Newsletter: On seizing the moment in crypto: Thoughts on the evolving regulatory environment, stablecoins, and Ethereum's future

Editor’s note: This post originally appeared in our newsletter — a guide to trending topics in crypto with insights and resources from engineers, researchers, and others on the a16z crypto team. Subscribe to see it in your inbox every other week.

The election marks a major shift for the industry with many pro-crypto candidates winning office. In this edition, we share thoughts on how the regulatory environment may change post-election; suggestions for U.S. agencies to seize the opportunity; and insights into stablecoins and Ethereum’s future.

The path forward, post-election

Miles Jennings, Michele Korver, and Brian Quintenz

In the wake of this election, you’re probably hearing lots of speculation about what will happen to crypto from a regulatory perspective. Most of these takes — and the many yet to come, no doubt — will just be noise.

The truth is that it’s too early to tell how everything will shake out. What we do know is that the months ahead will mark a significant shift for the industry and the people working in it.

We’re optimistic that the U.S. will now be a better place for crypto builders, and that startups here won’t have to be so focused on merely surviving a hostile regulatory environment. Instead, they can keep working toward all of the exciting progress crypto can make when allowed to thrive with bipartisan support, such as:

- giving people ownership over their digital identities,

- new business models for creators,

- low to no-fee cross-border transactions with stablecoins,

- new ways for small businesses to engage with their customers,

- decentralized social networks that empower users,

- development of physical infrastructure like energy grids,

- blockchains that democratize AI and games,

…and so much more that we can’t even imagine yet. The future of crypto in the U.S. is bright — it’s the perfect time to build here, and we’re excited about the possibility of regulatory clarity to come.

plus: here are a16z cofounders Marc Andreessen and Ben Horowitz on the election’s implications for tech generally and also for crypto in the latest episode of their podcast.

7 things U.S. agencies could do to seize the crypto opportunity

Brian Quintenz

Imagine if Department of Transportation officials were prohibited from ever getting into a car or riding an airplane. That’s what is happening with the government employees who are tasked with regulating crypto: Right now they’re restricted from using any amount of it, according to a 2022 legal advisory notice from the U.S. Office of Government Ethics.

While it’s obviously important to maintain ethical standards around conflicts of interest, sensible policy comes from engagement with the technology and the knowledge that provides. Government employees charged with regulating crypto should be allowed to use it.

This is just one of seven proposals that Brian Quintenz, our head of global policy, recommends government agencies take to help create a functioning regulatory regime for crypto that incentivizes decentralization while protecting consumers. Others include ways to increase efficiency, competition, innovation, and more.

Trend-tracking: Stablecoins

Sam Broner

Millions of people have transacted trillions of dollars using stablecoins, and yet definitions of the category, and therefore people’s understanding of it, are still fuzzy. To understand the richness and limitations of the stablecoin design space, one useful lens is the history of banking: what worked, what didn’t, and why.

Stablecoins offer users many familiar experiences from bank deposits and bank notes — convenient and reliable store of value, medium of exchange, lending — but in an unbundled, “self-custodiable” form. Like many products in crypto, stablecoins will likely speedrun banking history, starting with simple banknotes before expanding the money supply through increasingly sophisticated lending.

Here, the author looks at three types of stablecoin tokens, along with their fiat predecessors in the tradfi banking stack, to evaluate how stablecoin adoption could play out.

