of the intellectual property could undercut the system’s overall economic decentralization.

Ultimately, if the terms of the web3 system were structured correctly, its decentralized economy would remain intact. For example, a web3 system using a widely available API (application programming interface) in its clients wouldn’t undercut the overall decentralization of the web3 system, but would likely enhance it.

From a legal decentralization perspective, the key questions to consider are: If the essential managerial efforts of the provider of the intellectual property are necessary to drive the success or failure of the web3 system? Would there be potential for significant information asymmetries to arise? Even if the intellectual property was critical to the success of the system, if the owner of the intellectual property could not revoke it at any time, then the answer to both questions could be no — thus supporting the legal decentralization of the system. This would also be the case if the owners of the intellectual property had to seek approval from the DAO prior to making any critical changes to the intellectual property.

This concept can be extended beyond intellectual property to other resources that might be contributed or licensed to a web3 system as well. For instance, if a third-party regulatory compliance service enabled DeFi protocols to confirm their users were verified U.S. persons, such a service should not undermine the decentralization of the web3 system. Similarly, one could imagine third parties providing marketing and business development-related services to the protocol — independent of the activities of the individual client businesses.

While there are many ways in which the introduction of third-party resources could harm the decentralization of the system, such risks (as with the above) can generally be mitigated through structural and contractual mechanisms.

