When is decentralizing on a blockchain valuable?

If you want to create a “new Facebook” or “new Google,” should you use a regular company or leverage a decentralized implementation through a blockchain? The answer may seem straightforward: crypto enthusiasts would answer with a resounding “yes,” while skeptics shake their heads. But the decision has less to do with faith than with practical market design considerations.

The fundamental question is how, precisely, decentralization through a blockchain can bring value to your business. In this article, I will guide you through an analysis of this question that’s rooted in economic theory and provide some insights to inform your decision. Like all models in economics, mine is built on several simplifying assumptions, which may not be applicable in all contexts. But the simplified model nevertheless helps uncover key sources of value for blockchains, and also helps characterize the context in which when decentralization may or may not be valuable.

At the center of this analysis is the “locked-in effect” – the idea that a user often finds it hard to leave a network after they have joined. Locked-in effects manifest for different reasons. Users may incur switching costs – the cost of the annoyance of setting up an account in another network. Alternatively, users may find leaving less attractive after they have spent time and effort training the algorithm of the network to adapt to their needs – think how Google learns from your past searches and personalizes search results to match your interests. Additionally, locked-in effects can be exacerbated by network effects that can give large networks significant advantages over competitors. Locked-in effects are inherent to many businesses, but their size varies case-by-case.

For the business owner, locked-in effects come with a temptation to exploit locked-in users to increase profits. Suppose you own a company that has millions or potentially even billions of users and market research indicates that you can increase monetization – perhaps through advertising or charging higher platform fees – without losing customers. What would you do? A game theoretic analysis (and, quite frankly, common sense) predicts that you should increase monetization.

The obvious danger, though, is that users may know that they can become locked-in and don’t want to be exploited. If you can’t credibly commit to not exploiting them (and you often can’t), then rational users, in my model, would demand “compensation” upfront. Such compensation might be monetary, but it can also take the form of no or very little advertisement during the growth phase of the network. Alternatively, users may refuse to join the network at all for the fear of being locked-in.

The key insight when considering using a blockchain, though, is that it allows you to generate credible commitment through the design of the network. That is, you surrender control over monetization decisions to the users, enabling them to decide it through decentralized governance. This means that users can safely join the network because they aren’t worried about it being exploited later, even if they do get locked in.

This leads to the main result of my analysis: It makes sense to decentralize your business using a blockchain when the locked-in effect is sufficiently strong.

Let’s go deeper into that conclusion.

The model: game-theoretic analysis

Here are the assumptions that underpin my model. Suppose that you are an entrepreneur who creates a network, deciding to either set it up using a centralized company, or to decentralize it through a blockchain. Further, the users interact with the network for many periods over a long period of time. Every day, potential users become aware of your network and can decide whether to join. Existing users can stay or leave. But existing users are locked-in, such that leaving the network in favor of another option has become less attractive. If you decide to implement the network through a regular company, you can change the intensity of monetization daily as you deem fit. If you decentralize the network through a blockchain, users will decide on the intensity of monetization through on-chain voting.

In this model, you as the entrepreneur are strictly interested in maximizing profits (this is another simplifying assumption), which are given by a function of the intensity with which the network is monetized, the number of users who are monetized, and the price at which such monetization can be sold – the number, for instance, of display ads on the network and the price an advertiser is willing to pay per ad and user.

Users, in this model, are interested in three aspects of the network. First, they derive utility from using the network – economist-speak for the fact that using the network gives them some form of value. Second, they dislike monetization (such as being forced to watch ads). Third, they enjoy any platform revenues from monetization that are shared with them.

Now we can solve the model through backward induction. That is, we look at the game-theoretic predictions for centralized and decentralized governance, which will show which mode of governance you should choose at the inception of your network to maximize profits.

Choosing centralized governance

Centralized governance allows you, the entrepreneur, to decide the level of monetization in every period. Two levels of monetization seem reasonable intuitively: first, a low level of monetization such that new users are willing to join, or a higher level of monetization that, while off-putting to new users, is not so high that it makes the the existing, locked-in users leave.

The monetization strategy that is more profitable depends crucially on the network’s growth prospects. When future growth is sufficiently strong, you are incentivized not to exploit the locked-in effect because you want to maintain network growth. But when growth slows down sufficiently, it makes more sense to forego network growth in favor of exploiting the locked-in effect of existing users by increasing monetization.

However, in equilibrium, users – having been subject to the whims of Web2 platforms for so many years – have gotten smart and anticipate future exploitation. They therefore insist on being “compensated” beforehand (in my model, compensation might be monetary, but it can also take the form of little or no advertisement during the growth phase of the network, for example), which is costly to you. Thus, the control over monetization that you retain in centralized governance serves as both the advantage and the disadvantage of centralization. You can freely increase monetization to increase profits. However, you can’t commit to future monetization choices but will instead do what is optimal at each particular moment.

Decentralizing using a blockchain

When you choose to decentralize using a blockchain, the first question to answer is how to share governance, that is, how many of the tokens to keep for yourself and how many tokens to distribute to the users. If you want to credibly decentralize your business, you have to give away control, which means giving third-parties a majority of the tokens. Otherwise, you could easily win against the users in any vote.

The tradeoffs are clear. If users have control over monetization, then you cannot exploit the users’ locked-in effect, and they will not exploit their own locked-in effect either. As such, users do not need to be wary of future exploitation and need not be “compensated” beforehand. Thus, the network will be able to grow continuously rather than experience a growth phase followed by an exploitation phase.