A deal-maker’s view

Jane Lippencott

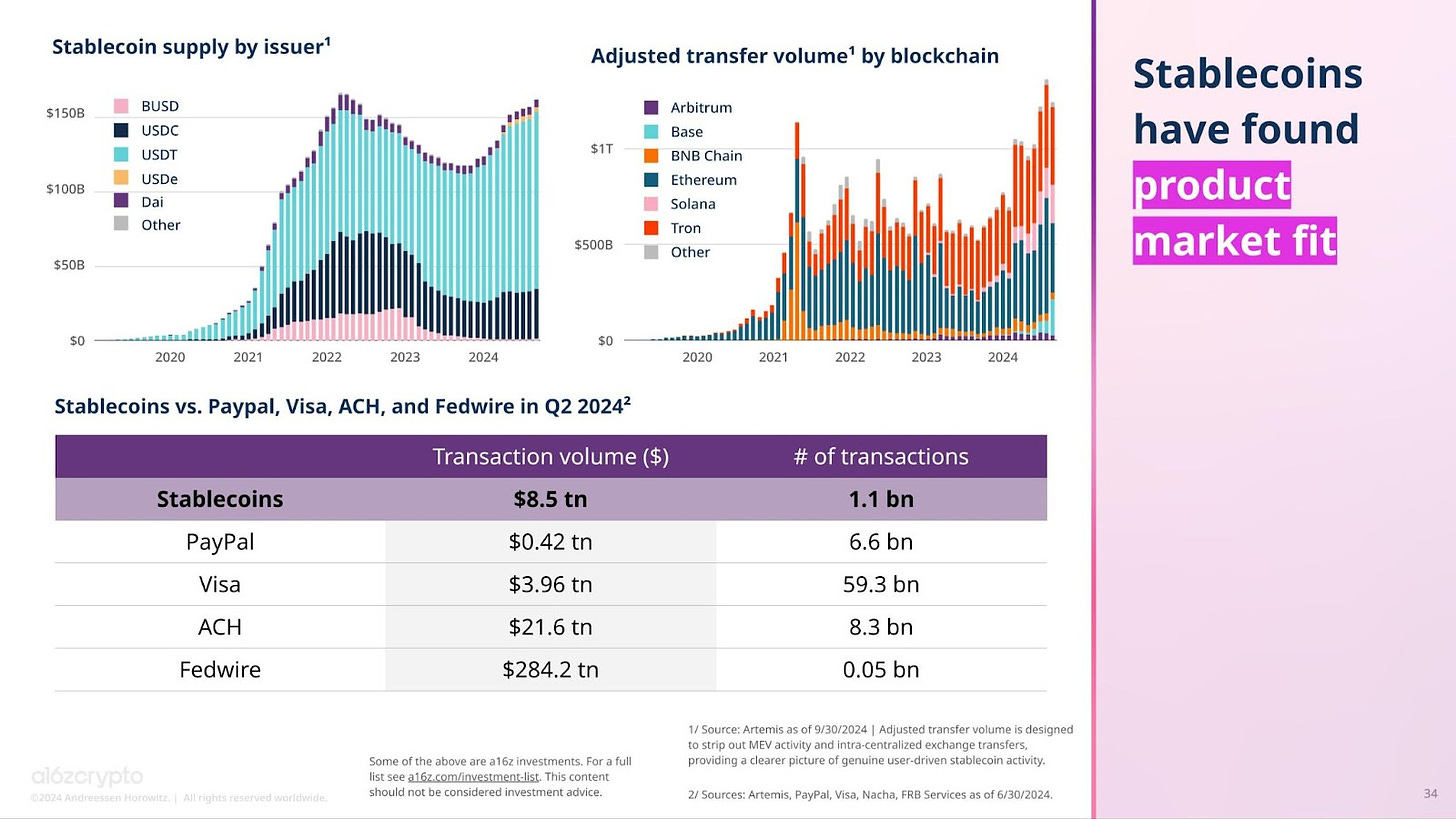

Onchain commerce has been a dominant narrative of 2024, with stablecoin volume ($8.5 trillion in Q2 2024) and market cap (nearly $180 billion today) demonstrating that the need for cheaper, faster, and more transparent payments is a cycle-resistant phenomenon.

a16z crypto State of Crypto Report, p.34

Underpinning this momentum, 2024 has brought real, institutional-level change. Stripe, SWIFT, and Visa have launched initiatives to use stablecoins natively, greenlighting banks all over the world to partner with crypto wallet providers and start accepting stablecoins on their customers’ behalf. Global regulatory bodies are discussing legislation aimed to clarify rules for onchain payments infrastructure, acknowledging the strategic influence that the first few countries to codify clear guidelines will gain in the ever-changing global financial system.

The sheer size of Stripe’s intended acquisition of Bridge — a B2B startup building APIs for stablecoin orchestration — encapsulates the seriousness that global fintechs and banks should be bringing to their boardrooms. When we meet with multinational corporations who are thinking about ways they can meaningfully leverage crypto and web3, the opportunities stablecoins present are consistently at the forefront.

More takes on stablecoins…

💵 What we still don’t know about stablecoins

Stablecoins promise to change the balance of power in long-established industries. Two recent articles from Lightspark Cofounder Christian Catalini (one with Jane Wu) explore the realities of the stablecoin market. In particular, stablecoin network effects could be weaker than most people anticipate, and competition in the market is far from winner-take-all. While industry insiders often cite liquidity as the primary reason only a few stablecoins will dominate, the truth is more complex. (Forbes / Harvard Business Review, with Jane Wu)

🇺🇸 How stablecoins can strengthen the U.S. dollar

Stablecoins are typically denominated in dollars and backed by dollar-denominated securities, which is leading crypto in some dollar-friendly directions, writes economist Tyler Cowen. And, as revealed in our 2024 State of Crypto Report, stablecoins have already found product-market fit, as a nearly free, nearly instant payments platform. All of this can concentrate interest in the U.S. dollar and bolster its status as the dominant global currency. (Bloomberg)

Inside Devcon: Glimpsing (possible) Ethereum futures

Noah Citron

At Devcon this past Tuesday, Justin Drake of the Ethereum Foundation revealed his vision for Ethereum’s future: the “beam” chain. Beam would be an overhaul of Ethereum’s consensus layer, inspired by lessons from building the beacon chain, the backbone of Ethereum’s proof-of-stake system.

Beam would be designed to improve staking economics, increase decentralization, add single slot finality, reduce block times, migrate to post-quantum cryptography, and use zkVMs to make validators more performant. Work on beam would continue alongside the existing beacon chain, with the goal of switching to beam around 2029.

Beam also represents an opportunity to onboard additional core development teams, Drake said, announcing plans to build beam clients both in Asia and South America. Drake emphasized that this is just his vision for Ethereum, but he hopes to gain alignment within the Ethereum community over the coming months.

…rawr

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investment-list/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures/ for additional important information.