How do you evaluate the success and growth of your crypto protocol or product? In web2, marketers have several playbooks for measuring success. In crypto, and especially across L1s, L2s, and protocols, the go-to-market playbook is still being written. Some metrics aren’t available, others matter less, and many need a blockchain-specific rethink.

I’ve spoken with countless growth and marketing leaders, each with different dashboards, which makes sense, since what counts as growth for an L1 or L2 isn’t the same as for a DeFi protocol, wallet, or game. Let’s consider these differences more broadly:

L1 and L2 growth is all about communities of users and builders. We can measure the success of both L1s and L2s by looking at their Monthly Active Addresses (MAAs), as well as the number of apps people are building on top of them. Growth in MAAs without app growth may signal just a few popular apps or spam activity; ideally, both grow together. The CMO’s role in this case is more as a marketing engine for the community, in addition to marketing the protocol itself.

Protocol growth, at the most basic level, is about users, volume, and Total Value Locked (TVL) — the total dollar value of assets deposited into a protocol’s smart contracts — or Total Value Secured (TVS) — the total dollar value of assets secured by the protocol. While TVL is a widely debated metric, looking at it in conjunction with other metrics discussed below can provide an overall picture of growth. One founder shared that they also calculate “cost of capital” for a given “active TVL” — meaning how big of a grant do they have to give compared to the fees/TVL they gain.

Infrastructure and other software-as-a-service (SaaS) growth is often about the growth of individual products. For example, developer platform Alchemy looks at customer and revenue growth within each product line, which is similar to what we see in traditional SaaS companies. More specifically, looking at the percentage of recurring revenue retained from existing customers or Gross Revenue Retention (GRR) indicates a sticky product and stable customer base, important for measuring recurring revenue. Net Revenue Retention (NRR) also accounts for upsells and reflects the ability to grow the revenue of this existing base.

Wallet and game growth look more traditional, too (not unlike the SaaS example above). But here, it’s about measuring overall usage and revenue with metrics like:

- Daily Active Addresses (DAAs), the number of unique addresses active on the network every day

- Daily Transacting Users (DTUs), or the number of unique addresses — a subset of DAAs — that make revenue-generating transactions on the network

- Average Revenue per User (ARPU), the revenue generated from a user or customer over a specific period

If tokens are involved, however, then token price and holder distribution enter the mix, but even those metrics depend on your goals. For example, do you want lots of smaller token holders, or a few whales? It depends; you will need to choose the measures that matter for your product or service’s category, stage, and strategy.

So what goes into your company’s metrics dashboard? To start, here are a few potential metrics to track, followed by more insight into where they fit into the marketing funnel — but it’s up to you to decide what to measure, how much to weigh each metric’s importance, and how to act on the data…

