Table of contents

- Historical precedents for rewarding contributions

- Two core puzzles in designing reward structures

- What these reward functionalities might look like

- Trade-offs, and when these reward functions might be useful

A core puzzle for democratizing online governance systems is understanding how to incentivize long-term civic participation via rewards. Current web3 governance systems tend to use transferable tokens, but those have some clear limitations (e.g., tendency toward plutocracy, low sybil resilience, and incentives to sell tokens and exit) which might be overcome by moving beyond coin voting. In this article, I compare the tradeoffs of reputation-based and token-based reward systems for participation in governance. I outline considerations for each of these governance reward systems, and discuss how they might be earned and what powers they might translate into.

Historically, societal and political influence has been heavily wealth-based rather than merit-based. In Ancient Rome, for example, the Senatorial class was distinguished by birthright and land holdings. During the Renaissance, wealthy families such as the Medici bankers in Florence leveraged their wealth to influence political and religious matters as well as cultural movements. Even in many liberal representative democracies today, wealthy individuals and corporations influence political matters through donations and lobbying. Other societal systems explicitly designed to reward merit, such as college admissions, often reward wealthy and connected individuals via legacy admissions and alumni donations.

If the goal in web3 is to move toward truly democratic online systems, then the question becomes how we prevent recreating wealth-based hierarchies. How can we prioritize merit, value, and contributions rather than wealth and connections?

Reputation is one way societies have tried to capture merit. For centuries, we have tried to find ways to collect and aggregate signals to discern who is trustworthy, competent, or deserves recognition, and in turn determine how to translate those signals into societal status, access, and decision-making power. These systems include, for example, the guilds of medieval Europe, which attested to the craftsmanship of artisans; word-of-mouth reputations in tight-knit tribal communities; academic credentialing from universities; and credit ratings to assess someone’s likelihood of defaulting on financial obligations.

Moreover, in today’s digital landscape, tech platforms have explored ways to signal reputation based on observed behavior rather than wealth. Think of Google’s PageRank algorithm, Reddit’s karma score, or Amazon and Yelp peer reviews. But these systems, while typically less directly tied to wealth and connections, have tended to be context-specific and not generalizable beyond niche settings; moreover, they are often prone to fraud and abuse. And of course, large-scale reward systems aren’t without major societal risks: China’s social credit score system, for example, or Saudi Arabia blacklisting individuals via spyware provide cautionary tales of how centralized design may lead to dystopian outcomes. The key, then, is balancing the power of the tech with the goal of decentralized design.

For the first time in history, web3 has allowed us to design and implement highly credible, universally available reward systems at scale. Blockchain’s immutability, for instance, ensures that rewards are tamper-resistant and recorded securely, while smart contracts can transparently automate the implementation of rewards, reducing the need for intermediaries. MakerDAO’s delegate compensation system is one example of a reward system explored in web3, and later in this piece I discuss other examples. These reward systems, based on new mechanisms for establishing trust and distributing rewards, could potentially be designed with input from a wide user base to democratize the governance process for entire tech platforms or other online communities.

At the root of designing reward systems are two non-trivial questions: 1) What should be rewarded? 2) Who gets rewarded?

Historical models like university credentialing or credit scores are coarse models for proxying the value of trustworthiness, contribution, and skill. The key concern with deciding what should be rewarded is determining whether signals represent truthful demonstrations of reputation. In online governance, for example, users might gain a reputation score for actions like voting, attending town halls, or submitting governance proposals. Is there a way to assess the effort and value of this behavior (the quality) in addition to documenting the frequency with which someone does these things (the quantity)?

At the heart of determining who gets rewarded is aggregation, where the tricky part is creating a standardized way of interpreting signals in a common language that translates across contexts. In the case of reputation, metrics have often been context-specific: Credit scores, for example, reflect financial trustworthiness, driving records gauge driving responsibility, and online restaurant reviews evaluate culinary skills. These metrics aren’t meant to be interchangeable – a stellar credit score doesn’t vouch for one’s culinary prowess. But in online communities using reputation-based governance, it may make sense to incorporate a more encompassing view of reputation. How then should we weigh these diverse reputation components, and how do they fit within a broader social landscape (e.g., social graph-based verification)? Should reputation be designed to incorporate all contents of someone’s crypto wallet, spanning finances, identity, or even virtual art and property?

Token-based rewards are transferable while reputation-based rewards would be non-transferable. One might wonder which one should be used, and why. Early experiments in web3 governance have generally been token-based but are currently trending toward more reputation-based systems as a default given clear advantages if implemented successfully (summarized in the table below).

In general, reputation-based governance likely makes sense for meritocratic systems prioritizing long-term community alignment, while token-based governance is probably preferable for projects prioritizing scalability and liquidity. Tradeoffs exist for instance along the access / entry dimension, where reputation-based systems may favor early community members who can begin building reputation sooner – although token-based systems are more accessible to wealthy individuals. Along the sybil resistance dimension, reputation-based systems aim to overcome inherent sybil vulnerabilities in token-based systems (e.g., the Beanstalk hack) by attaching reputation to identity. However, this potentially raises concerns with privacy depending on the method used to verify identity, though these concerns might be overcome via zk-SNARKS or other types of zero-knowledge proofs.

In practice, it may make sense to incorporate some combination of both tokens and reputation score, for example where reputation leads to some but not all governance functionalities. Optimism’s bicameral house, with a reputation-based citizen’s house and token-based Token House, would be one implementation of this, but the design space is large. Past work has argued that reputation systems should rely on a pair of tokens, one for signaling reputation and the other for offering liquidity. Other projects are exploring dual governance models where staked token holders have veto power over governance token holders. In the case of Lido, both LDO and stETH tokens are transferable, although one could imagine building non-transferable reputation-based governance tokens into a similar dual token model.

