Table of contents

- How to think about token-related risks: Legal, commercial, operational

- Strategy 1: Decentralize

- Strategy 2: X-clude

- Strategy 3: Restrict

Editor’s note: “How can I launch a token” is one of the most common questions we get from founders, given the rapidly evolving nature of the crypto industry. As prices rise, and FOMO sets in – everyone else is launching a token, should I? – it’s even more important for builders to approach tokens with caution and care. So in this special series of posts, we cover getting ready for launch, frameworks for managing risk and assessing operational readiness, an a few rules to consider before launch. Be sure to sign up for our newsletter for more on tokens and other company building resources.

Tokens are one of the most powerful digital primitives available to crypto founders. They’re also one of the riskiest to bring to market. Challenges mount for startups attempting to launch tokens that are both useful and compliant, and as the recent ruling in the U.S. Securities and Exchange Commission (SEC) enforcement action against Coinbase makes abundantly clear, the strategies companies use to issue tokens and how they talk about those tokens matters a lot. The stakes are high – crypto enforcement actions have doubled since 2021 – and an SEC investigation can cost a startup millions. Class action lawsuits, which remain an ever-present threat, can run several times that.

The good news is that, despite all of this noise, a pathway exists for entrepreneurs to launch tokens in good faith while mitigating most risk, starting with the SEC’s guidance from April 2019. Admittedly, a lot has happened in the last five years and the industry has changed even more dramatically from the ICO boom that preceded them. But, the foundational principles of the SEC’s framework are just as relevant and valid today as they were when it was first released.

So, even though there are many companies that skirt U.S. securities laws and rush tokens out the door, this path is ultimately a dead end. The reality is that the legal risks of tokens are existential. And examples of government inaction are not equivalent to consent. Instead, entrepreneurs should pursue strategies that embrace the SEC’s framework, which can all but eliminate legal risk. While these strategies may create new complexities for a startup’s commercial prospect and operations, they can also help entrepreneurs build better, more durable products.