Core metrics: What matters

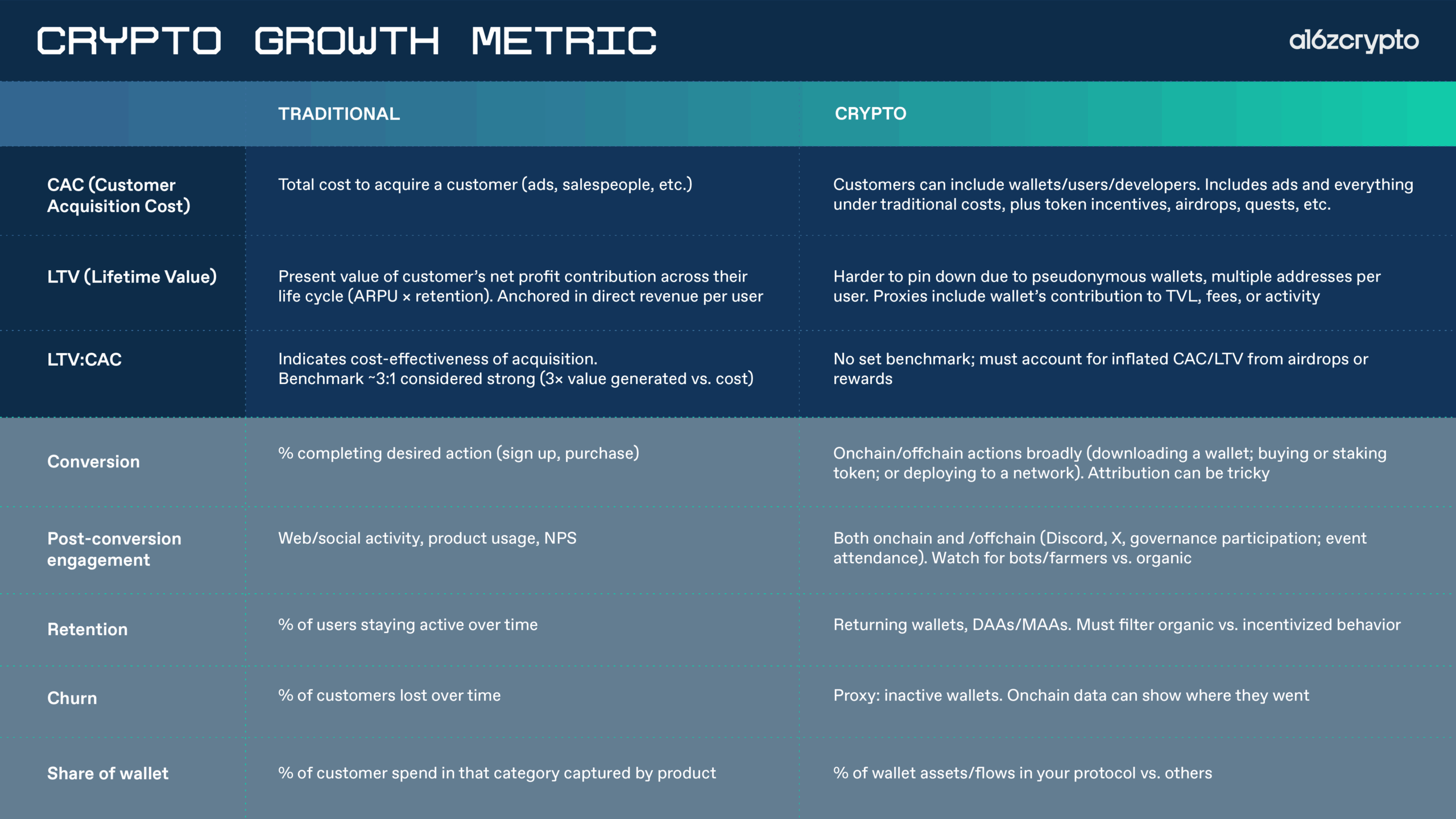

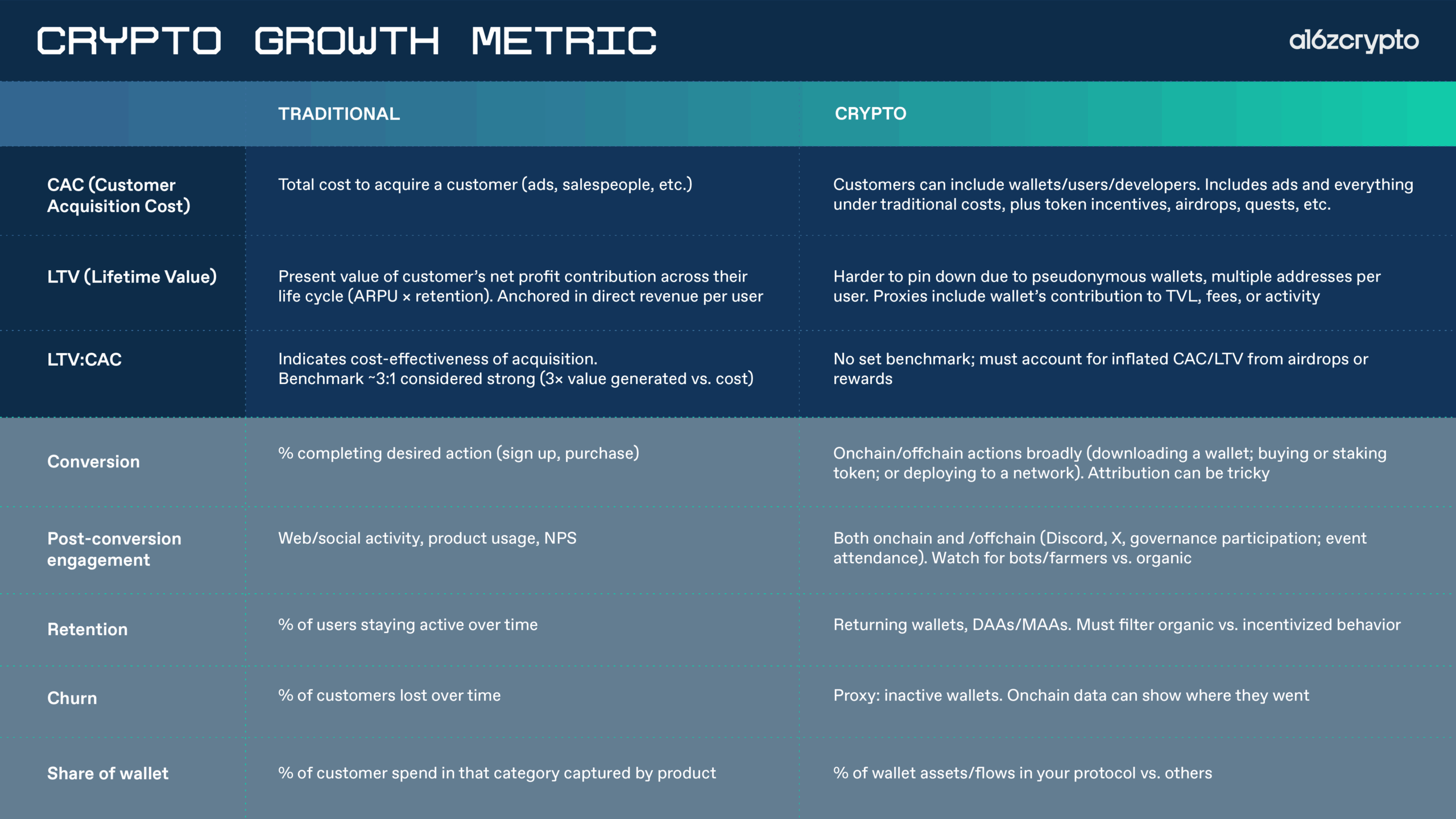

Key growth metrics, like CAC, LTV, and ARPU (which we define below and which our team previously defined here), are central to understanding the success and efficiency of customer acquisition efforts.

While these concepts are well established in traditional SaaS, they require some adaptation in crypto contexts where “customers” often mean “wallets”, and where value creation can look different. We redefine these metrics below, along with nuances specific to crypto.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) refers to the total cost of acquiring a customer, which can be measured in a couple of different ways:

- Blended CAC, broadly defined, is calculated by dividing total acquisition costs by the total number of new customers. It tells you the average price you’re paying for each new customer across all channels — not just how much you paid to acquire customers, but also those acquired organically (which makes it hard to see which specific growth tactics are driving results).

- Paid CAC, on the other hand, focuses only on customers acquired through paid marketing. Too often, teams “spray and pray” with paid spend without measuring results. Paid CAC shows how much it costs to acquire those customers, and whether specific campaigns are actually effective. It’s especially important to measure this in crypto since early on, we saw many teams get distracted by paid rewards without figuring out what was actually working for their products.

What counts as a “cost”? When calculating CAC, costs can include advertising spend, sponsorships, marketing collateral development, and token incentives for quests (on platforms like Galaxe, Layer3, or Coinbase Quests) as well as airdrops to targeted wallets.

Who counts as a “customer”? In this context, “customer” might mean “user” or “developer;” for example, a net-new wallet transacting on a protocol can be considered a customer of that protocol.