Yet surrendering control and giving away governance tokens imposes serious costs. First, you cannot choose monetization of the network. Second, you have to share revenues with the users through the governance tokens. This is necessary to align the incentives between you and the users. If you did not share any revenues, users would not want any monetization of the network.

Should you decentralize at the start?

Considering some edge cases might be clarifying.

First, consider the case where no locked-in effect exists. Recall that the disadvantage in a centralized implementation was the lack of commitment to not exploit the locked-in effect in the future, leading to unhappy users who are nonetheless locked in. Without the locked-in effect, though, there is also no lack of commitment. This eliminates the disadvantage from centralization, and only the advantages remain. As a result, centralization will generally be preferred if there are no locked-in effects or if they are very small.

If locked-in effects are very large, it may not even be possible to attract users to the network. In particular, the threat of exploitation in the future may be too substantial to overcome, even if you did offer monetary compensation or to not monetize the network during the growth phase. In this case, decentralization is clearly preferable, as only then users can be attracted to the network.

The optimal choice

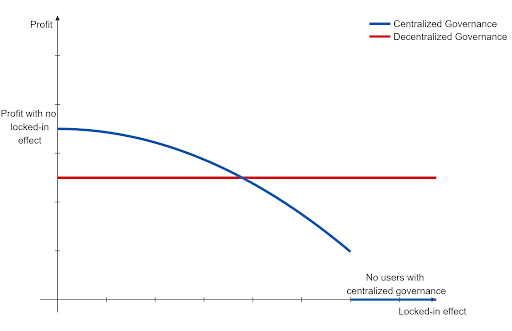

What, then, is the optimal choice of governance for the range of locked-in effects between the two extremes? A graph can help visualize the dynamic. The x-axis is the size of the locked-in effect, while the y-axis is your profit.

The profit under decentralized governance does not depend on the size of the locked-in effect (users do not exploit their own locked-in effect), so you can draw it as a horizontal line. When there is no locked-in effect, the profit with centralized governance sits above the profit with decentralized governance. For locked-in effects that exceed some large enough threshold, we draw profit with centralized governance at 0.

As the locked-in effect increases, the red line depicting the profits with decentralized governance does not change. But the profit with centralized governance – the blue line – slopes downward as the locked-in effect grows. This may seem counterintuitive because a larger locked-in effect allows the entrepreneur to achieve higher profit in the exploitation phase. But in total, it is more expensive to induce users to join the network than the profits that can be generated from exploiting them in the future. The result, perhaps surprisingly, is that profit with centralized governance will eventually fall below the profit that can be achieved with decentralized governance.

This logic brings us to the conclusion we started with: it is optimal to choose decentralized governance if the size of the locked-in effect is sufficiently large. How large exactly “sufficiently large” is has to be determined on a case-by-case basis and depends on the specifics of the network, such as the strength of network effects, users’ aversion to monetization, the potential profit from monetization, and user growth. (There is some academic work on how to measure that size of locked-in effects that could be directionally useful.)

Airdrops: at what time should you decentralize?

So far, the analysis has assumed that you have to decide whether to decentralize or not at the inception of your network. In practice, it is possible, and also quite common, to start with a centralized network and to decentralize it progressively over time. But decentralization must not be delayed for too long because the decision to decentralize is subject to a commitment problem, just as the monetization decisions are.

For example, suppose that you have promised your network’s users to implement decentralized governance at a later time. You keep delaying the decentralization of the network until you feel reasonably happy with the result. But by then, the network has grown very large and it is more profitable to exploit the users rather than to surrender control over the network by decentralizing it. If you delay decentralization for too long, users expect that you will not follow through with your plans.

That said, it may be beneficial to delay decentralizing the network for a while. In the model, it is profitable to delay decentralization until the commitment to not exploit your users has become sufficiently valuable. For practical purposes, it may also be advantageous to retain a larger degree of control over the network while it is being built – for example, to resolve problems, fix bugs, and otherwise improve the network (what some call “progressive decentralization”). But again, the network has to be decentralized before the temptation to retain control over the network to increase profits becomes too large. In practice, this would typically mean staying in charge of the network for a while and then airdropping the governance token and converting to decentralized governance. It may also be beneficial to distribute the tokens over time to gradually reinforce the desired commitment, rather than distributing them all at once. The timing of decentralization and token issuance is also often influenced by applicable regulatory considerations.

***

In this article, I have tried to convince you of one way (among possibly many) that decentralization can create value for your business: the value of the commitment to not exploit your users in the future. I focused on the strength of the locked-in effect as the key variable. If the locked-in effect of the users is strong enough — and thus your commitment problem sufficiently severe — decentralization through a blockchain is the more profitable option. If the locked-in effect is small – if users can come and go freely and easily – it may be more profitable to implement the network through a centralized company.

***

Marco Reuter is a PhD candidate in economics at the University of Mannheim, a researcher in market design at the ZEW Mannheim and at the Collaborative Research Center of the Universities of Bonn and Mannheim. His research interests include market and mechanism design. Recently, he’s been focusing on the economics of blockchains and cryptocurrencies.

***

I would like to thank Scott Kominers for valuable feedback and Tim Sullivan for his editing.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.