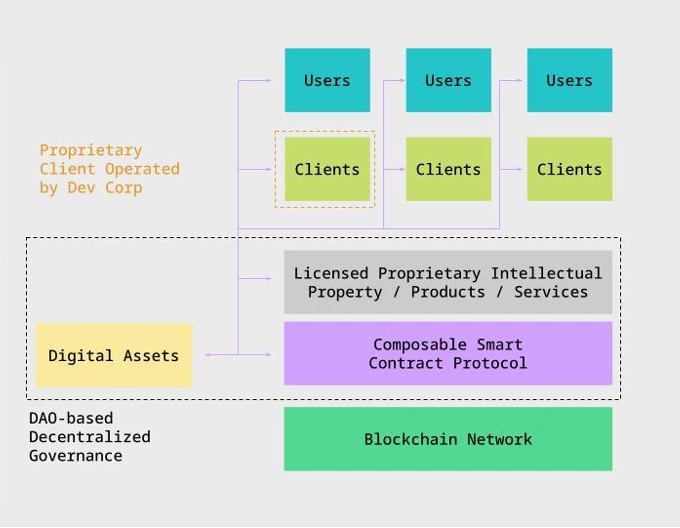

Given the above and the fact that the complexity of web3 protocols is increasing, it is unlikely that even the most extreme governance minimization will be able to eliminate the need for all human input. As a result, DAOs must take additional steps to ensure that the decisions it has to make are made effectively. For instance, in the case of Blockzaar, if a new version of the protocol were to be released, the DAO would need to choose to accept it.

Accepting that most political systems tend toward autocratic leadership (also as the Machiavellians observed), a DAO should seek to establish a leadership “class” for the ecosystem to more effectively handle the remaining governance matters. But it’s critical to counterbalance the powers among any leadership class by design, so that any emerging leaders are perpetually subject to open opposition.

While DAOs could attempt to use non-token based voting designs — like proof of personhood — to overcome autocracy, the principles outlined by the Machiavellians, which were based on lessons from observing contentious politics, suggest such designs are unlikely to be successful in the long run. Even though proof of personhood could remove the differentiated rights of token holders based on their ownership of tokens, the token holders of a DAO using this approach would likely consolidate into new groups based on new kinds of property rights and new class divisions. So while proof of personhood could mitigate a DAO’s vulnerability to attack, it would be unlikely to eliminate autocracy.

Establishing a system of checks and balances provides a better alternative. Fortunately, incentivized decentralization provides a fertile ground for exploring other tools for balancing power among leadership. Below, I share one potential design for a DAO that utilizes a bi-cameral governance layer — not unlike the U.S. Congress, which is divided into the House of Representatives and the Senate.

