Competitive strategy — the art of crafting and executing plans to achieve an advantageous position in the market — is integral to any business, and especially relevant for platforms because it determines their ability to achieve network effects and scale. But web3 fundamentally transforms the nature of competition and collaboration, which necessitates a rethinking of the way firms establish their market position, achieve network effects, and capture value.

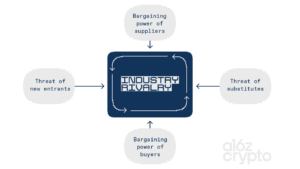

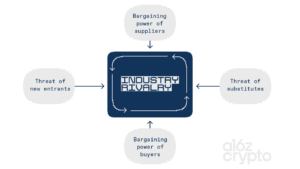

One of the best-known ways to think about strategy is the Five Forces Framework, which HBS professor Michael Porter introduced in 1979. The framework helps map the competitive landscape of an industry and explain where a firm’s defensible advantages lie.

But how might the Five Forces be different in the context of web3 — in particular, how might web3 technologies and mechanisms change how platform entrepreneurs think about competitive strategy?

Here’s the tl;dr: Competition in web3 can be substantially more intense along all the different dimensions reflected in the five forces. But the same features that make competing in web3 challenging offer an opportunity to grow the overall pie. And a bigger pie — even if any given firm captures a smaller share — can still lead to a bigger slice than in the traditional platform business model. This helps explain the logic of the fundamental web3 ethos: a common effort to grow the size of the pie for all.

Porter’s Five Forces: A quick primer

As the name suggests, Porter’s framework identifies five “forces” that drive an industry’s competitive dynamics.

First, a firm faces threats from existing competitors:

- Force #1: The intensity of competitive rivalry: the landscape of firms competing in your market.

Moreover, a firm faces threats from two types of new or future competitors:

- Force #2: Threat of new entrants: the potential of new firms to enter the market and compete with your company.

- Force #3: Threat of substitutes: the potential of alternate products or services to be used in place of your offerings.

And finally, a firm’s competitive position is also affected by the relative market position of its suppliers and consumers:

- Force #4: Bargaining power of suppliers: the ability of suppliers to influence the price and terms of supply.

- Force #5: Bargaining power of customers: the ability of customers (or, in the case of many tech platforms, users) to affect prices and conditions of sale.

The five forces are typically depicted with challenges from new entrants and substitutes running horizontally, reflecting competition across the industry, and the pressures of suppliers and customers pictured vertically, reflecting competitive dynamics up and down the value chain.

Implications for competitive advantage

Examining the five forces helps us understand how defensible a position in a given market or industry may be — in particular, the extent to which a firm is likely to be able to capture value. If an industry is characterized by significant competitive threats on one or more of these dimensions, then a firm in that industry may have a harder time.

More tactically, the framework also aids us in identifying and reasoning about what Porter called competitive advantages — sustainable sources of differentiation relative to competitors. For example, a firm might differentiate through specialized technology that gives it a quality or cost advantage, or through economies of scale that give it more favorable terms with its suppliers.

Critically, competitive advantage is not absolute. Instead, it’s relative to other firms in the industry. So changes in the five forces can affect a firm’s competitive advantage and/or its defensibility. For example, the rise of e-commerce in apparel and retail markets — a source of new entrants and substitute products (forces #2 and #3) — reduced the competitive advantage brick-and-mortar retailers had in local markets. Similarly, the scale of a social media platform like Facebook allows it to lock in users through high switching costs, reducing the overall bargaining power of its users (who in this context are its buyers; force #5).

Revisiting the five forces in web3

Innovation through decentralized networks, open protocols, and shared ownership intensifies competition along each of the dimensions highlighted in the five forces, disrupting many typical sources of competitive advantage.

Open development on public blockchains can enhance the threat of new entrants (force #2) by making it easier for new firms to enter a given market. In web2 platforms, both the underlying software and control of network data have historically been sources of competitive advantage. For example, X (f.k.a. Twitter) keeps its product codebase and user data closed off from competitors, and even recently severely limited access to its API. To build a fully competing product, a new entrant would have to recreate a similar codebase and re-create the platform’s social graph.

In the open source world of web3, by contrast, a new entrant can leverage established user and content networks, as well as existing protocols and codebases. New entrants or existing competitors can use onchain data to identify and recruit a platform’s top customers (a strategy colloquially called a “vampire attack”). This strengthens the threat of new entrants (force #2) and also intensifies competition among existing firms (force #1).

Likewise, composability and the possibility of protocol forks both strengthen the threat of substitutes (force #3). An entrepreneur can take the open source code of another platform and then compose on top of it by adding additional features and mechanics to create an entirely new product that might serve users’ needs better than the original.

Meanwhile, in web3 applications, users and other stakeholders (such as content creators) are typically given direct ownership of their data and other digital assets, and those assets are typically portable and interoperable across platforms — which can greatly enhance the bargaining power of both users and stakeholders (forces #5 and #4, respectively). For example, in web2 multisided platforms like Fiverr, users and ecosystem stakeholders (e.g., creators) typically suffer from a lock-in effect, which means that they have to accept a platform’s policies or else leave their data, reputation, and history behind. In contrast, in web3, dissatisfied users or creators can easily transition their data and reputation over to a competitor.