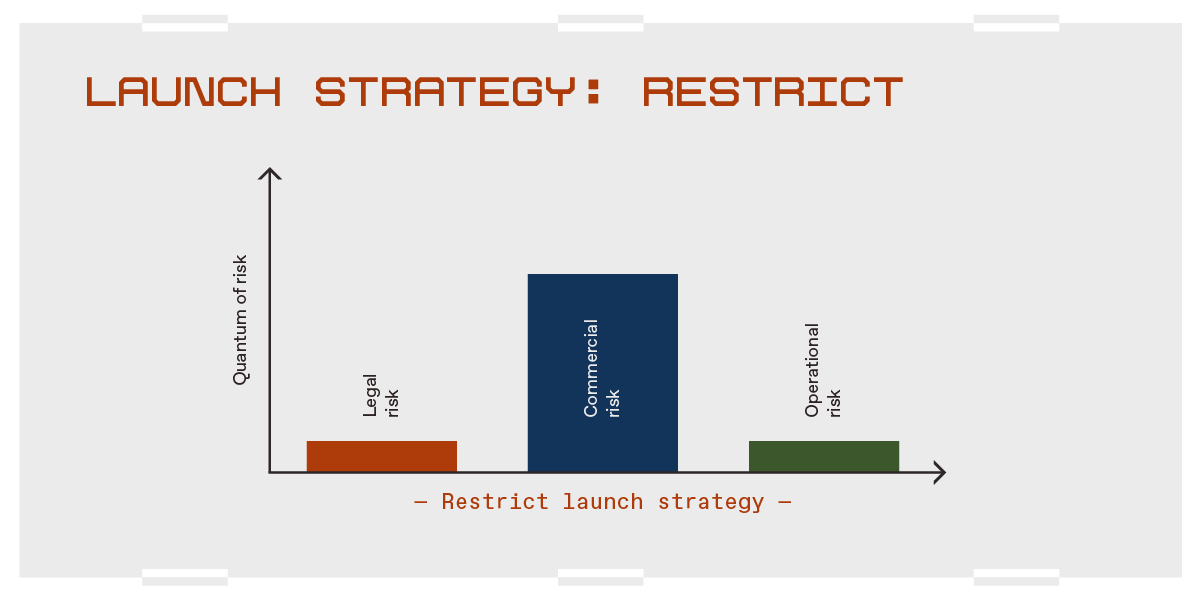

In this post, I’ll cover the different types of risks that arise from launching a token. Then I discuss three distinct but often complementary strategies for launching a token compatible with U.S. securities laws. I call this strategic framework the “DXR” framework: Decentralize, X-clude the U.S., and Restrict. All of these strategies come with their own risks and opportunities for teams to consider (alongside legal counsel) well in advance of a token launch.

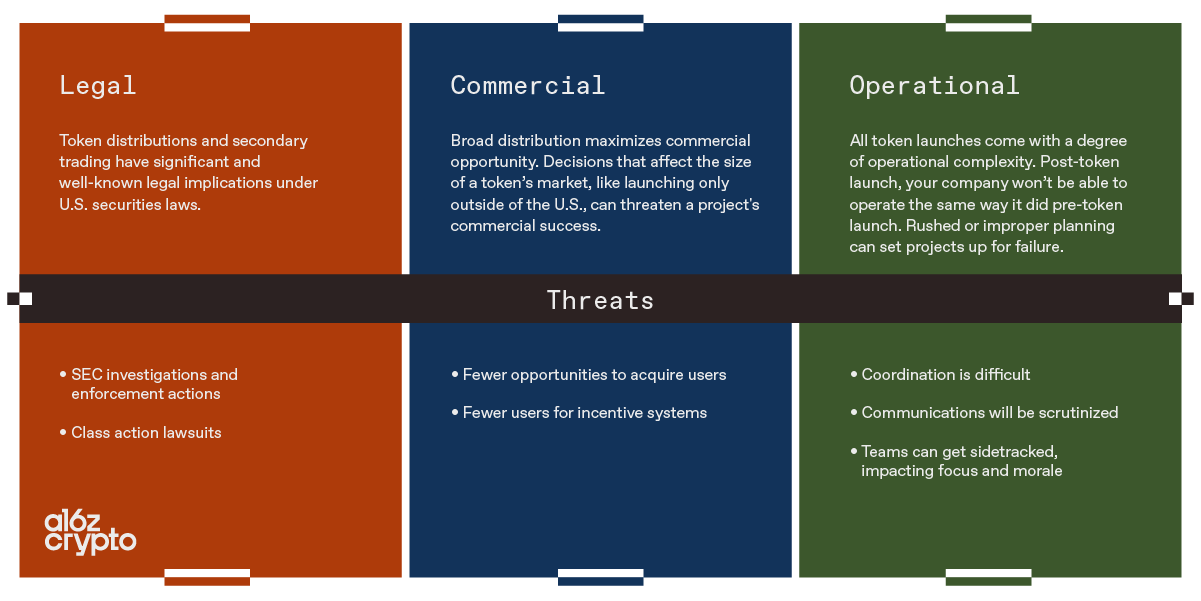

Launching a token comes with significant risks that can impact every facet of a project. It’s impossible to cleanly cordon off and compartmentalize every risk, but I delineate between legal, commercial, and operational risks below.

Each launch strategy introduces different complexities within these categories. The framework can help entrepreneurs better understand what risks might be worth taking – like taking some operational risk to foster greater decentralization, or accepting short-term commercial risk to reduce legal risk.

Every project has a different risk profile. Targeting users outside the U.S. comes with different commercial and legal risks than focusing on U.S. users. A project with a 100+ person team has to manage different operational risks than a 10-person team. The characteristics of the project’s underlying technology (e.g., a blockchain network or a smart contract protocol) and its token’s characteristics also play a role.

