In this edition:

- Markets as information systems: How prediction markets address “the knowledge problem”

- Designing good governance starts with how (and why) token governance works

- a16z cofounder Ben Horowitz on how crypto can help solve AI’s pressing challenges

- How to make time for creativity (and still get things done)

- Launching a blockchain task force, and other things states can do to advance crypto legislation

- More news and updates: the S&P’s crypto index, an institutional take on prediction markets, tokenized deposits, and more

TOP OF MIND

Chris Dixon

Decades before the global internet, economist Friedrich Hayek articulated what every systems builder eventually learns: Information is everywhere, but no one person can see it all. The tacit, unspoken knowledge embedded in people’s unique experiences can help us make better decisions; the problem is that no centralized planner can access it.

This “knowledge problem,” as it has become known, is about coordination, not computation. Even today, it can’t be solved by better computers or more data. The solution, as Hayek wrote in “The Use of Knowledge in Society” (1945), is decentralization.

Markets, in Hayek’s view, aren’t just for allocating resources; they’re information systems. Prices compress local knowledge into signals, align incentives, and create feedback loops that process dispersed information and help society navigate the future.

Prediction markets make this idea concrete, turning collective knowledge into prices that reflect probabilities. And their adoption is happening at exactly the right time: With trust in institutions reaching historic lows, these systems offer a new kind of credibility that’s built on openness and transparency.

As DeFi reimagines finance and stablecoins reimagine payments, prediction markets reimagine forecasting, with implications that extend well beyond finance: businesses, analysts, policymakers, and everyone else can use prediction markets to hedge risk, access real-time forecasts, and better prepare for the future.

Read more on our investment in Kalshi (also here) or see our explainer on prediction markets and why they matter.

GOOD GOVERNANCE

Andrew Hall

Builders often struggle with when — and whether — to give governance rights to tokenholders. A useful starting point for addressing these is going back to the basics: what is governance meant to do, and what can governance help protocols achieve?

Ultimately not every project needs token voting. What matters is designing governance that matches a protocol’s level of programmability, the kind of decisions it has to make, and how its community deliberates. Here’s what else you need to consider.

AI X CRYPTO

From payments to provenance tracking to proof-of-personhood, a16z cofounder Ben Horowitz explains how crypto can help solve some of AI’s most pressing challenges.

Watch the full interview on AI’s impact on the economic, cultural, and media landscapes. Or, go here for a roundup of the AI x crypto use cases we’re excited about.