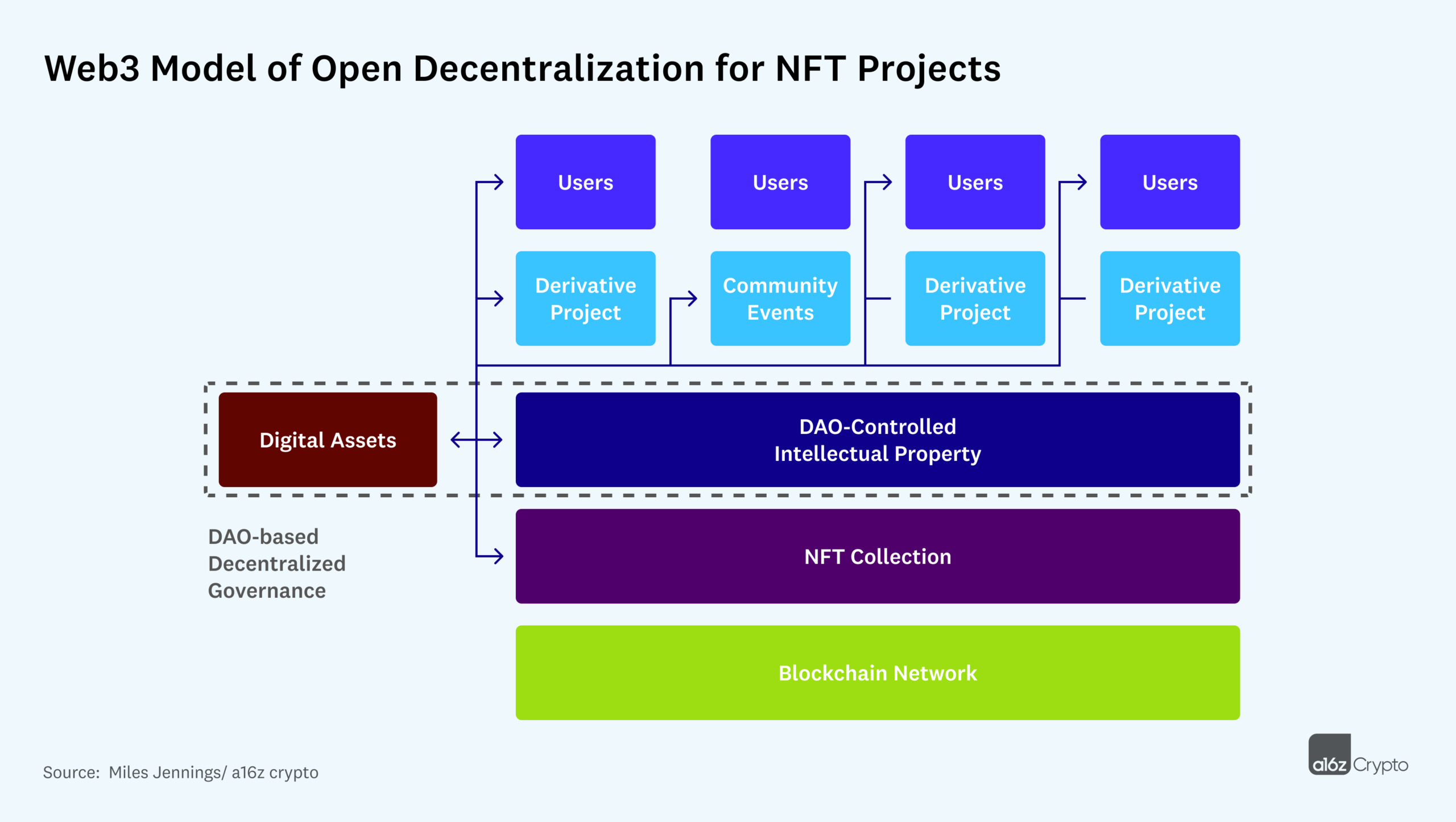

Open decentralization: How to decentralize NFT projects

Non-fungible token (NFT) projects and their communities are an emerging and increasingly popular type of web3 system that offer a good opportunity to discuss some additional concepts of open decentralization.

First, it’s important to understand the legal basis for why most artistic NFTs can be excluded from U.S. securities law, which is that they fail the fourth prong of the Howey test: The value of an NFT is largely intrinsic and not derived from the managerial efforts of others. But as NFT projects have grown in complexity, the Howey analysis has become less straightforward. NFT projects now often involve additional content creation/ additional NFT drops, implementation of NFTs in video games, community-driven product development, and other activities — all of which potentially increase the reliance of NFT holders on the managerial efforts of others.

NFT projects should therefore consider incorporating the principles of decentralization into their web3 systems, particularly if they intend to couple the project with a fungible token. What would that model of NFT project decentralization look like? The image below is one example. It reflects: (1) an NFT collection minted on a blockchain and held by various users; (2) intellectual property contributed to the NFT community, most likely relating to the NFTs themselves (which could be “staked” to the community by the holders) and any lore created by the community; (3) digital assets distributions and incentivization mechanisms; (4) the launching of DAO governance with respect to the community intellectual property and DAO treasury; (5) the initiation of derivative projects; and (6) the hosting of social gatherings and events.

In this model, economic decentralization for NFT projects can be achieved through several steps:

- First, the DAO could use its initial resources on community engagement (e.g., Twitter,Discord, etc.) and to fund social gatherings and other events — thereby boosting the implicit incentives of the community (i.e., its popularity).

- Second, those implicit incentives — along with explicit incentives (such as fungible token awards, access to NFT sales, etc.) — could then be used to incentivize the creation of derivative projects utilizing the community’s intellectual property. Developers would receive rewards for developing such projects, and consumers would receive awards for using them. For example, the DAO could employ a third-party developer to create a play-to-earn game using the community’s characters, with in-game tokenomics featuring the native digital asset of the community. In this regard, derivative projects act similarly to the clients described in the earlier open decentralization models, making the overall system less dependent on any single source to drive value to NFT holders, which helps limit the risk of significant information asymmetries arising.

- Finally, another significant tool that NFT projects have at their disposal are royalties on secondary sales of NFTs accruing to the DAO, which can fuel their decentralized economies. These royalties would provide the DAO with a decentralized revenue stream during periods in which derivative projects may not be producing sufficient returns for the system.

Eventually, the combination of value accruing to the ecosystem from derivative projects and secondary sales could drive the creation of a healthy decentralized economy for the NFT project.

From a legal decentralization perspective, the key questions would again be: Are the essential managerial efforts of any third party necessary to drive the success or failure of the web3 system? And is there potential for significant information asymmetries to arise? The answer to both questions would depend on many of the same considerations discussed above.