Competitive advantages and opportunities in web3

The preceding analysis might seem to paint a bleak picture of trying to build a sustainable competitive advantage in web3 — relative to web2, competition in web3 can be substantially more intense along every dimension. Customers and suppliers can more easily switch platforms, while both existing competitors and new entrants can leverage onchain data to bootstrap protocols and networks to quickly achieve quality levels on par with established incumbents. This puts immense pressure on platforms to deliver value — and can make value capture more difficult.

But the situation is not nearly as hopeless as it might at first appear. The same features that make competing in web3 difficult offer an opportunity to grow the pie in terms of value creation by incentivizing users to contribute — which, at least in principle, leads to a bigger pie, such that capturing a smaller share can still lead to a bigger slice than in the traditional model.

And although competition is intensified across all five forces, web3 enables other sources of competitive advantage that dovetail with the open and decentralized nature of the technology — embeddedness and community cohesion. These forces aren’t completely new, but they are far more pronounced in web3.

Embeddedness

In web3, pretty much everything is composable. As in classic open source software frameworks, firms can thus have their protocols or assets become embedded in many other systems and business processes to establish competitive advantage. The more a given protocol becomes an established standard, the more it contributes to the value of the network — and the harder it is for competitors to fork or work around it.

Think of it this way: If you invent a “Lego block” that many people want to build on, that block’s ubiquity can serve as a competitive advantage and enable value capture. There’s even a sense of strength in layered embeddedness reminiscent of the way that blockchain records become more secure the older they are. If protocol A is used as a component of protocol B, and B is subsequently used as a component of protocol C, then A’s position in the network is reinforced because if C wants to eliminate its dependency on A, it also has to remove the dependency on B. And the same is true of digital assets. Once a given token has a range of different applications, it’s harder for a newcomer to supplant it.

Community cohesion

Web3 also facilitates the process by which users become personally attached to and engaged in a firm’s ecosystem. Digital ownership enabled by blockchain incentivizes users to build a relationship with a given brand or platform, and the strength of this effect can be a powerful source of competitive advantage. When users have a preference for using a given platform — as well as a vested incentive to contribute to its success — users may choose to stick with that platform even when it’s possible to switch. And conversely, with a strongly cohesive community, users will often actively contribute to a platform’s ecosystem in a way that grows its value proposition relative to competitors.

***

The key components of Porter’s Five Forces remain the same in web3 as they are both in web2 and in the offline world. In fact, competition along those dimensions can be even more fierce. Yet the path to value creation in web3 is less zero-sum.

In web2, platforms strengthen their positions at the cost of another platform — a zero-sum game. By contrast, web3 presents a competitive landscape in which the focus is on building collaboratively. Embeddedness and community cohesion create what might seem like an odd dynamic — at least for anyone who has fought for sustainable competitive advantage in other contexts. The path to value creation is more positive-sum. A web3 project can only become embedded if it creates something useful, and community cohesion by definition can only take place if users want to contribute to the underlying project and platform.

The ethos in web3 — even though the space is robustly competitive — has to be a common effort to grow the size of the pie for all. While the standard visualization of the five forces depicts a tug of war, web3 looks more like a networked model powered by collaboration.

***

Acknowledgments: The authors thank Shai Bernstein, Jana Bobosikova, Christian Catalini, Sonal Chokshi, Chris Dixon, Jad Esber, John William Hatfield, Miles Jennings, Steve Kaczynski, Mahesh Ramakrishnan, Jason Rosenthal, Tim Roughgarden, Tom Stackpole, and Ali Yahya, for helpful ideas and comments. Special thanks to our editor, Tim Sullivan. For more on strategy in web3, see Scott’s presentation at CSS 2023 and listen to this episode of our podcast “web3 with a16z.”

***

Scott Duke Kominers is the Sarofim-Rock Professor of Business Administration at Harvard Business School, a Faculty Affiliate of the Harvard Department of Economics, and a Research Partner at a16z crypto. He also advises a number of companies on web3 strategy, as well as marketplace and incentive design; for further disclosures, see his website. Kominers’s first book — The Everything Token: How NFTs and Web3 Will Transform the Way We Buy, Sell, and Create, co-authored with Steve Kaczynski — is now available.

Liang Wu is the Head of Community and Growth at the Harvard Crypto, Fintech, and Web3 Lab, and a Senior Researcher at Harvard Business School. As a researcher, he writes case studies on leading Web3 and AI companies for the Building Web3 Businesses course in the HBS MBA program. He is also an investor and advisor to Web3 projects and companies. Previously, he worked in Strategy and BizOps across Web3 and Enterprise SAAS companies where he built teams and communities and led growth initiatives. He writes Life in Color, a newsletter about emerging technology (especially AI and Web3).

Both Kominers and Wu gratefully acknowledge research support from the Digital Data Design (D3) Institute at Harvard. Part of this work was conducted during the Simons Laufer Mathematical Sciences Institute Fall 2023 program on the Mathematics and Computer Science of Market and Mechanism Design, which was supported by the National Science Foundation under Grant No. DMS-1928930 and by the Alfred P. Sloan Foundation under grant G-2021-16778.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investment-list/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures/ for additional important information.