“Token-based governance” refers to a system where incentives or rewards are linked to the ownership or acquisition of fungible tokens – tokens that can be bought and sold on the open market. This includes, for example, Uniswap’s UNI tokens, which can be used to vote in Uniswap governance. The transferability of these tokens makes it straightforward to onboard new participants to protocol governance compared to reputation-based systems, although these systems potentially enable plutocratic dynamics where those with more capital exert greater influence. Token holders have a direct financial stake in the success of the project, motivating them to vote in ways that promote their own long-term financial value. Unfortunately, token holders’ financial interests may not always align with long-term non-financial community interests. Examples of these types of tokens include ERC-20 tokens in Ethereum, ICS-20 tokens in Cosmos, and SPL tokens in Solana.

Currently, most projects use a “one-token, one-vote” model – where voting power is a direct function of token wealth – to vote on decisions about the project. In MakerDAO, for example, MKR token holders have voted on protocol changes, such as risk parameters for collateral backing the DAI stablecoin. In the decentralized lending protocol Aave, AAVE token holders have voted on which projects should receive funding from the Aave Ecosystem Reserve. In the decentralized exchange Uniswap, UNI token holders have voted on fee structure alterations to the UNI token which affects how transaction fees are distributed among liquidity providers and token holders.

Some examples of reward mechanisms to distribute transferable tokens that have been implemented in token-based systems include:

Reputation is earned rather than purchased. While reputation may also take the form of a token, the implementation is different from fungible tokens which can be bought or sold on the open market. In practice, reputation most often leverages non-fungible tokens (NFTs) such as ERC-5114 (“soulbound” badge) tokens in Ethereum. Optimism citizen’s house badges, and Polygon’s proposed reputation-based voting via Polygon ID are examples of current identity-based governance systems. Reputation-based governance might work in any number of ways in-practice, including peer attestations, automated scores based on observable behavior, or centralized selection (in later sections of this piece I outline tradeoffs between different reward mechanisms).

Reputation tokens could hypothetically take the form of a non-transferable fungible token (for instance, if the transfer function in an ERC-20 contract were disabled). One might use non-transferable fungible tokens to rate community members’ contributions in a more fine-grained way – for example, the number of reputation tokens can be easily fractionalized and used to assign rating to community members on a continuous scale rather than a discrete scale created by a few reputation badges represented by NFTs. These reputation-based governance systems can more equitably distribute influence and potentially offer better Sybil resistance. Inherent challenges to reputation-based systems do exist, however, such as scalability and the subjective measurement of contributions.

Reputation-based governance rewards are still in the early stages of implementation. Some examples of potential ways to earn reputation include:

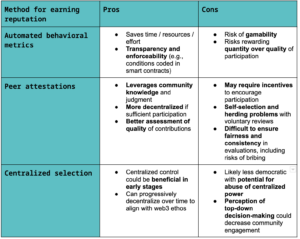

Because reputation systems are not simply purchased on an open market, the space for designing how reputation rewards are earned is wide. The table below summarizes pros and cons of different ways ecosystem participants can earn reputation:

In addition to deciding how rewards are allocated, a key consideration is determining what value, access, perks, or influence the reward yields. Currently, most web3 governance systems use transferable tokens that translate into voting power, where one token equals one vote. But different types of value could be attached to rewards. Whether the rewards are transferable (token-based system) or non-transferable (reputation-based system) also influences the implications of these decisions, but at the high level these powers could be attached to either transferable or non-transferable reputation.

Successful reward structures would likely involve mixing and matching mechanisms based on a project’s nature and mission, and governance rewards might correspond to different combinations of governance power, non-governance utilities, or IRL perks.

To recap, there are various considerations to weigh when designing reward systems for online governance. Here’s a list of concrete questions one might ask when designing these systems. A project’s answers to these questions will have implications for whether their rewards system should align itself on either reputation or tokens.

***

Recent writing has highlighted that ultimately, whether token-based governance makes sense for a project depends on whether a project is civic or economic in nature. As I outline above, there are tradeoffs along specific dimensions (i.e., scalability, entry, privacy, sybil resistance, etc.). While there are arguments in defense of coin voting (e.g., skin in the game), a common concern with token-based governance systems is the potential for plutocracy, where wealthy actors exert disproportionate influence – which clearly flies in the face of the web3 ethos. Another concern with transferable token governance is the potential risk of market-based exit (i.e., participants selling their tokens) when prices increase.

Conversely, reputation-based systems aim for meritocracy by attaching governance or other powers within a community to an earned reputation. Non-transferable reputation systems, however, can be difficult to implement due to the complexity of measuring and validating reputation. For that reason, exploring reputation-based governance and other ways to move beyond transferable token voting is an open and likely fruitful area for decentralized governance. I’ve outlined some considerations about the implementation of reputation systems, but this is an evolving space and I look forward to further discussion – and experimentation – on ways to design effective online democratic governance systems.

***

Eliza Oak is a PhD student in political science at Yale University. She studies the politics of emerging tech and society with a focus on democratic online governance. She was a research intern at a16z crypto during the summer of 2023 and continues to work with the research lab studying web3 governance.

***

Acknowledgements: Thanks to Noemi Glaeser, Andrew Hall, Scott Kominers, Ethan Oak, István Seres, and Porter Smith for their input. Special thanks also to my editor, Tim Sullivan.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investment-list/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures/ for additional important information.