SHIFTING GEARS

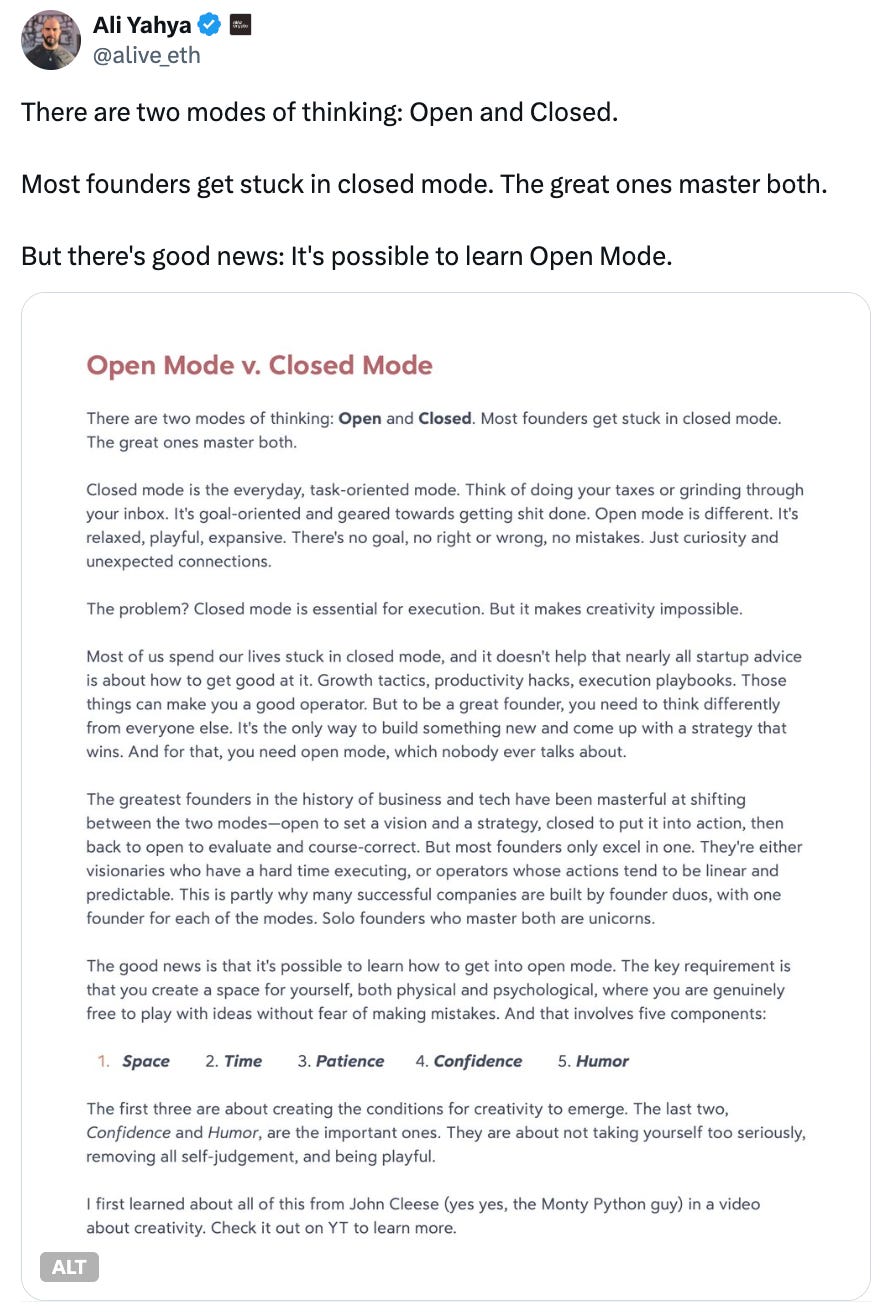

Where founders get stuck, and how to switch modes

POLICY ACTIONS

Federal crypto legislation is moving fast, but there’s a lot states can do to promote responsible crypto innovation. Here are 5 targeted, proactive actions states can advocate for:

- Adopt the DUNA, which allows blockchain project networks to remain decentralized yet compliant

- Ensure that existing laws don’t misclassify (and thus mistreat) tokens

- Launch a blockchain task force or working group to evaluate and run experiments

- Pilot (and scale) public-sector blockchain use cases for government operations

- Use stablecoins to make government procurement and disbursement processes less expensive, more efficient, and more easily auditable

Read more on what states can do to take action.

NEWS AND UPDATES

Staking is now available in New York, bringing the total to 46 states that allow “staking.” [We’ve covered what network staking is, and why it matters, in this previous edition of the newsletter.] As reported by Decrypt, staking was previously restricted in New York due to state regulators’ objections there. But Coinbase announced this week that “Thanks to Governor Hochul’s leadership in embracing progress and providing clarity, this milestone marks a meaningful step forward in ensuring residents of the Empire State have access to the same economic opportunities already open to most other Americans.” [Well, except for those who live in California, New Jersey, Maryland, or Wisconsin.]

Prediction markets just went institutional, with the largest exchange company in the world (ICE, parent of the New York Stock Exchange) announcing a strategic investment in a prediction market (Polymarket) this week. ICE stated that they will become a global distributor of the prediction market data, “providing customers with sentiment indicators on topics of market relevance”; they may also partner on future tokenization initiatives.

S&P is launching a crypto index to give stock market participants tools to evaluate and gain exposure to the crypto market. This week, the company behind the popular S&P Dow Jones indices (S&P Global) announced it will combine cryptocurrencies and publicly traded crypto-linked equities into a single “crypto ecosystem” index called the “S&P Digital Markets 50 Index.” The index currently features 15 cryptocurrencies and 35 crypto companies involved in digital asset operations, infrastructure, financial services, and other blockchain applications and supporting technologies. According to the company, “Cryptocurrencies and the broader digital asset industry have moved from the margins into a more established role in global markets… From North America to Europe to Asia, market participants are beginning to treat digital assets as part of their investment toolkit — whether for diversification, growth, or innovation strategies.”

The world’s largest custodial bank is reportedly testing tokenized deposits. As shared in Bloomberg, the project is part of the bank’s “broader work to modernize infrastructure, which includes scaling real-time, instant, and cross-border payments,” according to an interview with BNY’s executive platform owner for Treasury Services, Carl Slabicki. Slabicki observed that tokenized deposits would help banks “overcome legacy technology constraints, making it easier to move deposits and payments across their own ecosystems — and eventually, across the broader market as standards mature.” BNY also previously partnered with Goldman Sachs to launch a tokenized money market fund (MMF) solution.

— a16z crypto editorial team

You’re receiving this newsletter because you signed up for it on our websites, at an event, or elsewhere (you can opt out any time using the ‘unsubscribe’ link below). This newsletter is provided for informational purposes only, and should NOT be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites or other information obtained from third-party sources — a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. Furthermore, the content is not directed at nor intended for use by any investors or prospective investors in any a16z funds. Please see a16z.com/disclosures for additional important details, including link to list of investments.