Once projects understand their risk profile, they can design launch strategies accordingly – reducing risk where a project has low tolerance and increasing it where it has high tolerance. The best token launch strategy is not necessarily the one that eliminates all risk or borrows from a big successful launch; it’s the one that best fits a project’s overarching strategy.

Decentralization is the critical feature of blockchain networks that can transfer power on the internet from closed and controlled corporate platforms to open and permissionless networks. Truly decentralized blockchain networks function more like public infrastructure than proprietary technologies. This paradigm shift has the potential to rebuild the internet in a way that promotes competition, safeguards freedoms, and more equitably rewards stakeholders.

Decentralization is counterintuitive and it is hard. Projects have to take a drastically different approach to building than other startups. They may need to open source software, give up control, and even fund competitive products. There is a litany of potential factors to decentralize, and the process takes time. Rather than achieving some immediately demonstrable and measurable threshold, most projects opt for “progressive decentralization.”

Roadmaps for decentralization can differ significantly depending on the characteristics of a project – they will look different for a Layer 1 blockchain, compared to a social network. And while many have valiantly tried, no universal definition of decentralization exists for these roadmaps to aspire to. The SEC has failed to expand on its definition of “sufficient decentralization” since 2019. And, as a result, the process is often opaque and the rules, particularly those relating to legal decentralization, remain unclear.

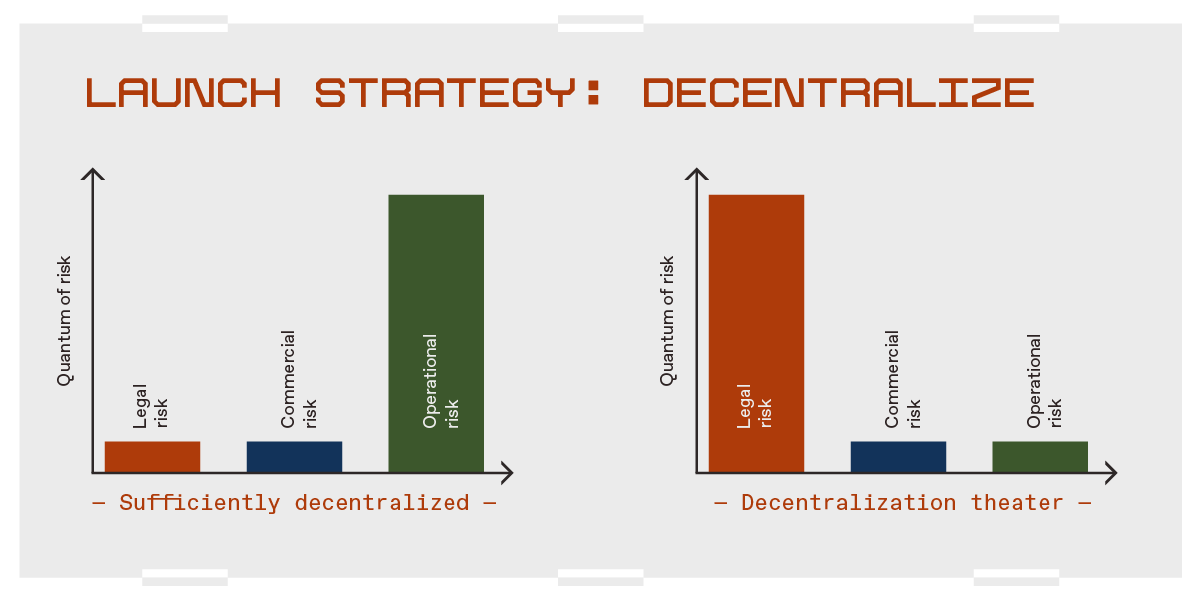

All of this makes decentralization difficult to achieve for good actors, and opens the door for misuse by bad actors – “decentralization theater,” where projects feign characteristics of decentralization for appearances, yet maintain control, remains a common bad practice in crypto.

Nevertheless, decentralization remains fundamental to the promise of web3. It is the only viable long-term strategy for projects that wish to launch tokens in the U.S. that convey broad rights (economic, governance, etc.) to tokenholders.

Legal: Decentralization mitigates the risks U.S. securities laws were designed to address by disentangling tokens from their founding team.

Critically, this can eliminate reliance on managerial efforts – a pillar of the Howey Test for determining whether a digital asset is subject to securities laws, and a defining characteristic of securities in the U.S.

Decentralization can also reduce the risk of information asymmetries that emerge when founders or developers have some information about the token’s performance that investors do not have. Distributing control across a community, not a management team, can ensure that everyone has access to the same information.

It follows that the amount of legal risk a project takes on is a function of how decentralized it is. If the value of a token does not depend on the founding team or another promoter, it should be free from the legal and regulatory risks arising from the Howey Test. This is the case with Bitcoin and Ethereum today. However, projects that have not yet reached this point remain subject to legal risk, and those engaged in “decentralization theater” have no credible defense against securities laws or their consequences.

Commercial: Decentralized projects have more flexibility when it comes to the scope and breadth of their token distributions. This means more opportunities to reach, engage, and grow their markets, and maximize their potential commercial opportunity.

Decentralization grows the entire pie.

For example, decentralized projects can airdrop tokens to U.S. persons and use token-based rewards to incentivize U.S. users to engage in activities that benefit the project. These projects can also more freely use tokens to incentivize independent and third-party developers and businesses, who are also likely to prefer building on open networks. Here, corporations are less likely to take control, arbitrarily change the rules, or make unilateral decisions on behalf of their communities.

Given these benefits, the commercial risk of decentralization is inherently low.

Operational: Decentralization, for all of its benefits, is operationally complex.

Founders must explore very different business models than a typical tech startup with the ultimate goal of making themselves redundant.

Building redundancy into a system takes time. Projects must create their own framework for progressively decentralizing and develop a thoughtful playbook for operating while decentralized. They must consider organizational structure, strict controls around communications, and incentivizing third-party developers.

All of these steps introduce operational inefficiencies, and while inefficiency is crucial for fostering true decentralization, it highlights why projects should make sure they are ready prior to launching a token. Of course, companies that fake decentralization avoid these operational complexities at the expense of increased legal risk.

Still, it won’t always be possible to hit every decentralization milestone before launching a token. A project may need to make big, ongoing changes to find product-market fit. Or they may need to use a token before it has achieved decentralization to acquire customers and users, implement a governance system, or any number of other reasons.

Fortunately, there are two more token launch strategies that projects can use to introduce a token prior to achieving “sufficient decentralization,” without taking on the risks described above: X-clude and Restrict.