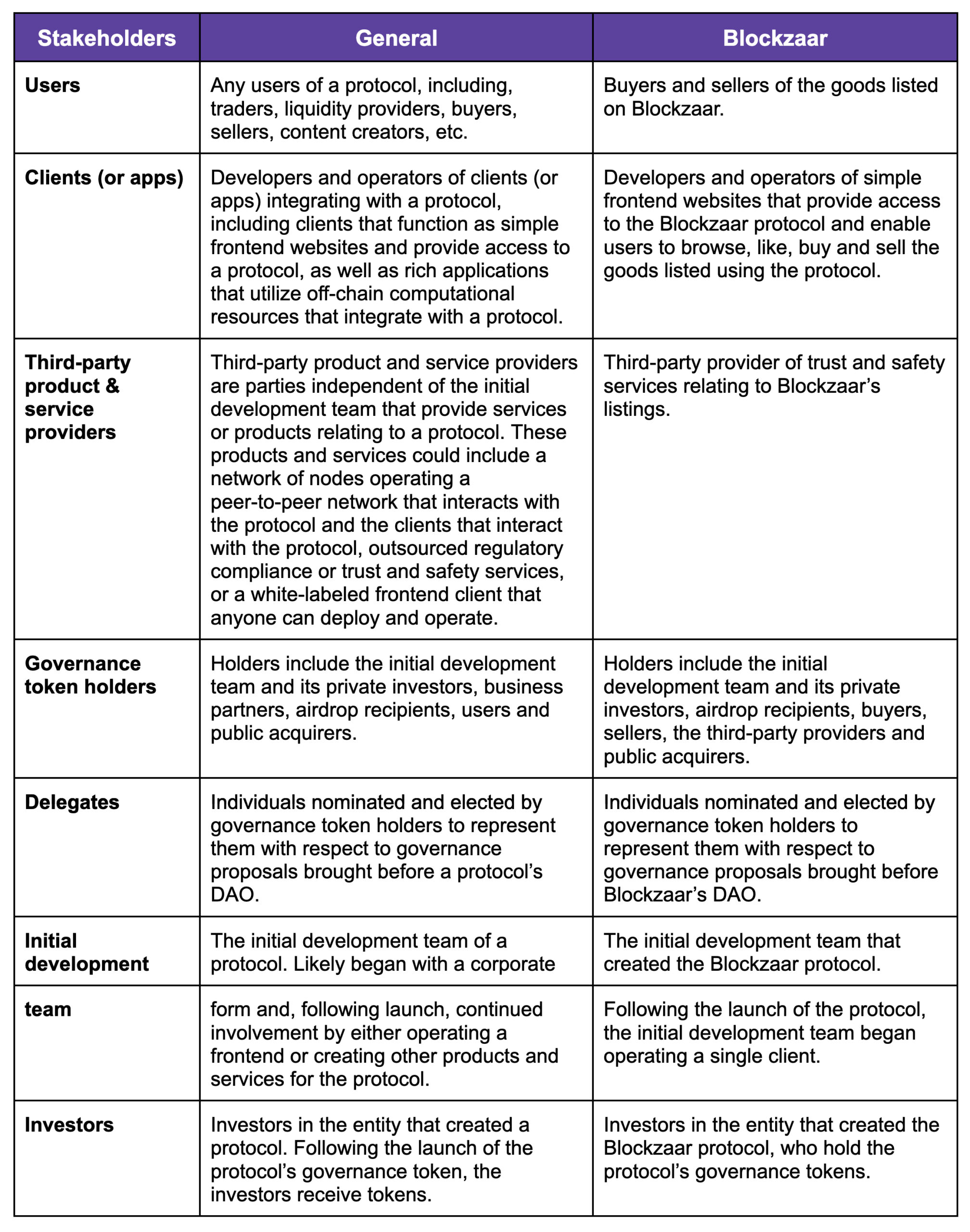

(1) Stakeholder council

If a protocol is able to incentivize a robust ecosystem of clients and third-party product and service providers all operating independent businesses, then it stands to reason that such individuals would have a vested interest in the governance of the protocol. Their livelihoods would potentially depend on the subsistence of the protocol. Further, a protocol’s most active users would also be likely to have a vested interest in the governance of the protocol, particularly if their use was in connection with ongoing businesses operated by such users.

Given their vested interests, these stakeholders are likely best placed to engage in the protocol’s decentralized governance. However, with current forms of token-based voting, these stakeholders are unlikely to have enough agency with respect to decentralized governance — thereby minimizing the potential to foster true stakeholder capitalism in these ecosystems.

This challenge can be overcome by using non-token based voting to provide stakeholders from each of the three constituencies with their own stakeholder councils. In particular, non-transferable NFTs (aka soulbound NFTs) could be awarded to certain individuals within each constituency, entitling such holders to propose and vote on matters before the DAO.

In designing any such leadership class, a DAO should:

Sufficiently disperse power among the leadership class such that no individual person or group of related persons could be said to control the DAO. For one thing, the establishment of the leadership class may have negative implications under U.S. securities laws. Multiple members from each constituency selected by the DAO to form the leadership class should be granted authority.

