6 questions every founder should ask about pricing strategy

This post is based on a workshop – “Web3 pricing and business models” – the authors hosted at a16z crypto’s Crypto Startup School (CSS23). Subscribe to the a16z crypto newsletter and YouTube channel for all the talks.

Deciding how to price a new product or service is one of the key challenges that founders need to tackle early in the product development lifecycle. In a relatively new market, like crypto, it can be difficult to know even where to start.

The strategy you choose will depend on your circumstances. Fully decentralized projects which have their own tokens – like many decentralized apps and web3 protocols – tend to have their own unique logic and design considerations. But for founders building other crypto-related businesses – like infrastructure providers, services-based startups, and such – some universal principles provide a template for thinking through product pricing.

Getting one’s approach to pricing right can have a dramatic impact on a company or project’s early customer wins, go-to-market strategy, and long term success. The key is ensuring that a product’s capabilities and features align to a philosophy that allows for optimal pricing. Conversely, once a product is in market, early customer expectations’ become set. After that, changing prices can be hard.

One of the coauthors learned this lesson the hard way while he was CEO of Ning, an early social company. In 2005, Ning began as an ad-supported platform that allowed anyone to create their own vertical social network. Several years into the company, it became clear, however, that a subscription-based business model was a better approach for Ning’s target market. While the transition ultimately succeeded, the path to get there was not easy.

Determining the right pricing for a new product in a new market doesn’t have to feel so overwhelming. Below, we pose six questions every founder should ask that can make the process more manageable… and dare we say satisfying?

1. What are all of the different ways I could price, and which approach makes the most sense for my market?

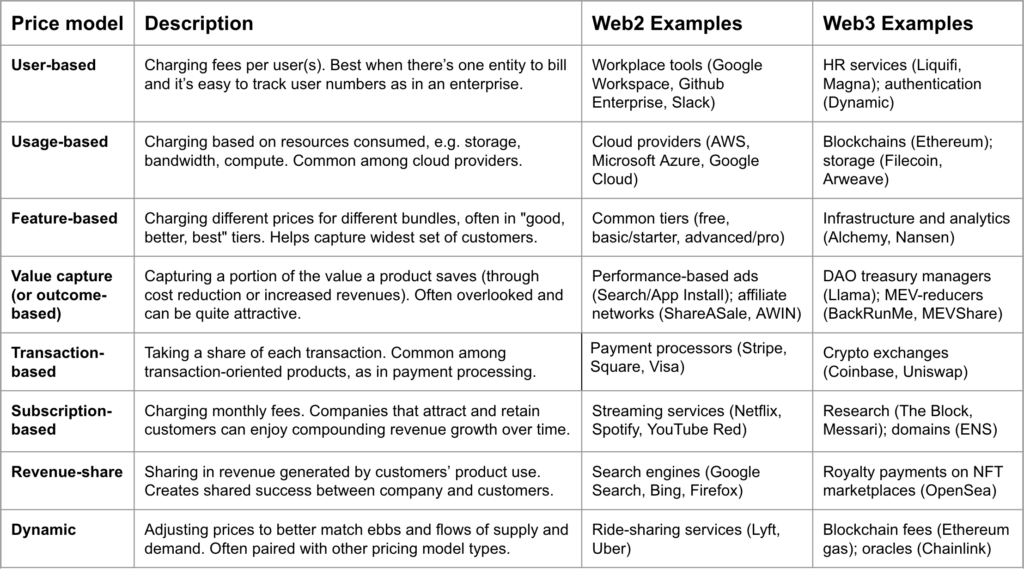

The first step is to identify all of the different possible approaches to pricing. By weighing each option, you can better find the approach – or combination of approaches – most suited to your circumstances. This exercise can unlock new insights or hybrid pricing approaches that better align with the needs of customers or the state of the market.

Here are some common pricing models along with brief descriptions of how they apply, plus a few traditional and crypto-specific examples for each. (It’s worth reiterating that these pricing frameworks largely apply to web3-adjacent projects that don’t have a token and aren’t fully decentralized.)

Now that you know the most common pricing methods, you can begin to apply this framework in practice.

Consider some examples from the crypto industry. While not every customer action is on-chain, you could use on-chain data to better forecast the differences between each pricing approach. For an insurance product, you could price based on the net asset value in a customer’s wallet. For a crypto security service, you could price based on an NFT collection’s floor price multiplied by the number of NFT holders.

You may find compelling ways to mix and match pricing methods. While examples above might be listed in a single category, they often cover multiple pricing model types. Alchemy uses both usage- and feature-based approaches, for example, and The Block uses both usage- and subscription-based ones. Choose the combination that works best for your purposes.

