When people talk about the recent past and envision the distant future of crypto, conversation always comes back to the cycle of wealth creation and redistribution. Consciously or unconsciously, there’s an understanding that growing the network doesn’t just involve enriching the current members, it demands expanding the number of people who can afford to participate.

It’s been discussed everywhere from Vitalik’s blogposts …

“This state of affairs in funding was possible at first because of extreme Bitcoin price rises from 2010-13, then the one-time ICO boom from 2014-17, and again from the simultaneous second crypto bubble of 2014-17, all of which made the ecosystem wealthy enough to temporarily paper over the large market inefficiencies.”

…to episodes of Bankless …

“I think what was perhaps one of the best things that came out of the 2017 ICO boom was the people were spending their eth and that led to reorganization and further distribution of eth across many many hands.” — Santiago Santos

…to observations from builders in the space …

Thinking about those examples from Ethereum’s recent history, one comes away with an image of the network as a self-regulating ecosystem: the moment currency becomes concentrated in a select few hands or activity confined to a narrow array of protocols, redistribution (and new innovation) eventually prevails, sending value spilling into new wallets, and attracting new people in the process.

The pace of innovation in the past few weeks has been especially breathtaking: Layer 1 chains have been attracting billions of dollars in Total Value Locked, Layer 2 solutions are scaling rapidly, and NFT sales have been breaking records. But we should be looking beyond DeFi and NFTs as well. As more people arrive to web3, there will be even more diverse ways to participate. And even though it might seem like a violation of the name of the industry itself, there should be more ways to interact with crypto that downplay the involvement of currency.

New entrants, rising prices

There are a lot of different ways to parse the size of the increasing pool of participants. We might look to centralized exchanges like Coinbase (68 million verified users, up from 34 million verified users last year). Add in Robinhood and Square, and you have something like 84 million crypto owners across those three companies. Or take the number of active Ethereum addresses, which was around 10 million at their peak this summer, per data from wallets like Metamask and data providers like Glassnode. Or total DeFi users over time (roughly 3.3 million people on Ethereum alone, up from 450,000 this time last year). Or the number of Ethereum wallets holding at least one NFT (1.2 million, up from roughly 500,000 last year).

Translating these numbers into something like a narrative, it’s clear there’s been an extraordinary surge in the number of crypto-traders in the past year (aka users who might view holding crypto primarily as an investment). There’s also a smaller — and growing — percentage of the population that is now taking their crypto and interacting with it through peer-to-peer payments, DeFi, NFTs, and community-building. In other words, people who now view crypto as a way of life.

Let’s say that the number of crypto users has at least doubled — if not quadrupled — in the past year. What this number doesn’t convey is that the price of Ethereum — and thus the price of participating in what is today’s most active crypto network — has increased significantly as well. This is arguably bad for new entrants.

Early net, falling costs

People often compare this time to the early days of the internet. And there’s a lot of truth to that: At the end of 1999, the top three internet providers in the U.S. covered roughly 26 million households (or around 100 million people), just a little more than the current number of crypto owners at Coinbase, Robinhood, and Square combined. Community networks like TheGlobe had 4.7 million users. Online brokers like e*Trade had 3 million customers (about the same number of DeFi users today). And the mission of web3 continues the vision of the early internet: We’re now trying to transfer value at the same rate of communication.

But most early users of the internet also were lucky enough to see prices go down every year: In 1996, AOL switched from usage-sensitive to flat-rate pricing, which not only drove more consumer adoption of the internet, but also led to more time spent online.

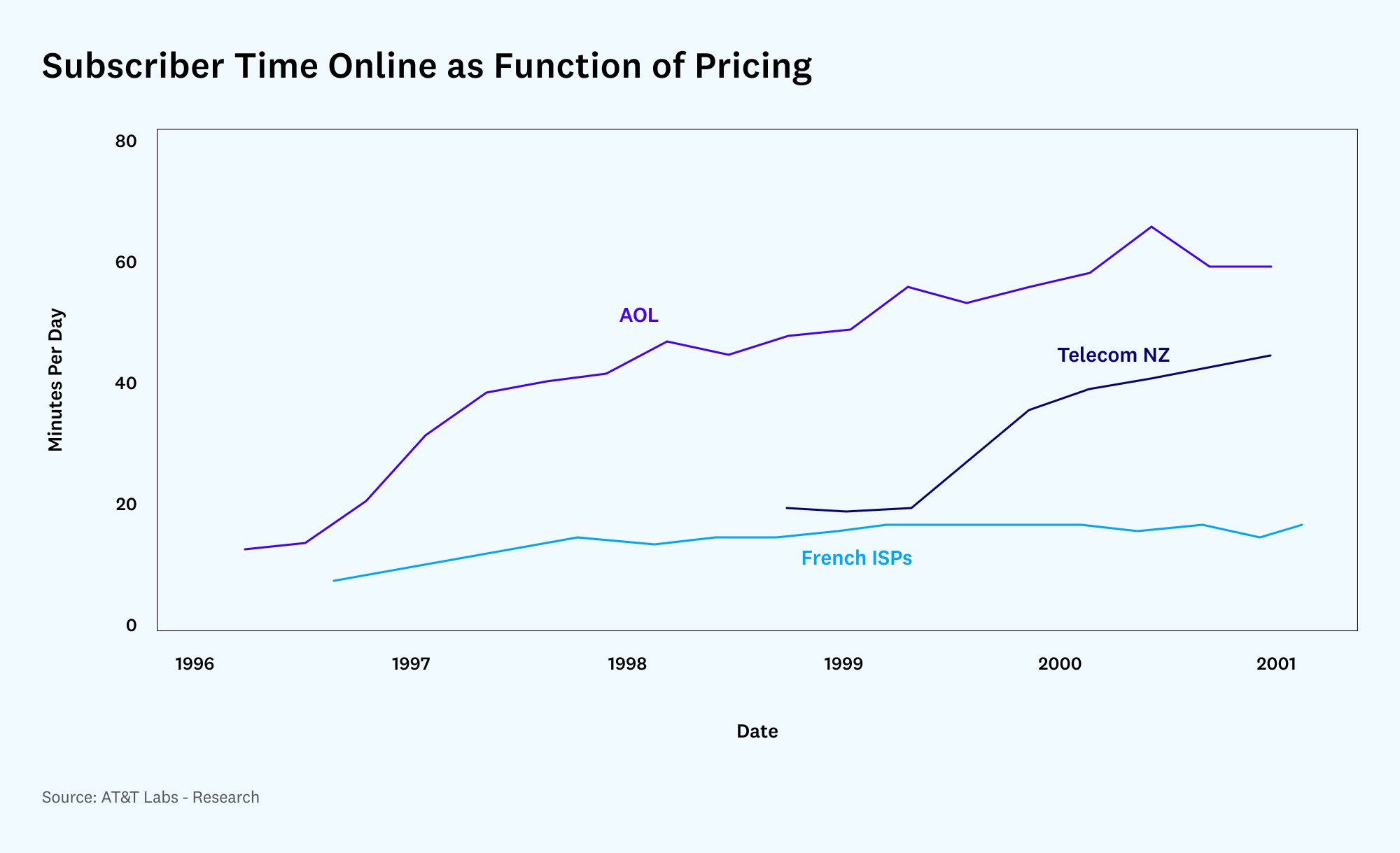

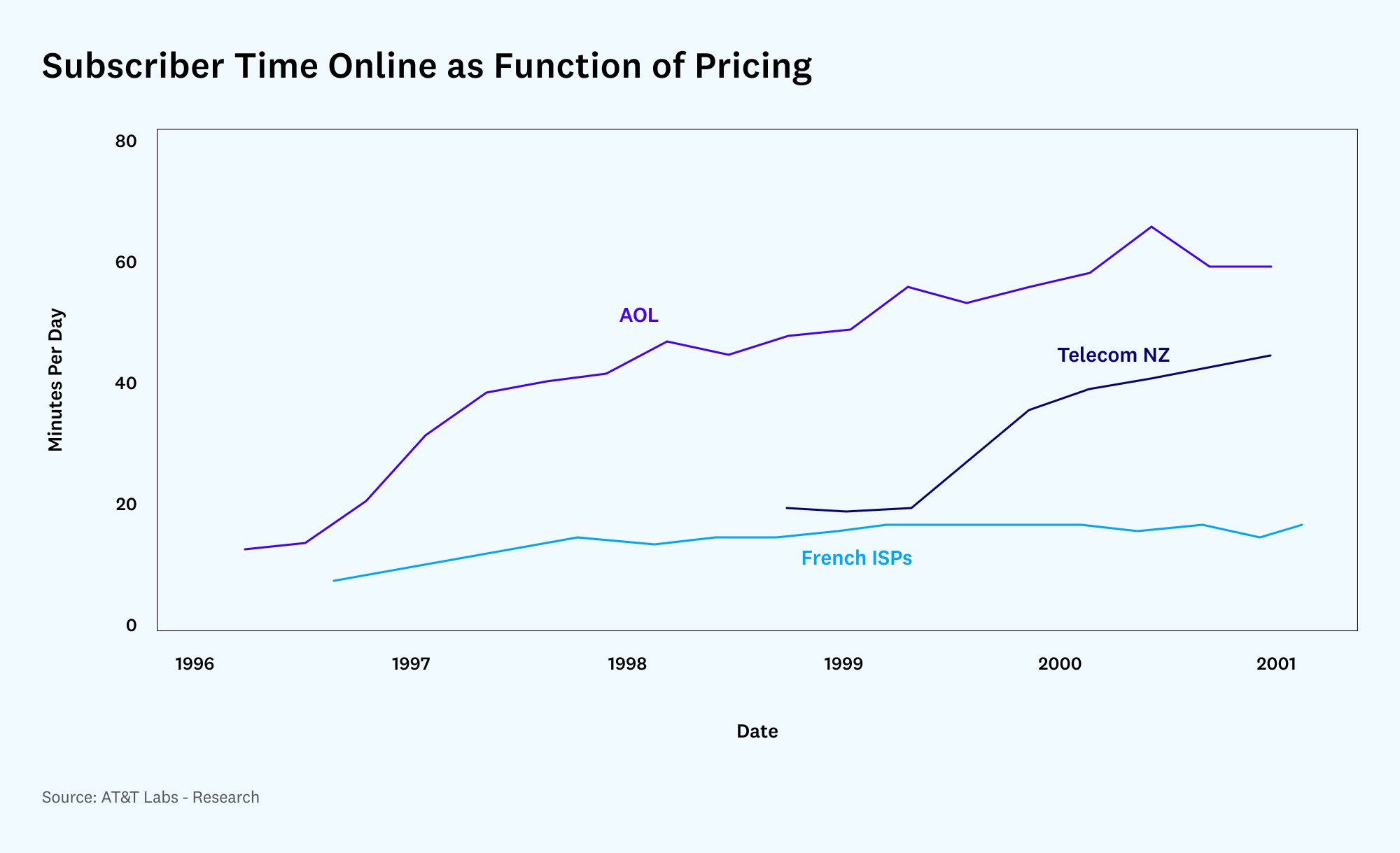

The above chart examines time spent online in the United States, France, and New Zealand from 1996-2001. After AOL switched to flat-rate pricing in 1996, internet usage tripled within a year, and then doubled again by 2001. It should be noted that internet speeds stayed relatively flat at 56 kilobits/second for dial-up users (who comprised the majority of internet subscribers at the time). The same happened in 1999 when Telecom New Zealand introduced flat rates in its XTRA ISP Business. Meanwhile, French ISPs continued to charge users per minute of usage until 2002, when the French telecom regulator ART mandated that ISPs reduce fees by 25-40% (as you can see in the chart, time spent online in France remained roughly flat in the country from 1996-2001).

The takeaway is that, although internet speeds stayed relatively consistent during the early days of the internet (before the proliferation of cable, DSL, and satellite connection, which began to saturate the market throughout the mid-2000s), time spent online still increased in countries where price declined. This likely created a virtuous cycle — the more time spent online, the more robust and valuable networks became, which was followed by more innovation. Apart from a $19.95 monthly subscription fee, there were few barriers to coming aboard.

Wallets are keys

I’ve been thinking about how lucky I was to have discovered crypto about a year ago — back when Ethereum was cheap enough that I was able to view whatever losses I experienced during my early days as a form of necessary tuition. When I lost money — thanks to fees, bots, or my own carelessness — it felt painful but not prohibitive; I could always go load up my wallet and begin the game again. It also didn’t hurt that the price of Ethereum was increasing almost every week: I’d rationalize every wallet refill as a mix between a game of roulette and a fate-induced act of dollar-cost-averaging.

But things feel different today: The gas prices are higher, the participants are more ambitious, the bots seem more sophisticated. Opportunities now seem increasingly reserved for insiders, bots with names like “mevsniper.eth,” and people who know which NFT drops to mint straight from Etherscan (and how to mint straight from Etherscan). Yes, I’m a promoter of the idea that you have to fend for yourself in the dark forest, DYOR, and get rugged (note: I mean both rugged as in resilient, and rugged as in rekt). But if it grows incrementally harder for new entrants to be competitive and agile in the current paradigm, we might limit the rate at which new crypto users grow.

The next wave of projects should prioritize not only speed and cost, but function as well. I do wish we saw more projects that made simply having a wallet — not holding a particular currency or NFT — as the only barrier to entry.

The loot that launched a thousand ships

The past few weeks have demonstrated some promising examples. Dom Hoffman’s Loot project was a kind of crucible for all kinds of opportunities, challenges, and innovations that exist in crypto. The NFT project spurred numerous derivatives (some of which generated tens of thousands of dollars worth of income for its creators), an in-game currency (or governance token?) called $AGLD and world expansions like Loot Characters. But my personal favorite variant amid the flurry came from Dom himself, who proposed creating “Synthetic Loot,” a way to general a virtual NFT from the keys of any users’ wallet (link to contract here). In the words of Dom, “creators building on top of Loot can choose to recognize Synthetic Loot as a way to allow a wider range of adventurers to participate in the ecosystem, while still being able to easily differentiate between ‘original’ Loot and Synthetic Loot.”

Here’s what I liked about the idea of Synthetic Loot: It could serve as a port-of-entry for people who are newer to crypto. And not just an onboarding module or online curriculum — if the Synthetic Loot ecosystem had advanced at the same rate as the rest of the Lootverse, it could have inducted newcomers and less eth-rich wallet-holders smack into the middle of the most exciting movement happening in Ethereum: an experiment in gaming, governance, and coordination. The dilemma with Loot is that it really only incentivizes Loot-holders to enrich the economy. Synthetic Loot could have expanded the range of participants much further.

Synthetic Loot didn’t generate as much excitement as other accessible forms of Loot, like mLoot, the mintable Loot expansion pack. From what I could gather, there was just one project that used the Synthetic contract to build off of Loot Characters and create sLoot renderings. There’s definitely an optimistic way of viewing the way this played out. The failure of Synthetic Loot to capture the hearts of users could also speak to the values of web3: ownership above all else. Synthetic Loot is not transferable or ownable like a conventional NFT, so it may not inspire builders and users to the same degree.

This doesn’t mean the idea of accessible NFTs is less compelling. Dapper Labs was an early pioneer — first with CryptoKitties and now with NBA Topshot — in creating user-friendly interfaces for people to interact with crypto, and advancing accessible pricing tiers that feel inclusive to everyone. As Brian Flynn of Rabbithole pointed out a few days ago, Dapper Labs also enabled developers to build on top of CryptoKitties, in the same way people are now building atop nascent NFT-oriented games. And on other chains too, there’s evidence of tremendous progress.

On September 5th, Andre Cronje, the founder of yearn (which itself has been compared to Loot), published a blog post called Loot & Rarity. In it, he laid out the roadmap for a D&D-esque game oriented around taking an NFT “Summoner” on adventures, leveling up, and earning skills and attributes. Crucially, the only fees involved in holding a Summoner are gas (fees that are cheap because Rarity lives on the Fantom blockchain). It set off a hum of activity: There’s now a working frontend for Rarity, a summoner search tool, a dungeon, rare gems, Rarity Gold, and other visualization tools on the way. There are also at least 100,000 unique summoner owners (though this doesn’t preclude the possibility that one player could have multiple wallets or summoners). On Friday, another developer known as “storming0x” launched Deevy Project, a trading card game on Arbitrum in which the first set is free for the user to mint. In the past few days, there have been other projects as well that remix the atomic units of web3 games: Miguel Piedrafita’s “wagmigotchi”-inspired gameon Polygon and Nour Haridy’s Lair of Wisdom on Fantom.

Mainstreaming crypto

This is not meant to pit any chain or game against another (full disclosure: I’m a Loot-holder). I’m more intrigued by this emergent stage of where we are in the mainstreaming of crypto. The first non-DeFi consumer-facing dApps are beginning to scale, L1s and L2s are starting to take activity off of the Ethereum mainnet — but the very thing that’s a testament to the strength of Ethereum (its current price) may also become a chokepoint of engagement going forward.

Ethereum, and crypto in general, isn’t able to lower prices at will — the cost of bootstrapping a network and incentivizing miners and stakers renders lower prices at the infrastructure layer a difficult task (such is the reality of being a decentralized network and not a multi-billion dollar telco company with an operating budget and the ability to use debt to fund capex). There are choices up-the-funnel, however, and developers have options about how to embed features that make interacting with crypto more accessible for the everyday user. I’m not suggesting that developers make things available for free (deploying a smart contract is expensive and time is irreplaceable). But where are the opportunities for more people to engage in crypto in a capacity that isn’t buying or flipping NFTs, using DeFi, or working for a DAO? And how will people learn the joy of collaboration and collective ownership over a network that has already priced them out?

It might be helpful to put this on a spectrum — where we are today, and what we might want to see more of in the future. On one end of the spectrum is participation through capital: This is what we saw in the emergent days of crypto networks, DeFi participation, and NFT trading. In the middle are developing forms of earning your place at the table — everything from earning DAO tokens through participation in a working group, to submitting proposals to a DAO for a specific job, to contributing to discussions on Discord, to completing quests on Rabbithole, to play-to-earn games like Axie Infinity. And on the other end are formats that are just beginning to materialize: participating in crypto first through the act of just having a wallet.

A few days after posting about Synthetic Loot, Dom also wrote about a way to make Loot expansion packs immediately available to all Loot-holders, without requiring users to pay for gas. This was another fascinating proposal: It would require developers to refer to a kind of standardized registry of all Loot expansions, perhaps demanding more coordination, but also unifying the ecosystem in a more network-friendly way. While it doesn’t seem like developers have adopted this standard, this is an optimistic sign of where the energy is headed. Between efforts to make on-chain, non-financial dApps more cost-effective, and exciting projects in accessible forms of games happening on other chains, it’s clear that there’s a desire to make crypto more tangible to the everyday user, along with the kind of grassroots coordination that can help make it happen.