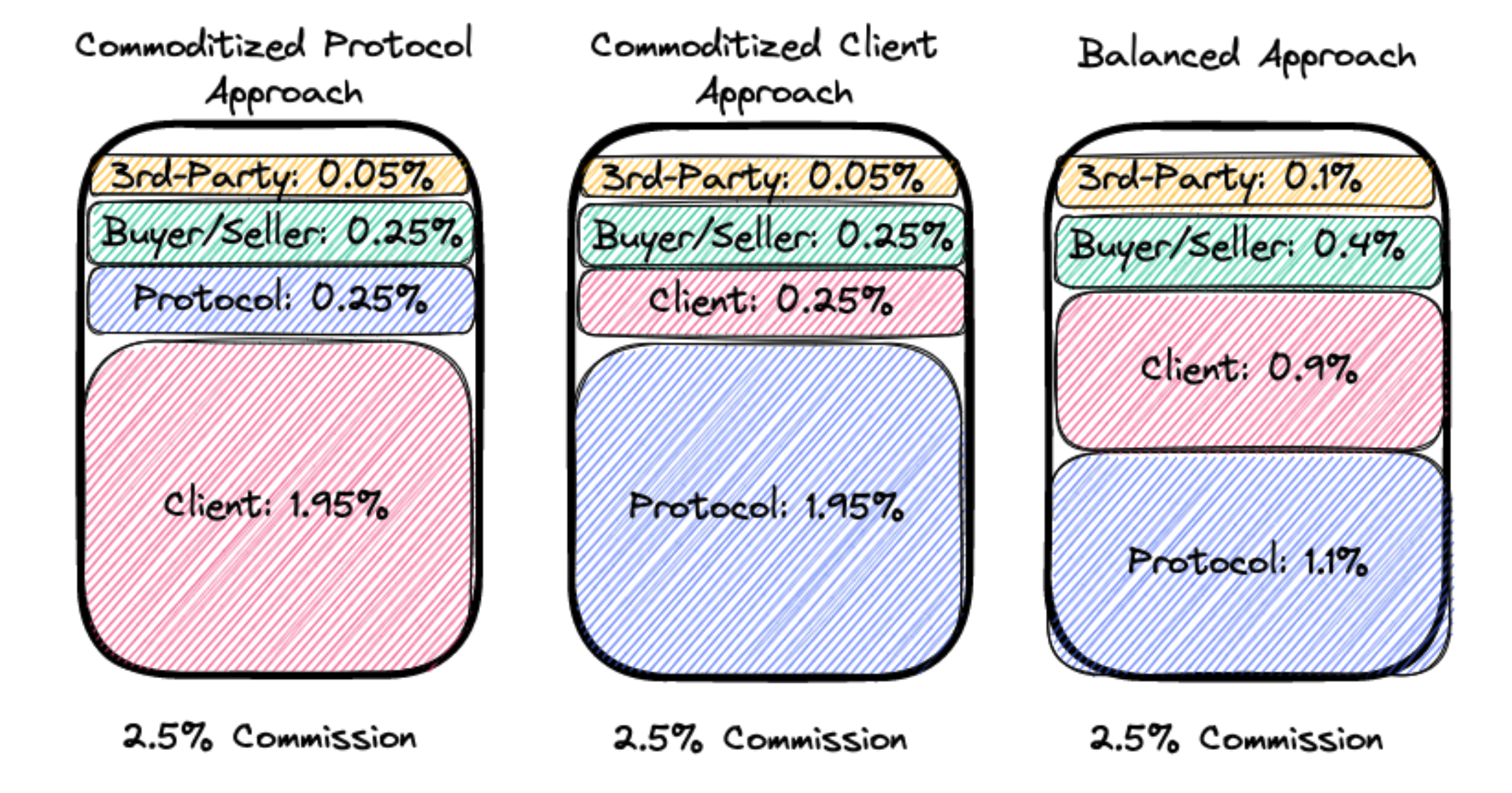

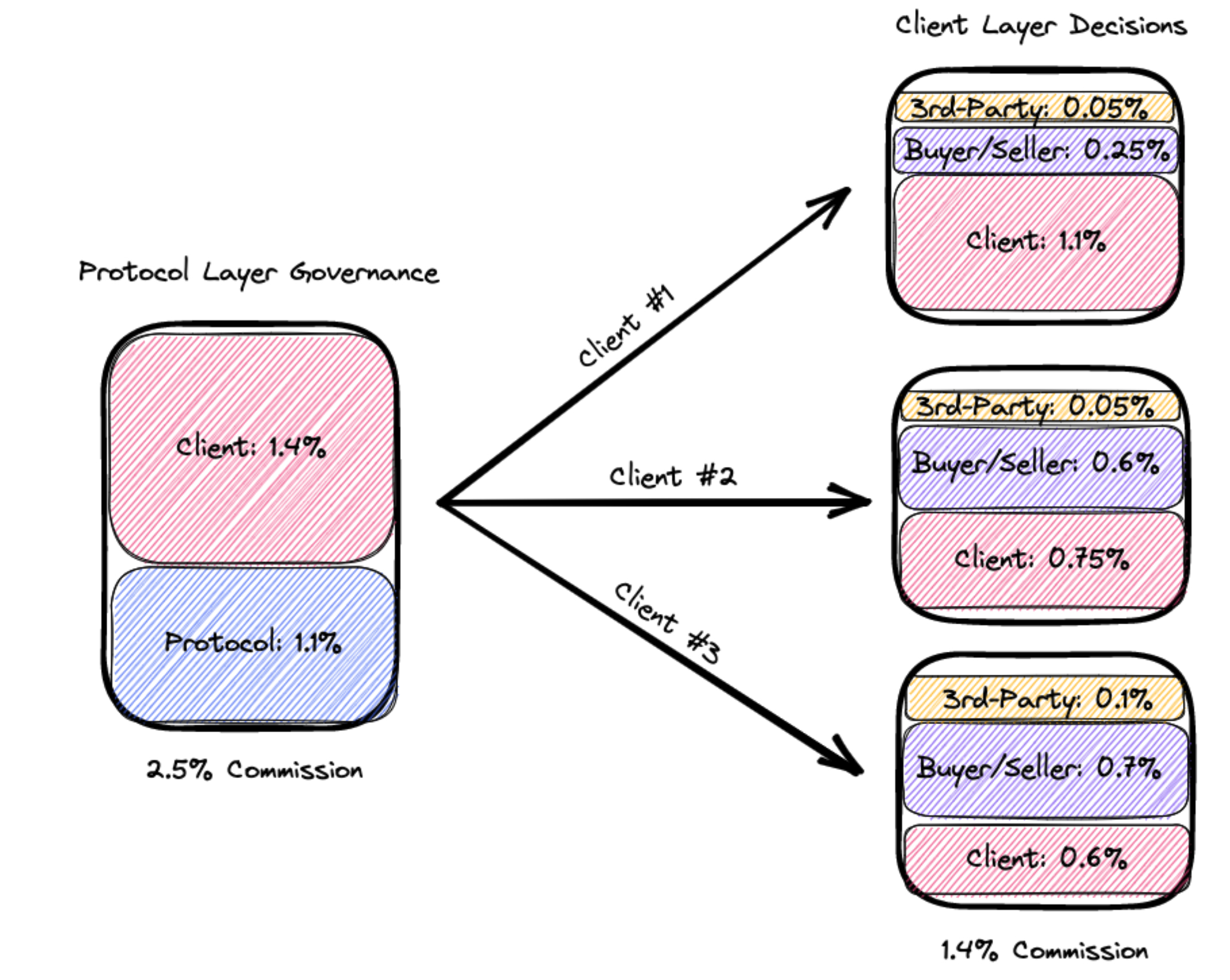

Assess the interests of the various stakeholders to determine where there are competing and aligned interests. While difficult, assessing these interests is more straightforward than assessing the interests of anonymous token holders, as one can start by looking at the on-chain incentives. For example, for Blockzaar, the incentive structure aligns the interests of users, client operators and third-party product and service providers against the interests of the protocol when it comes to the allocation of commissions earned – which as discussed above is a complex parameter setting to be established by the DAO.

Meanwhile, the interests of such stakeholders may not be aligned when it comes to treasury management and/or protocol maintenance and upgrades. For example, users may want the DAO’s treasury to be used for products and services that benefit users, as opposed to those that benefit client operators; and third-party product and service providers may be opposed to such expenditures for fear of greater competition.