2. Are there opportunities for me to price differentiate within my product line?

Most technology products appeal to a range of customers. The gamut spans from casual first-timers with basic needs to self-sufficient pros seeking more advanced features to enterprise customers who often want the highest level of service and capability that a company can offer. This range of needs and desires creates an opportunity to tailor product offerings to different customer segments through a Good, Better, Best framework.

Here are some examples of the framework in action:

| Product | Good (least expensive) | Better | Best (most expensive) |

| GM car brands | Chevrolet | Buick | Cadillac |

| Amex credit cards | Green | Gold | Platinum/Black |

| Lyft ride types | Wait & save | Preferred | Lux |

| Apple phones | iPhone SE | iPhone [latest] | iPhone [latest] Pro |

| Netflix subscriptions | Standard with ads | Basic/Standard | Premium |

| Alchemy plans | Free | Growth | Enterprise |

| Bored Ape Yacht Club NFTs | Bored Ape Kennel Club | Mutant Ape Yacht Club | Bored Ape Yacht Club |

The first offering – Good – provides a solid set of capabilities at an attractive price point. This typically least expensive option gets the job done for a large swath of the customer base. Better builds on Good and usually adds a few additional core capabilities that cater to customers who see the offering as a key tool in their daily workflow. Best appeals to customers who require a specialized feature-set to accomplish their goals or who simply want to know that they are purchasing the most sophisticated offering available.

Within this framework, founders will often want to experiment and iterate on the product capabilities that go into each bucket.

Pro tip: When selling to enterprises, ensuring that the Best offering includes an appropriate level of support, security, and onboarding and deployment assistance is key. Without this level of product robustness and focus on customer success, implementations will often fail to gain traction. In these cases, you may lose a customer or reference, which can make it significantly harder to sign the next major customer.

Think about the customer you’re trying to target. Who is this person? What does the person need or desire? One helpful exercise is to map the various stakeholders within a prospective customer’s organization to understand all the places where value accrues. For example, a marketing automation tool might directly benefit the marketing team, but it might also free up analytic resources on adjacent teams, like a data science group, that can now be used on other projects. Focus not just on benefits for a single stakeholder but to address differentiated selling points for all types of stakeholders.

3. Am I charging the right price?

While founders often worry about overpricing their product, a more common mistake is to underprice.

For a new technology product to gain market traction, it has become conventional wisdom to talk about the new product needing to improve that which preceded it by 10X. In today’s tech market – which has increasingly sophisticated customers, a plethora of competing products and services, and entrenched providers who enjoy large moats and lock-in – a 10X improvement is likely the low bar of what new entrants need to offer to break through. An improvement of this magnitude is basically table stakes.

When a team builds a new product that really does deliver at this level and beyond, the company has the opportunity to capture meaningful economic value in exchange for the productivity improvement, growth acceleration, or cost savings they are delivering to their customers. Discovering where the efficient frontier of this value exchange lies is a key factor in successfully defining pricing for a new product.

One effective and simple way to conduct this exploration is to separate prospective customers into two cohorts – Cohort A and Cohort B – and to share dramatically different price points with each of them. Imagine that for Cohort A, a startup offers their Good offering for X dollars per month, Better for Y dollars per month, and Best for Z dollars per month. Simultaneously, the startup pitches Cohort B the same offering at 5X for Good, 5Y for Better, and 5Z for Best. In this example, Cohort B’s pricing is literally five times higher than that of Cohort A. What the startup should observe, in this case, is the variation in win rate between the two cohorts. If four out of five prospects in Cohort B still sign up for the service, this suggests that the pricing shown to Cohort A undervalues the offering.

You might be surprised by how much people are willing to dish out on your product or service!

Another consideration is the denomination of your pricing. In other words, you need to decide what combination of fiat, stablecoins, and/or tokens you accept. While it may be more customer-friendly to accept a wide variety of payment methods, this may also increase your exposure to market fluctuations. Consider that, if your expenses are primarily in fiat, it might make sense only to accept fiat and stablecoins. You must be able to meet your expenses.

4. How do other products or services in adjacent markets price?

When thinking through how to price a new product or service, a good place to start is to look at the approach taken by peers in adjacent markets. Surveying comparable products can provide a helpful starting point for your own pricing strategy.

For founders building in web3-related categories such as infrastructure, gaming, developer tooling, and so on, look at how analogous web2 products price. A number of web3 startups are innovating in the security and scam prevention space, for example. By looking at the pricing pages of the many companies that offer similar services for web2 consumers and enterprises – like Aura, Bitwarden and CrowdStrike – founders can quickly identify a number of potential pricing models that are already well understood in the market.

