I shared briefly why decentralization matters, and why startups should decentralize, here. So now the question is how.

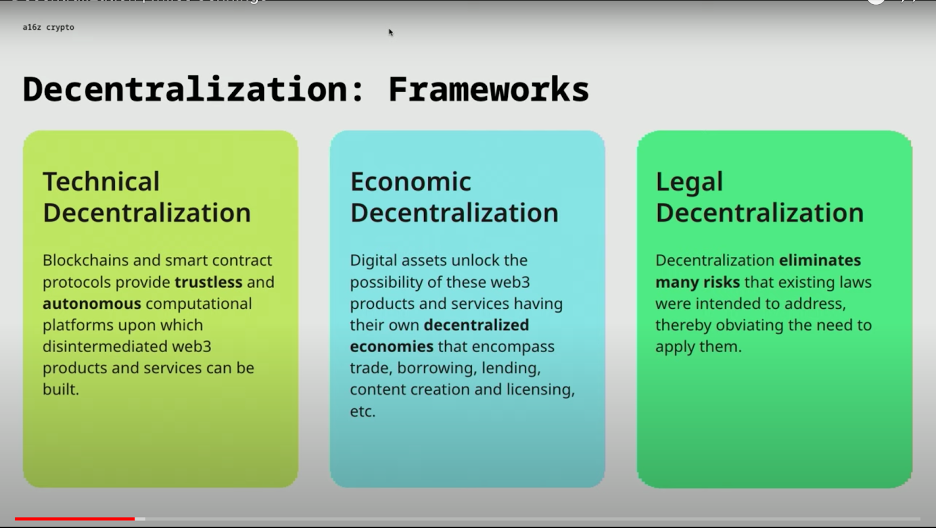

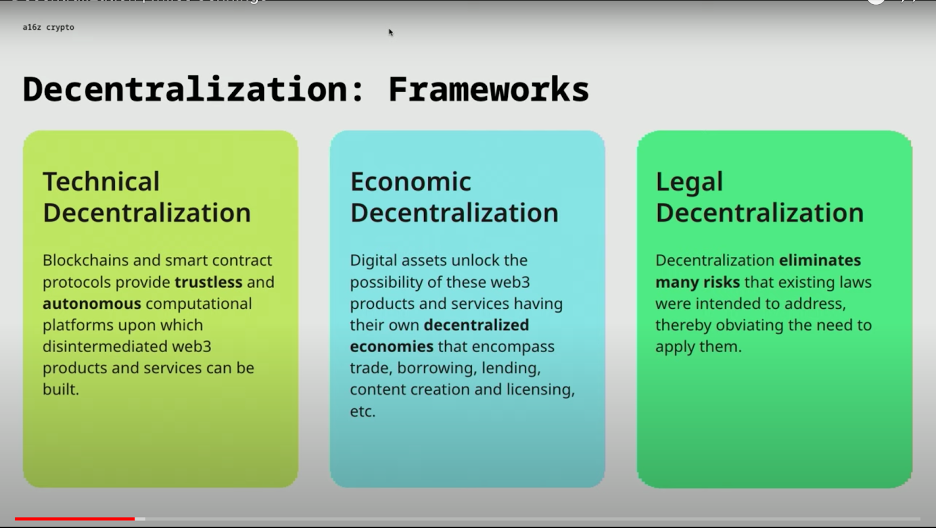

Here are the three main frameworks for decentralization to help you organize and operationalize your efforts… including a key example for why this matters legally, too.

#1 Technical decentralization

This is the ability of blockchains and smart-contract protocols to create a trustless and autonomous ecosystem in which people can compute and transact in a disintermediated fashion. The baseline hurdle for achieving technical decentralization is dependent on what kind of protocol you’re developing.

- For a blockchain like Ethereum, technical decentralization is very challenging because it’s dependent on safeguarding against all kinds of attacks, such as from validators, node operators, etc. Ultimately, the system and everything needs to be able to continue running autonomously, fund itself and withstand attack.

- By contrast, if you look at a simple smart-contract protocol — that is, if you were to deploy a smart contract and make it immutable — then you could very well argue that it was technically decentralized right away because no one can then step in and change that the smart contract.

So technical decentralization is kind of a moving hurdle depending on the protocol that you’re building.

#2 Economic decentralization

When you introduce digital assets to web3 ecosystems, you have a much more complex product.

Again in the case of Ethereum, the ability of the system to use its own digital assets to reward people who provide services to the system (as well as to transact) creates a decentralized economy around Ethereum. And as a result of the creation of that economy, a new challenge is introduced — keeping the system economically decentralized. If too much value accrues to one person or if one person is able to control the network by manipulating the price of the tokens, that would jeopardize the security and utility of the overall system.

#3 Legal decentralization

Decentralization has the ability to obviate some of the risks that are associated with transacting in assets. In finance, our whole legal system is pretty much designed around trying to mitigate the risk of one individual having to trust another with money. We have a lot of laws around intermediaries and rules around how they’re able to act — all designed to protect consumers from the conflicts of interest that those intermediaries might have. In a peer-to-peer system, like you can have with a blockchain, you don’t need intermediaries. As a result, it’s not necessary to apply intermediary-based legal regimes.

For instance, because decentralized exchanges enable disintermediated peer-to-peer exchanges of digital assets, broker-dealer rules that are meant to protect investors from intermediaries are largely unnecessary. Rules regarding conflicts of interest don’t make sense where conflicts of interest aren’t possible.

A similar concept applies to digital assets and securities laws. Securities laws are meant to address risks by requiring disclosure requirements and creating a level playing field where all investors are on the same kind of footing — because otherwise you’d end up with market manipulation and people taking advantage of other people and, ultimately, inefficient capital markets.

The way that our legal system generally looks at securities is that information asymmetries are most likely to happen when you have managerial efforts driving the value of a given asset.

Just think about the difference between Apple stock and oil:

- One reason Apple stock is treated like a security is because Tim Cook has access to a lot of information that might affect the value of Apple stock. He knows how many iPhones they’ve sold and how many they’ve produced and all kinds of other information that isn’t available to the general public. So in order for Apple’s stock to publicly trade on markets they’re obligated to disclose all of the material information that might be relevant to the price of that asset. For securities, issuer-based disclosures are necessary to keep a level playing field for investors.

- Now compare that to oil. Oil isn’t a security. It’s a commodity, and as a commodity all the information about oil and what the price of oil might be is publicly available. Now there might be organizations like OPEC that change the amount of oil that they’re going to produce, which has impacts on the price — but there are other organizations or countries that can take actions to impact the price of oil. So you’re not talking about the fundamental kind of information asymmetry that exists with respect to stocks. For commodities, asset-based disclosures can help establish a level playing field for investors and issuer-based disclosures are unnecessary.

So what do we do about digital assets in web3? If a web3 system can eliminate significant information asymmetries – and it can eliminate reliance on managerial efforts — then we can say that the system is sufficiently decentralized, such that securities laws are no longer necessary to apply. (Of course when it comes to legal decentralization, founders are often confused and the rules are currently not as clear as they should be because the SEC hasn’t set them out in a manner that’s very clear.)

For more on understanding decentralization for builders — principles, models, how — go here. Because in web3 systems, the three types of decentralization — technical, economic, legal — must be viewed holistically. Changes to one may affect the others, and it’s a fine balance.

Editor’s note: This is the second part of a short two-part series that covers decentralization at a high level, based on this talk at CSX, a16z crypto’s startup accelerator. Part one is here; for more deep dives on some of the concepts, go here.