But, in this case, the intellectual property in the NFT scenario likely contributes, rather than hinders, to the community’s overall decentralization. Why? Because the intellectual property is contributed to the DAO from a decentralized source (the NFT holders). Furthermore, if the DAO were to control distributions of tokens, additional minting of NFTs, and decentralized intellectual property — along with decentralized revenue streams (either from royalties or derivative projects) — the system would be unlikely to develop significant information asymmetries.

Most NFT projects are still in nascent stages, so we have yet to see many examples of NFT projects deploying decentralized tokenomics, but we expect to see a variety of mechanisms. In the meantime, many learnings can also be incorporated into NFT projects from other web3 systems.

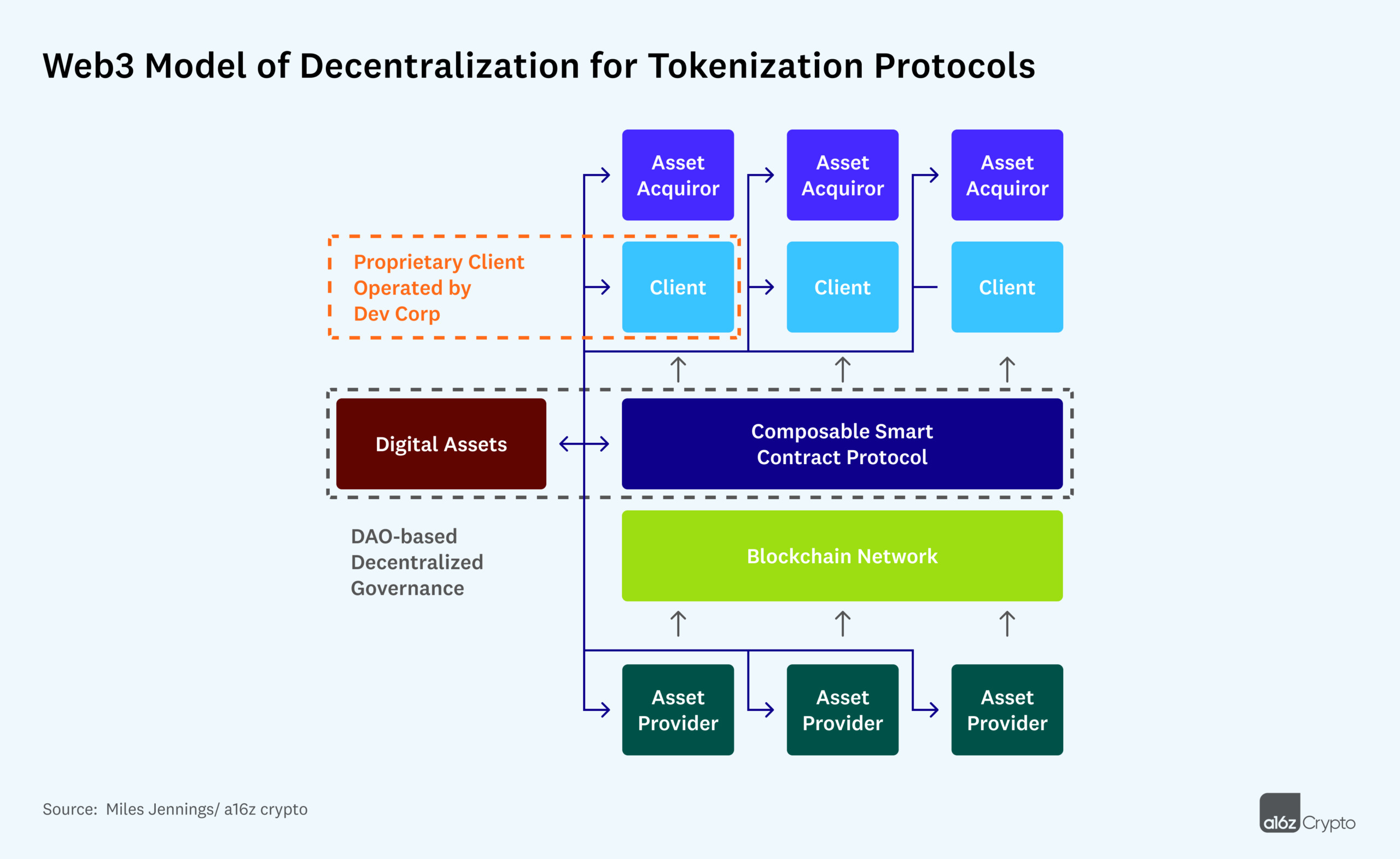

Open decentralization: How to decentralize tokenization protocols

Tokenization protocols are another type of emerging web3 system. In these systems, assets are onboarded to a blockchain, tokenized by a smart contract protocol, and then sold or used for other purposes. Types of tokenization protocols include serial NFT-minting projects, digital asset marketplaces, and protocols that tokenize real-world assets.

The open decentralization model below reflects:

- assets brought on-chain from multiple providers through a shared smart contract protocol;

- the smart contract protocol tokenizing such assets;

- the sale or use of such tokenized assets through multiple clients;

- native digital asset distributions and incentivization mechanisms; and

- the launching of DAO governance with respect to the community intellectual property and DAO treasury.

In this model, economic decentralization is achieved through sufficient diversity of inputs (asset providers) and outputs (asset acquirors), as well as the decentralization of the layers through which the tokenized assets flow (the blockchain, the smart contracts, and the clients).

The protocol’s DAO could also use explicit incentives (fungible token awards, no commissions/ fees, etc.) to:

- incentivize asset providers to provide assets to the system;

- incentivize clients to make a market in the tokenized assets; and

- incentivize acquirors to acquire such assets or to consume them.

While the initial developer company may initially play a significant part in any of these roles (asset provider, client operator, asset acquiror), once the system is decentralized, the developer company would eventually be just one of many actors in any given role. This would limit the risk of any significant information asymmetries accruing to it and reduce the reliance on its managerial efforts. In addition, many roles could be undertaken by the DAO and/ or subDAOs.

Over time, the explicit incentives could also be adjusted to account for potential shortfalls on either the supply side or the demand side. In a decentralized marketplace for instance, token incentives to sellers (the supply side) could be increased to bring more goods for sale onto the platform; and token incentives to buyers (the demand side) could be increased to encourage more purchases.

From a legal decentralization perspective, the key questions, yet again, would be: Are the essential managerial efforts of any third party necessary to drive the success or failure of the web3 system? And would there be the potential for significant information asymmetries to arise? The answer to both questions depends on whether the DAO could effectively manage its incentives to balance supply and demand as in the example above — but more broadly, it’s really about preventing any single asset provider, asset acquiror, or client from becoming so important that the success of the entire system relies on any one entity’s efforts.

For additional models and use cases, as well as more details relating to the above models, please see the full paper.

* * *

Builders of web3 systems currently face numerous challenges in initiating, managing, and scaling decentralization. But the framing of decentralization as a single design challenge with three aspects — technical, economic, and legal — should provide a strong reference guide to help builders as they use the novel components of web3 systems to overcome these challenges, even as regulatory requirements may shift.

Failure to account for all three of these elements will lead us to a web3 that falls short of the future that blockchain technology and cryptocurrencies make possible. No one wants a “web3“ that’s built on new tech, but that is otherwise indistinguishable from web2. Instead, by building systems that carefully and deliberately design for decentralization, builders can create digital infrastructure, and give life to decentralized economies, which will form the foundation of the internet for decades to come. It’s time to build that internet, and that future.

Special thanks to Chris Dixon, Sriram Krishnan, Sonal Chokshi, Eddy Lazzarin, David Kerr, and Adam Zuckerman for their contributions and insights, as well as to all of the authors of the works I reference in the more comprehensive version of this piece.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.