5. Do my unit economics work?

Losing money on every customer but making it up in volume is a strategy that doesn’t work for very long, particularly in an economic environment where there has been a broad pullback in startup funding, like the one in which we find ourselves currently. This is a recipe for bankruptcy.

Founders should understand the unit economics of their company from early on in the startup’s life. They should also develop a strong point of view about how these unit economics will change, evolve, and improve over time. With a little preparation, founders can significantly increase their chances for success.

In the early dotcom era, founders pursued a number of ambitious ideas such as grocery and one hour delivery of convenience items. Many of these startups went bust – but then, years later, businesses with strikingly similar models, like Instacart and Doordash, succeeded. A combination of at least four factors made the unit economics of these newer businesses work whereas prior attempts failed. These differences included:

- A 10x+ increase in the number of internet users

- The advent of the ubiquitous, always-connected smartphone

- The development of sophisticated routing and logistics software

- The willingness of suppliers, like grocery stores and restaurants, to integrate with this software (based on a realization that doing so could drive incremental business)

Having the foresight, tenacity, and ability to change the trajectory of one’s unit economics can lead to a long term sustained advantage that others will struggle to emulate. The superior margins that Apple enjoys in its iPhone business are, for example, a function of at least three factors: 1) enormous volume which enables a superior cost structure for the business, 2) a supply chain that the company has built, refined, and heavily negotiated over more than a decade, and 3) a premium brand. While gross margins don’t determine the overall fate of a startup, they can have a long lasting impact on the degree to which companies can invest in R&D, marketing, and other critical functions that determine long term growth rate and success.

6. If I imagined that my market was going to grow 10X-100X and I captured 100% market share, would I end up with an interesting business?

As a founder/CEO, it’s normal to spend countless hours and sleepless nights obsessing over the strategy and details of your company in an effort to find product-market fit, overcome numerous obstacles, and achieve long term success. In the back (and frequently the front) of every founder’s brain is the ever-present fear of failure.

However, in our experience, there are outcomes much more painful than failure. What’s even worse is to spend years building a product and company and make just about every decision within one’s control correctly only to discover that the market opportunity isn’t large enough to justify the incredible investment of time, talent, and capital that the founder and team poured into the pursuit. Beware Pyrrhic victory.

A simple way to test whether this failure mode is likely (and hopefully to avoid it!) is to do a simple top-down spreadsheet exercise early in the history of the company. Imagine for a moment that the market you are pursuing grows 10X to 100X and your company captures 100% share of this future market.

Next make an assumption about the average revenue per customer and multiply future market size * average revenue per customer * market share (in this case 100%). How does the math look? Does the imaginable market opportunity look large enough that one can build an interesting company? If so, excellent! If the market doesn’t look large enough to be interesting, perhaps there are changes to be made in market sizing or average revenue assumptions. As Disney CEO, Bob Iger, so aptly put it, the best business advice he ever received was to avoid getting into the business of manufacturing “trombone oil” – a limited market, to be sure. While it might be possible to become the best trombone oil manufacturer in the world, the world only consumes a few quarts of it per year.

Very few founders take the time to do this math – but this simple exercise can prevent heartache, pain, and missed opportunity down the road.

***

***

Thank you to Robert Hackett, Guy Wuollet, and Carra Wu for their contributions to this piece.

***

Jason Rosenthal is an Operating Partner at a16z crypto, where he works closely with the CEOs and founders in our portfolio to provide leadership guidance, help them plan for and react to the aspects of running companies in rapidly-changing markets, and generally help them become the best version of their professional selves. Jason has spent more than 25 years as an internet entrepreneur and executive, including more than 10 years as a startup CEO, and his career has been dedicated to the development of transformational new platforms.

Maggie Hsu is a partner at Andreessen Horowitz leading go-to-market for the crypto portfolio. She previously led go-to-market for Amazon Managed Blockchain at Amazon Web Services, and before that led business development for AirSwap, a decentralized exchange. Maggie has held executive positions at Zappos.com and Hilton Worldwide. She was also a consultant at McKinsey and Company. Maggie is also a cofounder of Gold House, a nonprofit collective of pioneering Asian leaders.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not necessarily the views of a16z or its affiliates. a16z is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party information; a16z has not reviewed such material and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities, digital assets, investment strategies or techniques are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments or investment strategies will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Additionally, this material is provided for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. Investing in pooled investment vehicles and/or digital assets includes many risks not fully discussed herein, including but not limited to, significant volatility, liquidity, technological, and regulatory risks. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures/ for additional important information.