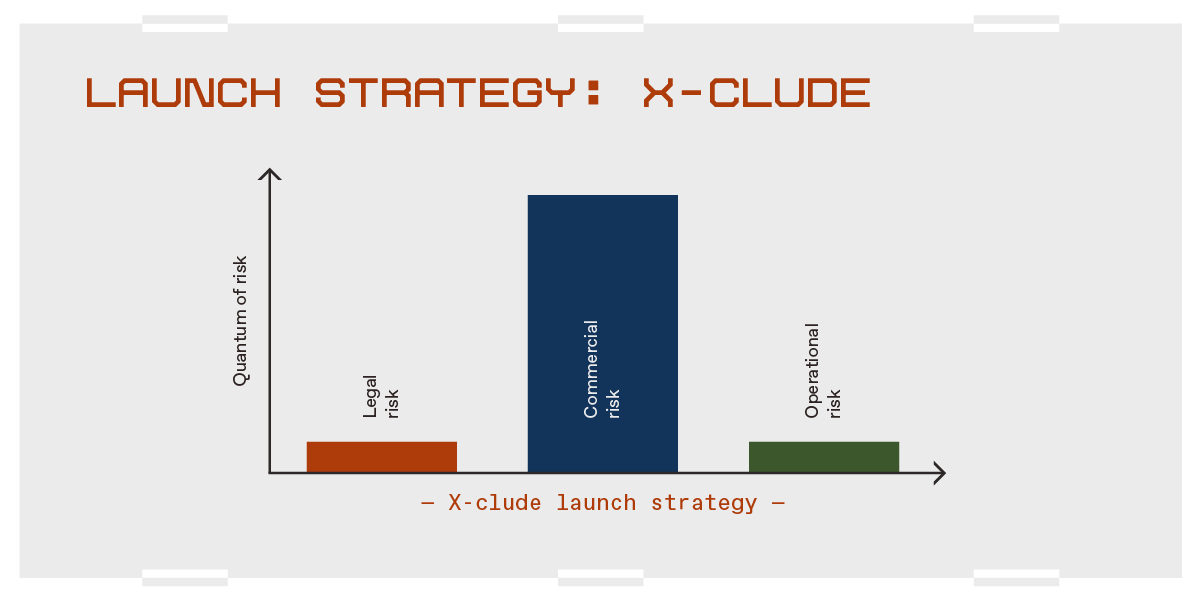

One way to avoid legal uncertainty in the U.S. is to simply launch outside of it.

With this strategy, the token won’t run afoul of U.S. securities laws even if it is deemed to be a security. While this is an unfortunate outcome of the SEC’s failure to foster web3 innovation in the U.S., it’s nevertheless a compelling option for projects that require a broadly distributed token in circulation in order to progressively decentralize.

Note that this strategy is a means to bolster, not replace, long-term decentralization. And it is not an excuse to blatantly ignore laws.

To take this path, token issuers can geoblock U.S. users from participating in airdrops and token-based rewards, as well as forgo listing on secondary trading platforms in the U.S., like Coinbase, Gemini, and Kraken. Projects can still issue tokens privately to investors and employees within the U.S. and abroad pursuant to any exemptions from securities laws.

Because the tokens are not listed on U.S. exchanges, secondary markets for the token are not likely to develop – a key focus for the SEC in recent years.

Legal: Leaving the U.S. out of a launch is a relatively straightforward way to reduce legal risk.

The strategy hinges on compliance with Regulation S, which provides an exclusion from certain registration requirements under U.S. securities laws for offerings made outside the U.S. by both U.S. and foreign issuers. Essentially, if a project isn’t making its tokens available to U.S. persons, the risk of SEC enforcement decreases dramatically, even if it is not “sufficiently decentralized”.

Most law firms active in web3 will have teams familiar with structuring and launching Reg S compliant tokens, so projects should consult their advisors before moving forward. Importantly, compliance with Reg S requires adherence to restrictions regarding communications and measures designed to limit the flow of tokens into the U.S.

Commercial: The problem with this strategy is that leaving a large swath of the global market can severely limit a project’s business strategy and increase commercial risk.

Using this strategy for the initial token launch and any token incentives does not preclude a project from ever making its product available in the U.S.; but it may mean that they need to treat people in the U.S. differently.

For example, a project could run a frontend website for its product globally but limit any token-based incentives to users that are outside the U.S. However, these differences can increase friction with U.S. users and jeopardize a project’s future viability there.

Operational: This strategy puts off the operational complexity of decentralization in the near term, but it does not eliminate all operational risks.

Fluctuating prices can undermine the token’s utility as an incentive mechanism for employees, third-party developers, and businesses. Price collapses are demoralizing and distracting for teams.

Further, compliance with Reg S requires strict restrictions regarding communications and lockups that projects must follow to preserve the exemption. Compliance with anti-money laundering laws may also be more challenging.

Another way for projects to avoid legal uncertainty in the U.S. is to eliminate the possibility of the public investing in their tokens. To accomplish this, projects can issue transfer-restricted tokens (TRTs) or use off-chain “points” instead of tokens. TRTs use the ERC-20 standard to limit who can hold a token and where it can be sent, while points more closely resemble airline miles.