Lifetime Value (LTV) and Average Revenue Per User (ARPU)

Lifetime Value (LTV) represents the present value of the future net profit from a customer over the duration of the relationship. LTV essentially measures what the customer gives back for however long they remain a customer, including how much they spend on your product.

LTV is already a nuanced calculation and concept. And in crypto, this concept doesn’t always translate directly, because “users” don’t always look like traditional “customers”. They might be pseudonymous wallets, for example, where one user might hold multiple different wallets. So LTV might instead reflect a single wallet’s contribution to TVL, or the total dollar value of assets deposited in a protocol’s smart contracts, which we cover above.

Where TVL could provide a snapshot of “how much is here now” for a DeFi protocol, LTV could still help answer “how much a particular wallet is worth to the protocol across its lifecycle.”

LTV:CAC ratio

The lifetime value (LTV) of a customer is often used to assess initial customer acquisition cost (CAC) against how “valuable” that customer will be over time. This LTV:CAC ratio offers insight into how cost-effective it is to attract new customers, by comparing the value a customer brings in against the cost of acquiring them.

With traditional SaaS products, a 3:1 ratio is considered strong because it suggests you’re generating three times more value from a customer than it costs to acquire them, leaving margin to reinvest in growth. In crypto, we don’t have established benchmarks like these yet.

It’s also important in crypto to evaluate the LTV:CAC ratio in the context of other acquisition incentives, like airdrops or points, which can misleadingly influence metrics. Ideally, incentives like these can help attract users to the product and help them get started, but then users like the product enough for it to keep growing without incentives — in this case, CAC would go down while LTV goes up, improving the LTV:CAC ratio.

Here’s a quick roundup of the key metrics we outlined here, and how to think about them in crypto:

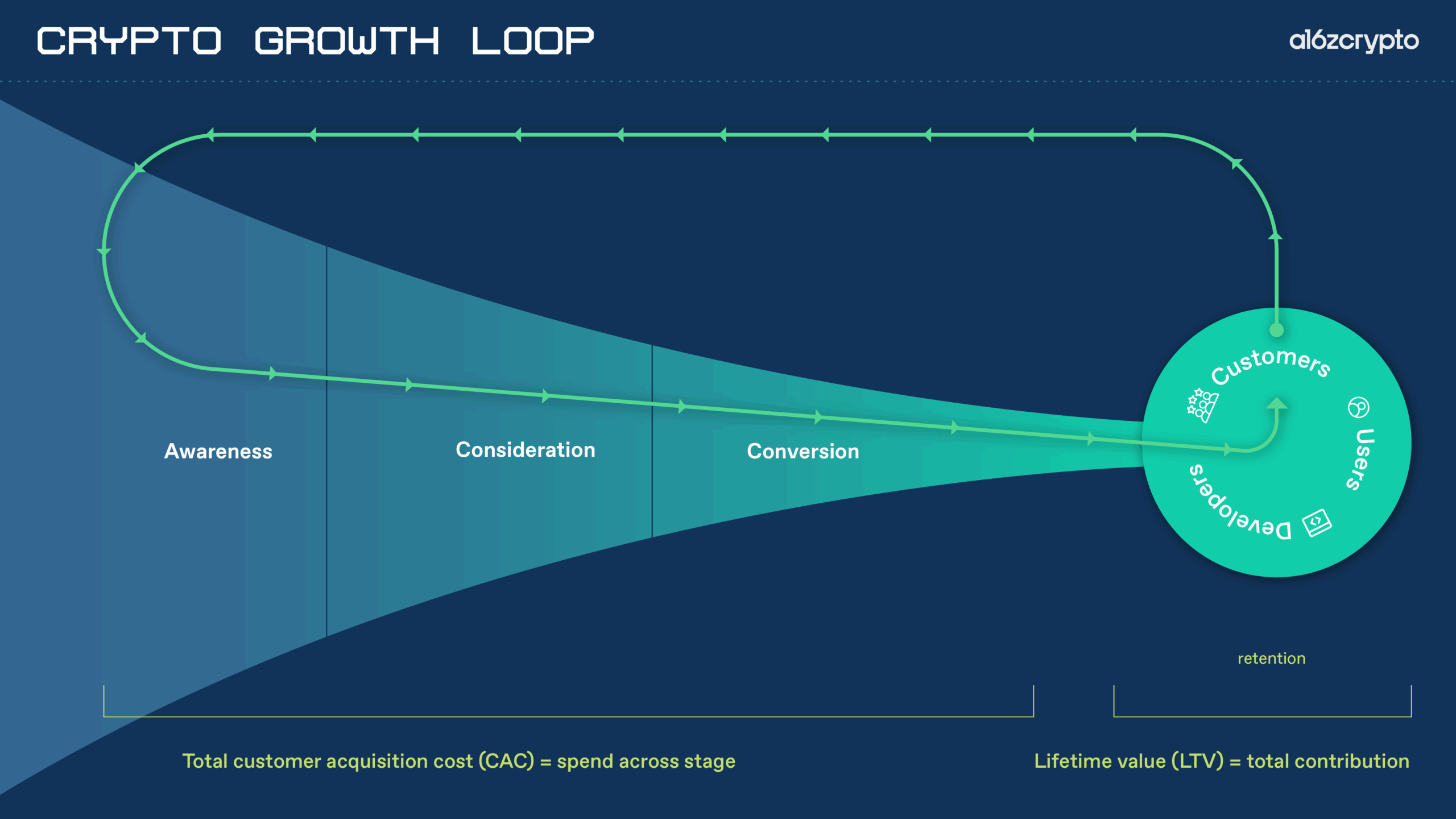

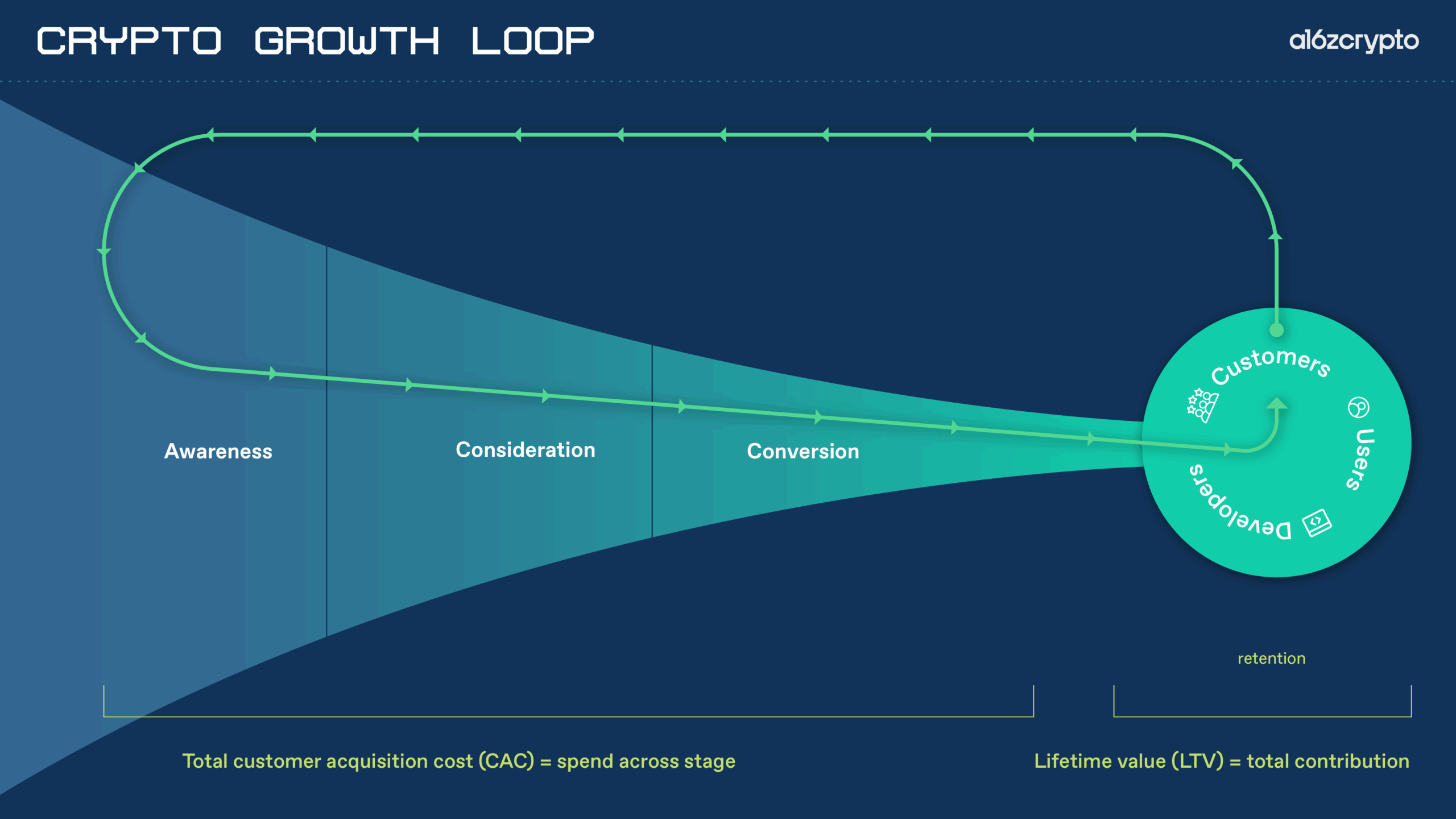

Taken together, these metrics provide a baseline for measuring how well your growth marketing efforts bring in users relative to the cost of those efforts across the different stages of the marketing funnel.

Breaking down the crypto growth funnel

With core metrics in place, the next step is mapping them onto the marketing funnel, from top to bottom. Note that the growth marketing funnel in crypto doesn’t always look like it does in web2; there are specific differences in crypto marketing and tactics, as well as crypto-specific quirks and opportunities at every stage of the funnel. These can include onchain behavior, token incentives, and community-driven dynamics.

So let’s go through each stage of the funnel, along with some key strategies and measures, and how they vary in crypto vs. web2…

Awareness/Lead generation

The first stage of the marketing funnel, whether classic or crypto, is awareness. Even in crypto, raising awareness of your brand is a prerequisite for everything that comes next.

This stage is also where you’ll start measuring CAC (defined above). “Reach” — the number of unique individuals who see your content — should also be a core metric. Reach is especially helpful when evaluating the success of mass-marketing channels such as press, media, and public relations more broadly. The challenge here will be distinguishing between short-term spikes in attention and truly “sticky” interest: Are the users just curious, or are they actually interested in using the product?

Beyond core acquisition metrics, the channels you use to find new users each come with their own strengths, risks, and crypto-specific nuances:

Key opinion leaders (KOLs) and influencers

Paying a random influencer or KOL with a large audience may seem like a reliable way to generate awareness, but this approach often fails to produce meaningful engagement. This is especially true when the influencer doesn’t have a genuine connection to the project, and so their audience doesn’t, either.

However, there’s a strong case for working with influencers that align with your project’s ethos, and can share their excitement in a believable way. Consider “micro-influencers”, the more niche, targeted, trusted voices your audience listens to; or even homegrown influencers, the experts from your team who have built a strong presence. Claire Kart, CMO of Aztec, a privacy-focused L2, is also an influencer for the companies she works with; Kart has also told us how she actively looks for up-and-coming influencers to organically connect with and bring into the Aztec ecosystem.

