Vampire attacks: A theory (and thread) on 'blood sucking' platform competition

In a “vampire attack,” a platform tries to directly incentivize its competitor’s customers to switch. This isn’t a new idea — airlines have had “status match” for ages — but it’s much easier in the world of crypto, where transactions are stored publicly on blockchains. With public transaction histories, a new entrant can just simply read its competitors’ transaction records and provide direct rewards or other incentives to top customers who switch.

What does this mean for consumers? The short version is that vampire attacks can result in virtuous platform competition that drives down prices. In short, “blood-sucking platform competition” can be good for consumers.

To arrive at this conclusion, in a new paper, we built a simple model in which platforms have some customers who are “captive,” and others who are mobile across platforms — and price-sensitive. In the real world, customers might be captive because of, for instance, search costs or lack of information about alternatives.

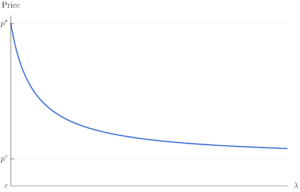

When platforms are only able to offer a single price to both types of consumers, the price curve declines in the share of the market that’s mobile, denoted by λ in the figure below. This makes sense, since the more of those consumers there are, the more firms want to compete for them.

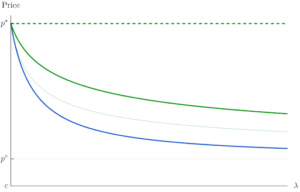

Next, we consider what happens when firms introduce loyalty programs as a way of convincing mobile customers to stay put. Consumers who are part of a platform’s loyalty program receive a discount at that platform but have to pay the standard price at a competitor’s.

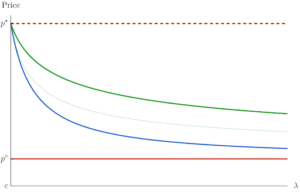

It turns out that loyalty programs are actually bad for all consumers — even the ones who get the discount. Why? First, firms now charge their captive consumers more, since they can protect their mobile consumers with a loyalty program. The resulting captive consumer price is the dashed green line in the figure below.

But if the platforms are monopolizing their captive customers, that means they have to drop their price a lot — and take a big loss — if they want to attract their competitors’ loyal customers… which reduces the likelihood that a platform will try to steal its competitor’s loyal customers. As a result, firms can charge even their loyal customers more; this is the solid green line in the figure below.

But when each firm can see who its competitors’ loyal customers are, vampire attacks are possible — that is, each firm can offer a competitor’s loyal customers the same price it’s giving its own loyal customers. This in turn leads to much more competition over those customers, driving the price they face down far below even the price before loyalty programs were introduced. This is the solid red line in the figure below.

In short: Vampire attacks restore competition for loyal customers.

This theory broadly accords with what we’ve seen among NFT trading platforms, with vampire attacks leading to intense competition for customer loyalty. A caveat, however, is that it’s not clear how sustainable the current vampire attack models are, especially since the legality and regulatory statuses of the strategies that many of them rely on are uncertain, and the relative success of such attacks may be different in scenarios where regulatory clarity and consistent enforcement exists.

Moreover, as Shai Bernstein and one of us (Kominers) discussed in a recent Harvard Business Review article, the competition induced by vampire attacks can only benefit consumers if it doesn’t incentivize firms to engage in malbehavior (such as with centralized crypto finance platforms taking on excessive risk in order to offer higher rates of return).

That said, overall, our analysis suggests that vampire attacks may contribute to increased — and hopefully virtuous — platform competition. This has the potential to reshape the digital platform landscape in a way that’s better for everyone.

* * *

P.S. Any ideas for alternate names for the “vampire attack” concept? The name is evocative, but doesn’t on its face sound like something you’d necessarily want to help enable.

P.P.S. There is in fact an economics literature on that other type of vampire attack.

This article is an adaptation of a recent Twitter thread summarizing our new economic theory paper, “A Simple Theory of Vampire Attacks.”

John William Hatfield is the Arthur Andersen & Co. Alumni Centennial Professor in Finance at the McCombs School of Business at the University of Texas at Austin.

Scott Duke Kominers is a Professor of Business Administration at Harvard Business School, a Faculty Affiliate of the Harvard Department of Economics, and a Research Partner a16z crypto. He also advises a number of companies on marketplace and incentive design; for further disclosures, see his website.

Special thanks to our editor, Tim Sullivan, as well as Shai Bernstein, Josh Bobrowsky, Christian Catalini, Sonal Chokshi, Lauren Cohen, Chris Dixon, Piotr Dworczak, Jad Esber, Joshua Gans, Zachary Gray, Hanna Halaburda, Mason Hall, Miles Jennings, Michele Korver, Sriram Krishnan, Eddy Lazzrin, Collin McCune, Kim Milosevich, Vivek Ravishanker, Natalia Rigol, April Roth, Ben Roth, Tim Roughgarden, Bryan Routledge, Scott Walker, Carra Wu, Ali Yahya, the Lab for Economic Design, and presentation audiences at the American Economic Association meetings, Harvard Business School, and a16z crypto for helpful comments.

—

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not necessarily the views of a16z or its affiliates. a16z is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration as an investment adviser does not imply any special skill or training. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party information; a16z has not reviewed such material and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities, digital assets, investment strategies or techniques are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments or investment strategies will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Additionally, this material is provided for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. Investing in pooled investment vehicles and/or digital assets includes many risks not fully discussed herein, including but not limited to, significant volatility, liquidity, technological, and regulatory risks. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.