Both TRTs and points are typically non-transferable for a set period or until certain conditions are met, often tied to a project’s decentralization milestones. Importantly, this strategy does not require that tokens have no real use case (TRTs can be used with a smart contract that is part of the project, like a staking module, and points can be redeemed). But it does require preventing tokenholders from buying and selling the token on secondary markets.

Again, this strategy should support, not replace, a project’s long-term decentralization plans. A few of the benefits of TRTs/points:

TRTs and points sound simple enough, and many projects use them carelessly. Don’t be fooled: Misusing these tools can have legal and regulatory consequences. Projects should consult their counsel to ensure they’re using them appropriately, and to avoid inadvertently running afoul of securities or money transmission laws.

Legal: TRTs and points can lower legal risk arising under securities laws when used properly.

The strategy hinges on making sure that no third-party can make an “investment of money” to acquire a project’s TRTs or points. If this is the case, distributing them would not satisfy the first prong of the Howey Test, and securities laws would not apply.

However, treating TRTs/points like investment products can cause problems. For instance, rewarding web3 participants with TRTs/points for engaging in economic activity that financially benefits the project; hyping the value of TRTs/points; promising future distributions of a specified number of transferable tokens in exchange for TRTs/points; and turning a blind eye to illicit secondary markets for TRTs/points. All of these activities can undermine the legal basis for this strategy.

Projects can guard against unauthorized secondary markets by using cease and desist letters, modifying a token’s terms of service, or even revoking assets and blacklisting addresses that participate in secondary markets.

Commercial: The key tradeoff with using TRTs/points is increased commercial risk.

This strategy allows projects to broadly distribute tokens, but does have limited utility when it comes to incentives. TRTs/points may work well for a project incentivizing users to engage in social activity, like attending a sporting event, completing a quest in a game, or posting on social media.

They are more challenging for use cases like decentralized physical infrastructure, where the project relies on people to use their own money to buy or operate equipment that facilitates the network. This is because users cannot sell their tokens to recover their funds, which may make them less willing to participate in the first place.

In other words, incentives may not be as compelling if users can’t sell them.

Operational: TRTs/points also reduce operational risk relative to other strategies.

With no secondary market, TRTs/points do not fluctuate in value, so they are not likely to have a significant impact on third-party developer or employee morale. However, the lack of a measurable price may also make them less useful as a motivational tool. And, of course, they cannot provide funding for operational needs.

Note that to preserve the regulatory treatment of TRTs/points, projects may need to adopt restrictions regarding communications and lockup periods.

—

Builders can mix and match all of these strategies based on a project’s characteristics and overarching business strategy. For instance, if a Layer 1 blockchain achieves significant decentralization during its testnet phase, the project developers may be comfortable with a global, fully-transferable token at the time of mainnet launch. Or the founding team may want to invest significant development effort into reaching certain milestones following mainnet launch. And, as a result, exclude the U.S. from distributions until the project reaches sufficient decentralization. Similarly, a web3 gaming project may seek to use a fully-transferable token outside the U.S. and transfer-restricted token within the U.S. until the game’s ecosystem has been sufficiently decentralized.

But when mixing and matching, avoid undermining the legal benefits these strategies afford. For example, launching a restricted token and listing it on a U.S. exchange at the same time would undo the legal protections the restrict strategy is intended to convey. Similarly, excluding the U.S. from a token launch while advertising the token heavily there undercuts the strategy’s protections.

Launching decentralized systems that stand the test of time is incredibly difficult, but it’s why most of us are working in web3. We can choose to see these challenges as a path to regulatory purgatory, or we can reframe them as opportunities for thoughtful innovation, and treat them as a set of constraints for designing better systems.

The DXR framework provides a path for entrepreneurs to more fully explore how tokens can drive decentralization without necessarily taking on all the risks that having a token entails. It can also empower them to build products that are more useful, more secure, and better for users – projects with tokens that last well into the future irrespective of the ongoing efforts of their founders.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.