Advertising

Advertising comes with its own set of challenges in crypto. For one, many crypto companies can’t run campaigns on traditional platforms like Google or Meta, given ambiguous and changing ad policies related to crypto advertising. Even beyond these access issues, there’s also some wariness around traditional ads among the crypto community, because scammers sometimes use similar ad formats to direct users to malicious sites.

Crypto marketers have had more success with advertising on X, on LinkedIn, on Reddit, on TikTok, or in the Apple App Store to boost a specific app. They can also consider alternatives like Brave browser ads, Spindl ads inside the Coinbase/Base app, or MiniApps and sponsored posts on Farcaster —or even optimizing for prompts and working their way into AI search answers.

Referrals and affiliate marketing

The idea behind referral programs is the same as in traditional marketing: You earn a reward when someone else signs up through your referral. What’s different in crypto is that the rewards can be sent instantly and verified directly onchain, which aligns incentives and makes the whole process smoother. Projects like Blackbird show how onchain referrals can grow into compounding network effects through persistent loyalty programs and community engagement, not just one-off customer acquisition campaigns.

Word of mouth is one of the most powerful growth drivers in crypto: For consumer-facing products, adoption is often recommendation-driven, where users recommend the product to other users simply because they enjoy the experience and find value in it. For infrastructure projects, referrals tend to grow from existing customers and developers.

Measuring word-of-mouth growth can be as simple as tracking a Net Promoter Score (NPS) across touch points, or by directly surveying new users, when signing up or after onboarding, whether they were referred and by whom.

In this sense, referrals act like an inverted, bottom-up marketing funnel: Instead of ending at the conversion stage, users feed new potential users back into the top of the funnel. Early users become evangelists who bring more people into the network (and who could be rewarded for their contributions), continuing the flywheel.

| A note on accuracy: Accurately measuring growth in real users/customers versus bots is an issue across industries, especially on social media. Crypto has some unique identity primitives that we can use, like verifying “proof-of-human” (via World ID), or verifying identity via zero knowledge proofs (via zkPassport), which can separate real users versus bots or airdrop farmers. Growth teams can use this not just for building sybil resistance around community growth mechanisms like airdrops, but also to get a better sense of their actual users and to help plan retention around their product. |

The power of a growing network

Finally, one driver of growth that’s unique to crypto is tokens, which is often the best way to attract users, developers, and liquidity to marketplaces which traditionally have struggled to overcome the cold-start problem. This is not about speculation, however: It’s more that when a token price goes up, it can draw in new users who want to be part of a movement or something that’s growing. Developers also take notice, because a rising price can signal that there’s an active community and real demand, making it a more attractive place to build.

Consideration/Interest

The next phase in a traditional marketing funnel is consideration, the stage at which potential customers are actively interested in the product, and are evaluating and comparing it against alternatives.

This is a particularly important stage in crypto, given every decision — from purchasing a token to ordering a hardware wallet — generally comes with a lot of education, since crypto is still a relatively nascent (and often complex) industry for both users and builders. The right level of information for users to make a decision and weigh competing products or platforms makes a big impact. It’s why so many companies, from Coinbase to Alchemy, have invested in educational content for both consumers and developers.

Effective educational content tends to go beyond detailing product features and benefits, and covers how a product works under the hood (e.g., security, custody, community and treasury governance, token economics model, and so on. Developers may want deep-dive technical docs and tutorials, while consumers often need explainers (for example, before sending real funds between wallets or blockchains).

Email campaigns to educate users during key flows (like product signups or purchases), in-product prompts and tooltips, interactive onboarding, and product trials or “testnet” setups to demo and experience features before committing to transferring assets are standard tools here. Companies are also starting to optimize their educational content for LLMs (as we mention above) — when someone has a question, it’s helpful for your company to come up.

Successful teams qualify interest not just by clicks or downloads, but by whether users take intermediate actions that demonstrate trust and intent — for example, joining a waitlist with a wallet, or adding small funds to test a feature. However, knowing whether or not these efforts are successful depends on the channel you’re choosing, as each has its own set of metrics. However, you’ll ultimately want to map these to some sort of conversion, which we cover next.

Conversion

Conversion is the stage of the funnel that comes after you’ve got a potential user’s attention, engaged them, and informed them. This is where users complete whatever action you’ve been setting them up for.