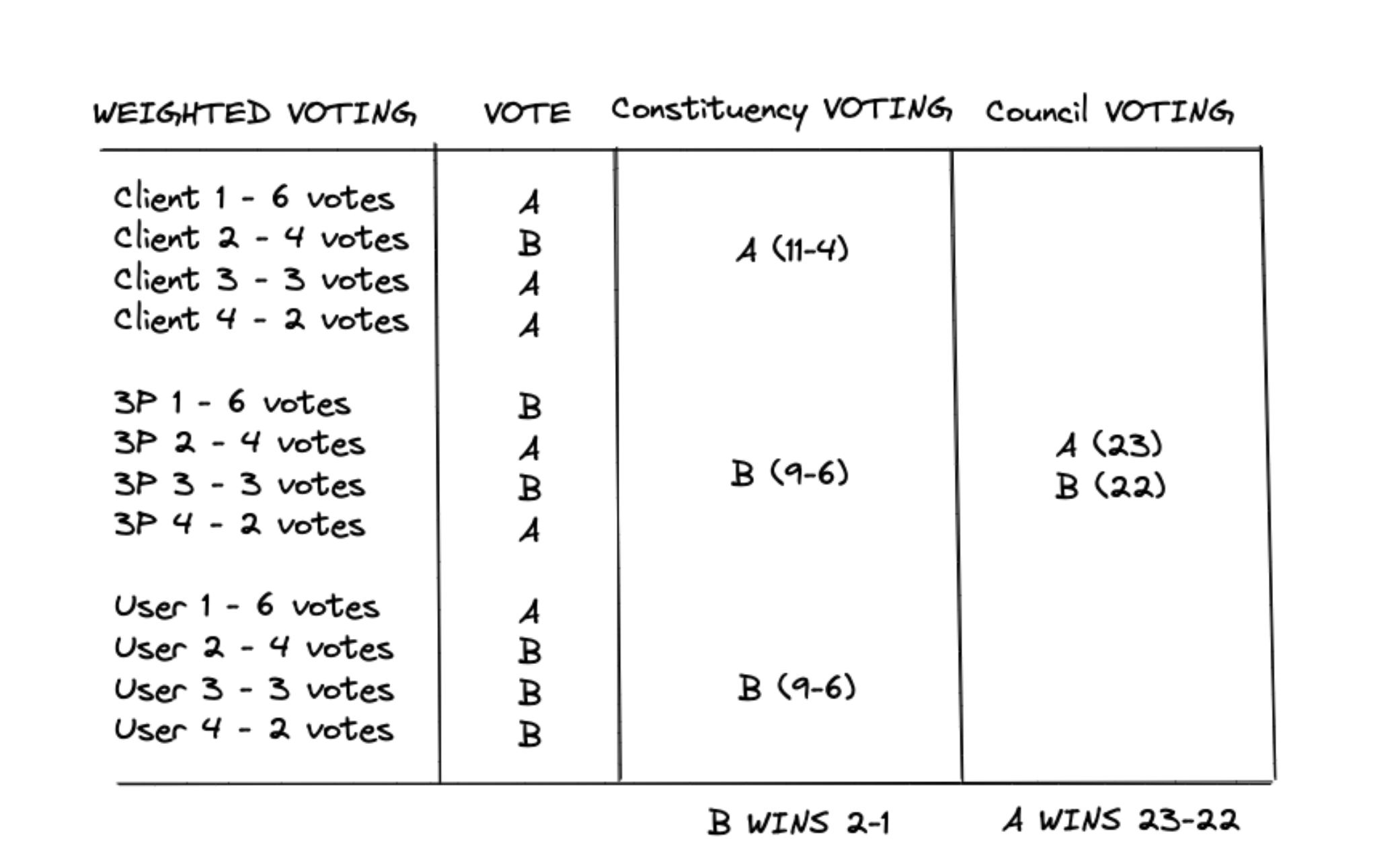

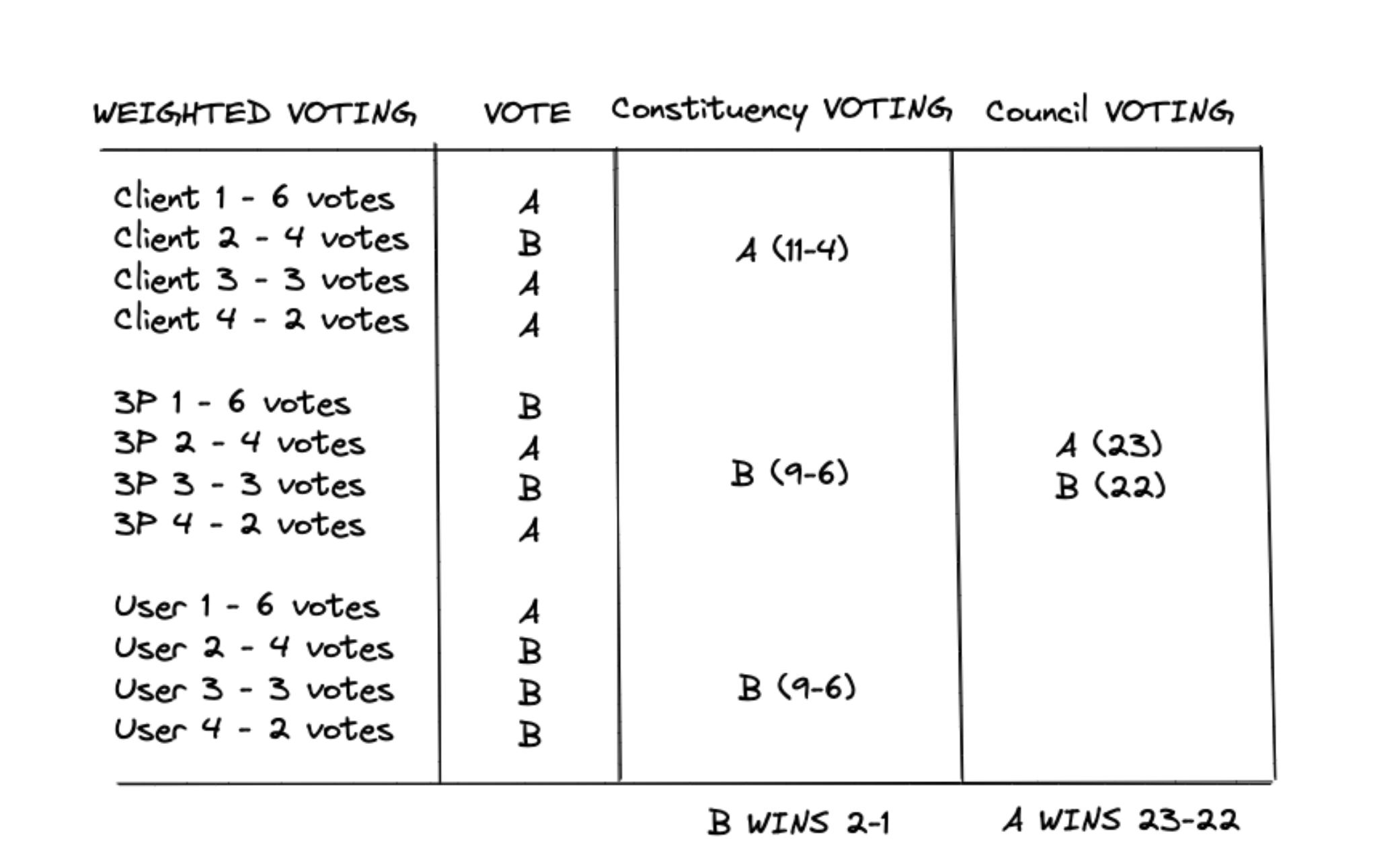

Balance the voting power of stakeholder representatives based on the interests of the respective constituencies. This can be accomplished through weighted voting, with the top performer in each constituency receiving the most votes, thereby promoting competition and rivalry among stakeholders. In addition, a single council vote or separate constituency voting can be used, as reflected in the figure below:

Any stakeholder council would be subject to the risk of hostile takeover if the same or affiliated parties controlled multiple clients and/or third-party product and service providers. However, such risk could be partly addressed through requirements that all such parties have distinct taxpayer identification numbers in the U.S. or by using some form of a proof- of-personhood protocol.

(2) Delegate council

The power of the stakeholder council should be checked by token holders, who inherently have a vested interest in the governance of the protocol, and one that may be opposed to the stakeholders represented by the stakeholder council.

A DAO could control for common problems (such as low participation, uninformed voters, etc.) that result from direct democracy by implementing representative democracy, most likely in the form of a delegation program. Among other things, delegates should be separate and distinct from any members of the leadership class and be properly compensated for the role that they play in the system’s governance.

