In his classic 2008 essay “1000 True Fans,” Kevin Kelly predicted that the internet would transform the economics of creative activities:

To be a successful creator you don’t need millions. You don’t need millions of dollars or millions of customers, millions of clients or millions of fans. To make a living as a craftsperson, photographer, musician, designer, author, animator, app maker, entrepreneur, or inventor you need only thousands of true fans.

A true fan is defined as a fan that will buy anything you produce. These diehard fans will drive 200 miles to see you sing; they will buy the hardback and paperback and audible versions of your book; they will purchase your next figurine sight unseen; they will pay for the “best-of” DVD version of your free YouTube channel; they will come to your chef’s table once a month.

Kelly’s vision was that the internet was the ultimate matchmaker, enabling 21st century patronage. Creators, no matter how seemingly niche, could now discover their true fans, who would in turn demonstrate their enthusiasm through direct financial support.

But the internet took a detour. Centralized social platforms became the dominant way for creators and fans to connect. The platforms used this power to become the new intermediaries — inserting ads and algorithmic recommendations between creators and users while keeping most of the revenue for themselves.

The good news is that the internet is trending back to Kelly’s vision. For example, many top writers on Substack earn far more than they did at salaried jobs. The economics of low take rates plus enthusiastic fandom does wonders. On Substack, 1,000 newsletter subscribers paying $10/month nets over $100K/year to the writer.

Crypto, and specifically NFTs (non-fungible tokens), can accelerate the trend of creators monetizing directly with their fans. Social platforms will continue to be useful for building audiences (although these too should probably be replaced with superior decentralized alternatives), but creators can increasingly rely on other methods including NFTs and crypto-enabled economies to make money.

NFTs are blockchain-based records that uniquely represent pieces of media. The media can be anything digital, including art, videos, music, gifs, games, text, memes, and code. NFTs contain highly trustworthy documentation of their history and origin, and can have code attached to do almost anything programmers dream up (one popular feature is code that ensures that the original creator receives royalties from secondary sales). NFTs are secured by the same technology that enabled Bitcoin to be owned by hundreds of millions of people around the world and represent hundreds of billions of dollars of value.

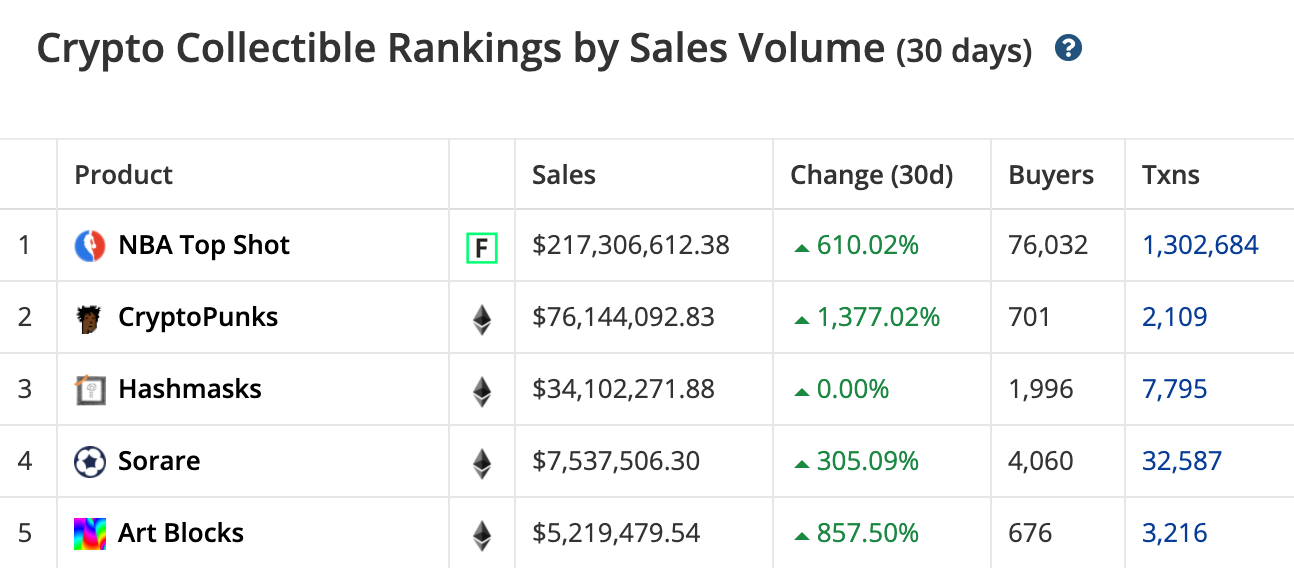

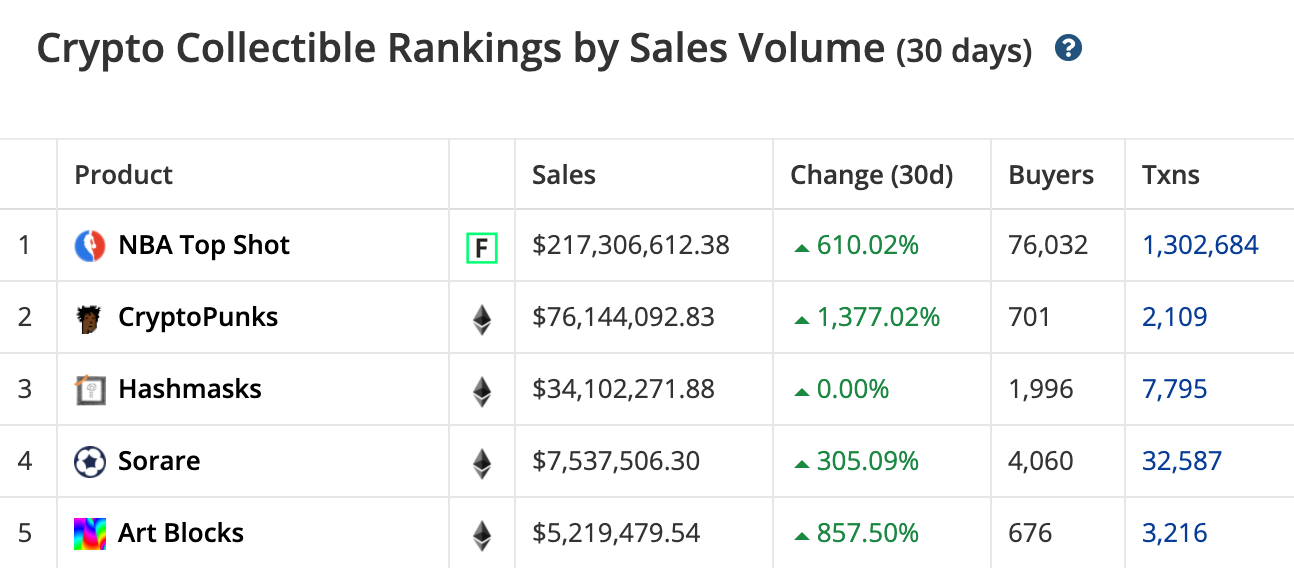

NFTs have received a lot of attention lately because of high sales volumes. In the past 30 days there has been over $300M in NFT sales:

Crypto has a history of boom and bust cycles, and it’s very possible NFTs will have their own ups and downs.

That said, there are three important reasons why NFTs offer fundamentally better economics for creators. The first, already alluded to above, is by removing rent-seeking intermediaries. The logic of blockchains is once you purchase an NFT it is yours to fully control, just like when you buy books or sneakers in the real world. There are and will continue to be NFT platforms and marketplaces, but they will be constrained in what they can charge because blockchain-based ownership shifts the power back to creators and users — you can shop around and force the marketplace to earn its fees. (Note that lowering the intermediary fees can have a multiplier effect on creator disposable income. For example, if you make $100K in revenue and have $80K in costs, cutting out a 50% take rate increases your revenue to $200K, multiplying your disposable income 6x, from $20K to $120K.)

The second way NFTs change creator economics is by enabling granular price tiering. In ad-based models, revenue is generated more or less uniformly regardless of the fan’s enthusiasm level. As with Substack, NFTs allow the creator to “cream skim” the most passionate users by offering them special items which cost more. But NFTs go farther than non-crypto products in that they are easily sliced and diced into a descending series of pricing tiers. NBA Top Shot cards range from over $100K to a few dollars. Fan of Bitcoin? You can buy as much or little as you want, down to 8 decimal points, depending on your level of enthusiasm. Crypto’s fine-grained granularity lets creators capture a much larger area under the demand curve.

The third and most important way NFTs change creator economics is by making users owners, thereby reducing customer acquisition costs to near zero. Open any tech S-1 filing and you’ll see massive user/customer acquisition costs, usually going to online ads or sales staff. Crypto, by contrast, has grown to over a trillion dollars in aggregate market capitalization with almost no marketing spend. Bitcoin and Ethereum don’t have organizations behind them let alone marketing budgets, yet are used, owned, and loved by tens of millions of people.

The highest revenue NFT project to date, NBA Top Shot, has generated $200M in gross sales in just the past month while spending very little on marketing. It’s been able to grow so efficiently because users feel like owners — they have skin in the game. It’s true peer-to-peer marketing, fueled by community, excitement, and ownership.

NFTs are still early, and will evolve. Their utility will increase as digital experiences are built around them, including marketplaces, social networks, showcases, games, and virtual worlds. It’s also likely that other consumer-facing crypto products emerge that pair with NFTs. Modern video games like Fortnite contain sophisticated economies that mix fungible tokens like V-Bucks with NFTs/virtual goods like skins. Someday every internet community might have its own micro-economy, including NFTs and fungible tokens that users can use, own, and collect.

The thousand true fans thesis builds on the original ideals of the internet: users and creators globally connected, unconstrained by intermediaries, sharing ideas and economic upside. Incumbent social media platforms sidetracked this vision by locking creators into a bundle of distribution and monetization. There are, correspondingly, two ways to challenge them: take the users, or take the money. Crypto and NFTs give us a new way to take the money. Let’s make it happen.

(Image: CryptoPunks — Larva Labs)

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.