As a metric, “conversion” is a broad term: In traditional marketing, it can mean a lot of things, from the number of customers making a purchase, to signups for a demo or requests to talk to a sales team. And it’s the same in crypto: downloading a wallet, purchasing a token, or even deploying code on a platform can all count as a conversion. As always, the definition will depend on your product and goals, but it’s important to be precise here in order to figure out the best measure according to those goals.

Tracking conversion by marketing channel (e.g. wallet downloads as the result of an in-person event) is critical; knowing which sources drive results allows teams to optimize spend, messaging, and more.

Measuring conversion accurately depends heavily on attribution as well, which can be tricky, particularly when tracking the user journey between traditional sites and social networks to onchain activity (it’s still hard to accurately measure a funnel that includes offchain-to-onchain actions or vice versa).

Web-tracking tools like Google Tag Manager can track website conversions, while newer tools that target wallet owners (such as Addressable) can help bridge the gap, enabling teams to track campaign performance from a website or web2 ad to an onchain action. However, the journey is rarely linear — a user might see a post on X, attend an in-person event, and only later make their first transaction.

While tracking attribution has historically been harder in crypto, it has been getting easier to see a holistic picture of growth. Many people have multiple wallets, but with better analytics tools, it has been getting easier to match multiple wallets with an individual — so an action that happens can actually be traced to a specific person or user. As privacy updates (GDPR, cookie restrictions, etc.) have made web2 attribution harder, the transparency of onchain data offers an advantage while also protecting identity.

Post-conversion engagement

In a traditional marketing funnel, the Engagement/Interest stage would measure product interactions pre-purchase. These interactions serve as a way to better understand the product and brand, and are often where initial interest evolves into committed participation.

In a crypto marketing funnel, it’s also worth measuring the post-conversion engagement of your users, both online and offline, as well as onchain and offchain. Measuring this engagement not only gives insight into how to retain users, but also into maintaining the overall health of your community, wherever they are.

For example, online engagement (which we also cover in our social media guide) can include metrics like:

- Discord or other hosted forum/chat participation

- X activity

- Sentiment across social channels

- Involvement in governance or voting

Many crypto marketers still lean on a more traditional marketing stack, especially for social listening. However, the traditional approaches still need to be adapted to crypto. For example, sentiment tracking, which monitors how a community feels about a project across social platforms, can be directionally useful, but shouldn’t be the sole input for any decision. Sentiment tracking can help teams identify active contributors, vocal community members, and even key influencers, and help assess how their messaging is landing. However, this data can also be very noisy in crypto where communities are fragmented across platforms, metrics vary in quality and depth, and a small number of highly active accounts can have outsized influence.

Beyond sentiment-tracking tools, some teams use other social-media monitoring tools (like Fedica, to name one example) to track and reward engagement. For example, they can recognize contributors who amplify content, create memes, participate in discussions, or who just generally drive energy and engagement within the community. It’s important to note here that incentivized activity is easy to game: Certain kinds of incentives can attract people who care more about earning rewards than about the project itself. Over time, this risks creating a community that looks active in the short term but that isn’t sustainable in the long term.

Of course, marketers can still see meaningful organic growth without incentivized or paid engagement; for example, by running strategies that interweave different types of content. Eco, a stablecoin liquidity layer, runs an organic content strategy on X based on what they call a “4-1-1 principle”: publish 4 posts that educate around the market opportunity for their offering; publish 1 “soft-sell” post (e.g., third-party endorsements); publish 1 “hard-sell” post (e.g., “use our offering”); then repeat this cycle with posts every few hours on a 7-day schedule. Using only organic posting strategies and leveraging major product announcements and co-marketing campaigns, Eco grew its total monthly impressions by nearly 600%.

Offline engagement, such as attendance at conferences or events, also plays a vital role in helping engage users through deeper connections. While measurement around these has traditionally been about aggregating email addresses to grow your mailing list (you all know the feeling of walking up to a conference booth only to have your badge’s QR code scanned), more nuanced tools include tagging your swag with NFC chips (for example using IYK) and running various campaigns to encourage taps/scans of it. Online platforms like Discord or Towns, meanwhile, provide dedicated spaces for ongoing interaction and relationship building, and there you could track not just the number of interactions (posts, likes, replies) a user conducts over a period of time, but overlay a quality and sentiment analysis for those engagements.

Retention

Retention answers the question: Who’s staying? This could be measured as the percentage of users completing an onchain action after a set number of days, or more broadly as the sustained activity level of users over time. You can calculate the percentage of users retained over a certain period by dividing existing users at the end of the period by how many you started with at the beginning of the period. If you are measuring mailing list subscribers or wallet downloads, retention would not be tracked as the initial signup, but rather as a measure of who’s still around after a period of time. Common retention metrics include: returning app users, or daily active addresses over a period of time.

In crypto, retention metrics must account for the tension between “long-term” and “short-term” behaviors, because there are powerful token mechanics and behaviors at play. For instance, a surge of airdrop farmers at launch may look like growth, but once the rewards stop, many will leave. That’s why it’s important to define your “ideal” user and measure retention relative to that cohort, not just raw total users. This is also why it’s important to measure product metrics – inherent to the product itself and organic interest in it – so as not to confuse what’s working, or not working, particularly if your product is pre-product-market fit. Otherwise you might think you found product-market fit when you really haven’t; that is, the interest isn’t really about your product but about the rewards.

Retention also naturally drives LTV, because if a user sticks around for longer, the more they will spend or transact. This increases their LTV and makes the LTV:CAC ratio more favorable.

Churn

Churn, the other side of retention, measures how many customers you lose (and when) throughout their lifecycle. It can be calculated in a few different ways, including by dividing the number of lost customers at the end of a time period by the total number of customers at the beginning of that time period (expressed as a percentage). One proxy for churn (though it doesn’t map perfectly to traditional churn metrics) is the percentage of wallets inactive after a certain period. An example could be if customers come in through a particular hype cycle or marketing push, sign up for wallets, and then never use them again. Some of those customers may re-engage at some time in the future, but the art of this calculation is to find the active, recurring, and returning users — not the hibernating ones that perform a one-time onchain action.

There are tools that monitor user interactions with decentralized applications (like Safary and others), which help identify friction points that lead to user drop-off, such as high transaction fees, confusing user experiences, or the need to complete multiple onboarding steps. For example, when Solana released their Seeker phone, some users hoped for pre-funded wallets (as with the earlier-generation Saga phone) to reduce the hurdle of getting started, since requiring manual funding before transacting can slow product adoption. Although Solana has shifted to doing dApp reward campaigns post-arrival, it’s important to go through and model all steps of an onboarding flow to reduce friction where possible.

To mitigate churn, there are also funnel-tracking and cohort-targeting platforms that allow crypto-specific customer engagement (one example is Absolute Labs’ “wallet relationship management”) which allow teams to create custom audience segments and re-engage users through both web2 channels and crypto-native tactics like targeted airdrops. Additionally, messaging individual wallets directly via secure, decentralized messaging tools like XMTP provides a way to deliver timely, personalized prompts that encourage users to return and continue engaging.

Share of wallet

One way to track churn and retention is by looking at “share of wallet”: the portion of a customer’s total spend in a given category that goes to your product or service. In crypto, this can be taken quite literally. By examining a wallet’s composition, you can see what assets it holds, how much, and where activity is directed. If a user stops engaging with your protocol, onchain data can reveal whether they’ve switched to a competitor. Of course, as protocol products and services become multi-layered it becomes harder to tell what or why they switched, but if you see certain patterns towards a particular competitor or other products with singular features, it could reveal a lot.

Similarly, if many of your token holders also own tokens from a related project, there may be opportunities for “co-marketing” to leverage that overlap — for example, by partnering with that project on a joint event, or giving the other project holders some of your tokens. General analytics tools like crypto data-hub Dune make this type of analysis possible, while more specialized platforms can offer other token-specific insights. Since most users maintain multiple wallets, linking them to a single end-user identity is also important; onchain analytics tools like Nansen provide wallet labeling across multiple chains to enable more accurate share-of-wallet analyses.

***

Measuring growth in crypto isn’t about copy-pasting the web2 playbook — it’s about adapting what works, discarding what doesn’t, and building new frameworks around what blockchains uniquely make possible. Every team’s dashboard will look different, given the different products we’re seeing, from L1s to games.

But data alone can’t tell the whole story. Ultimately, quantitative metrics are just one part of the story: Nothing can replace a deep qualitative understanding of your audience and users as well. The conversations in your community (whether buzz about a project, or even just memes and vibes), the energy you feel at events, or your instincts about what’s working and what’s not are just as important in guiding growth strategy. Even the behavior of a few power users may be more valuable in the initial stages than the behaviors of everyone else. These more qualitative signals often provide the earliest indication of product-market fit. The best crypto growth strategies balance data with intuition, and blend short-term tactics that build excitement with long-term strategies that build stronger communities.

Acknowledgements

Thank you to Steph Zinn, Sonal Chokshi, Jay Drain, Daren Matsuoka, Jay Kurahashi-Sofue, and Claire Kart for their contributions to this piece.

***

Maggie Hsu is the Head of Go-to-Market for a16z crypto. She previously led go-to-market for Amazon Managed Blockchain at Amazon Web Services, and before that led business development for AirSwap, a decentralized exchange. Maggie has held executive positions at Zappos.com and Hilton Worldwide. She was also a consultant at McKinsey and Company.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.