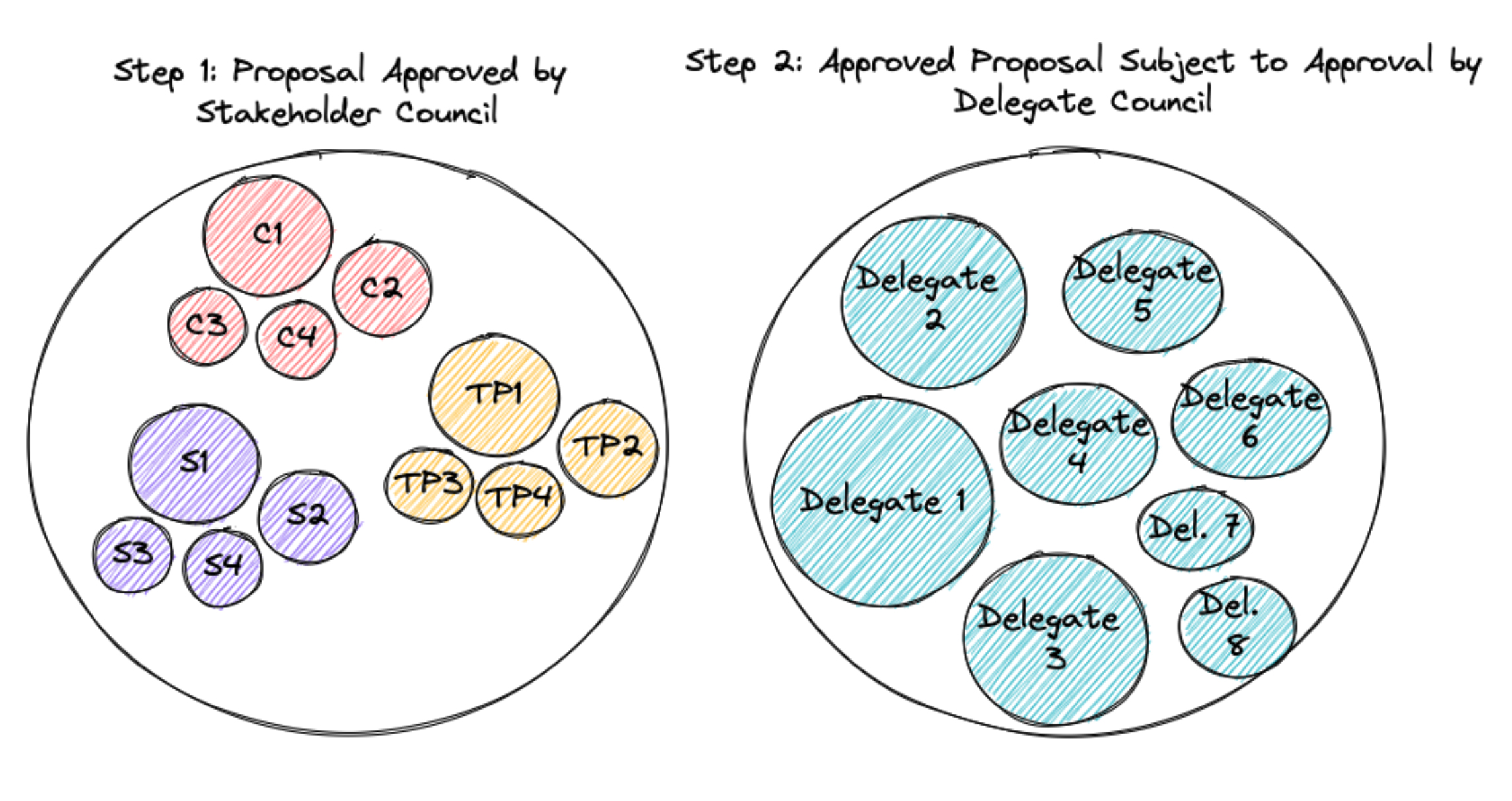

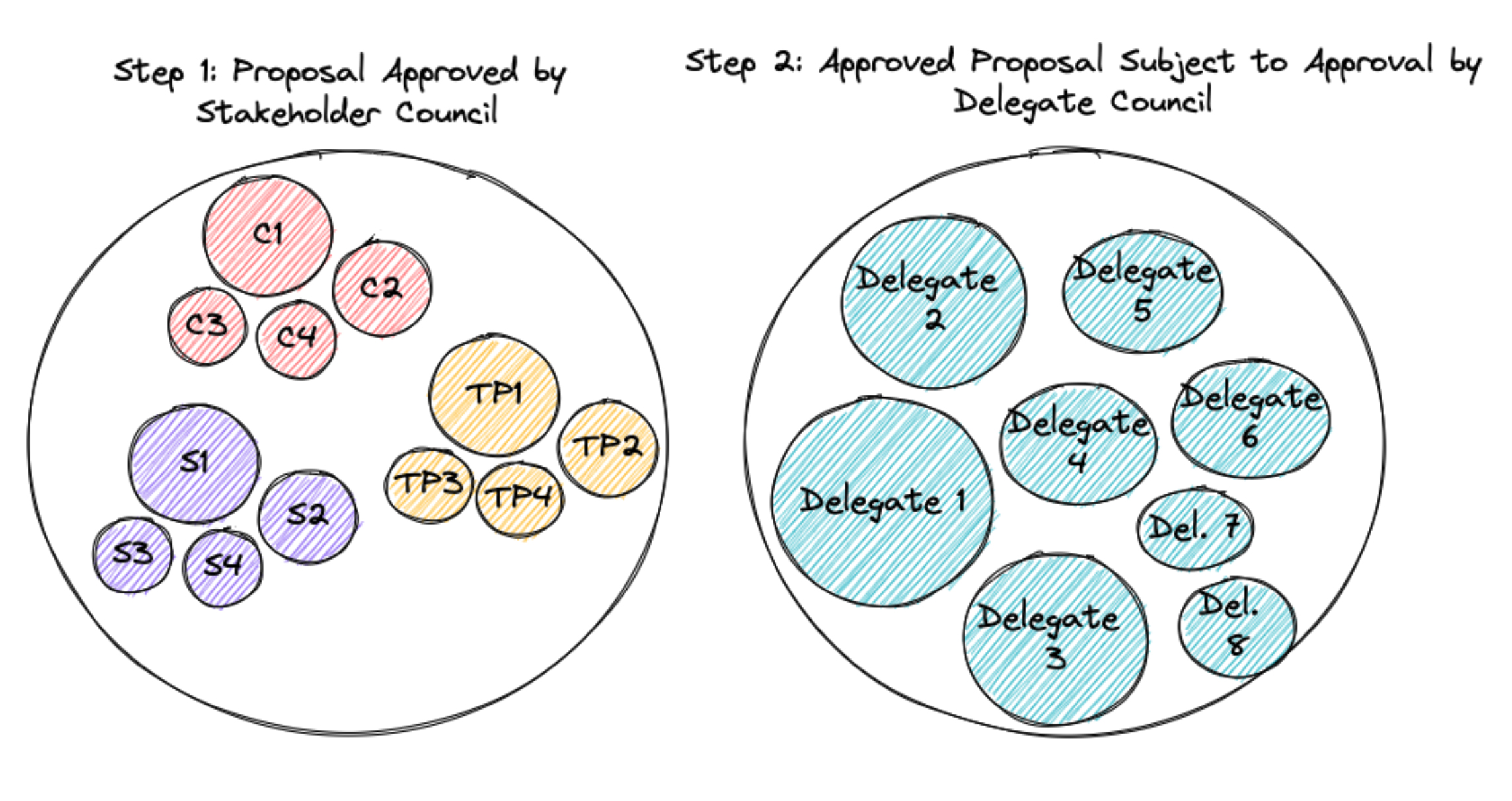

Together, the stakeholder council and the delegate council would have the power to approve proposals brought before the DAO. One or both councils could be the initial governance layer responsible for creating new proposals, with the other layer then having either negative authority (a proposal approved by one council goes through unless vetoed by such council) or positive authority (a proposal approved by one council only goes through if approved by such council).

While this setup is similar to the dual house structure Optimism (for instance) uses, the key differentiator is that the Blockzaar DAO’s stakeholder council (like Optimism’s Citizen’s House) would be systematically populated by the top-producing stakeholders in the system. These stakeholders are more likely to have a vested interest in the propagation of such systems as compared to good actors without obvious incentives. Because the livelihood of the stakeholders is ultimately dependent on the protocol, they are much more likely to take the governance of the protocol seriously than good actors who are simply participating in decentralized governance out of a spirit of civic duty. Such an arrangement would help to make DAOs function more like an industry consortium than a homeowners’ association.

This concept of relying on self-interested factions — rather than on disinterested or high-minded social designers — has been explored in other areas, including institutions of constitutional and international law, with self-interested factions being the overwhelming victor.

For Blockzaar, the DAO’s leadership class and governance structure could be set up as follows:

- The stakeholder council is composed of: (1) the operators of the top four clients (as measured by transaction volume); (2) the third-party product and service providers that created the top four products and services (as measured by transaction volume of clients using such products and services); and (3) the top four sellers (as measured by transaction volume).

- The voting power of the leadership class is weighted and broken into three separate series by constituency (as reflected in the image above). The leadership class votes as a single council.

- The delegate council is composed of 8 delegates selected and approved by token holders, with proportional voting power based on the number of tokens delegated.

- The DAO defaults to no changes in governance happening, so any proposal approved by the stakeholder council does not take effect unless it is approved by the delegate council.

This example governance system for Blockzaar can be illustrated as follows: