No matches

We couldn't find any matches for "".

Double check your spelling or try a different search term.

Still can't find what you're looking for? Check out our featured articles.

Featured Articles

News you can use: Hot topics, fact checks, trends, industry moves

AI needs crypto — especially now

How to design decentralized governance that addresses current issues in DAOs and fosters true decentralization in web3

Web3 should triumph over web2 because web3 enables decentralization; decentralization reduces censorship and promotes liberty; liberty enables opposition to power; and opposition to power drives greater progress. But first, we need to fix decentralized governance.

Since it is still early days for decentralized governance, many web3 protocols and DAOs (decentralized autonomous organizations) are still developing solutions to address the issues that arise from decentralized governance. As someone who closely tracks decentralized governance practices across web3 — including how it influences decentralization and can be incorporated into various models of decentralization — I believe that applying Machiavellian principles to decentralized governance in web3 can address current shortcomings, because Machiavelli’s philosophy was developed with a pragmatic understanding, formed in that time, of the struggle for social power. These social power struggles are similar to those experienced by protocols and their DAOs, which often have unclear, unpredictable, or inefficient social hierarchies.

In a companion piece, I outlined four Machiavellian principles as guidelines for designing more robust and effective decentralized governance — that is, “Machiavellian” DAOs that: (1) Embrace governance minimization; Establish a balanced leadership class that is subject to perpetual opposition; Provide a pathway for the continual upheaval of the leadership class; and Increase the overall accountability of the leadership class. So in this piece, I share design considerations, strategies, and tactics that DAOs can use to implement guidelines to create a “Machiavellian DAO” — a DAO based on Machiavellian principles.

The strategies and tactics I propose aren’t suitable for all DAOs: They introduce inefficiencies and friction to decentralized governance that may make them inappropriate for certain systems, such as highly dynamic and evolving systems or systems that are civic in nature. But for protocols that are further along in their development and that are focused on economic growth while maintaining credible neutrality — like a hypothetical web3 marketplace protocol I call “Blockzaar” as an example in this piece — the benefits of increased friction may far outweigh the costs.

Two steps to address before designing a DAO

Before I share design principles, it is critical to establish who the relevant stakeholders in the ecosystem are. Identifying these various stakeholders then enables the DAO to determine what their inherent incentives are — a prerequisite to balancing the power of such stakeholders.

After addressing these two preliminary steps, builders can then implement the four Machiavellian design guidelines that follow.

Step 1) Identify protocol stakeholders

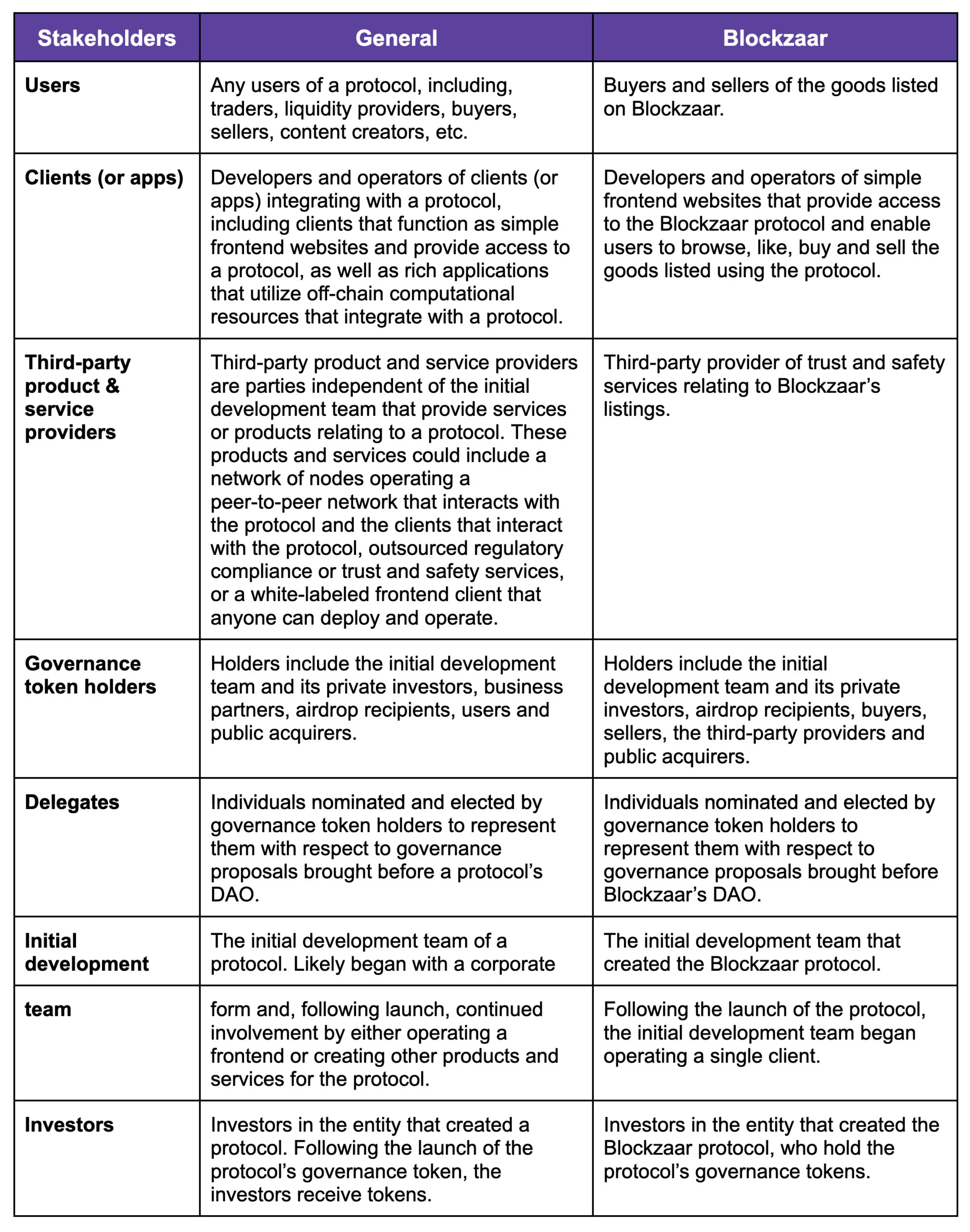

The stakeholders of a web3 protocol include a number of different participants, including users, apps (or clients), third-party product or service providers, governance token holders, delegates, the initial development team, and investors:

Step 2) Understand incentive structures

The more active stakeholders (as opposed to passive investors) there are — and that are economically incentivized to see the protocol grow and develop — the more parties there are to choose from to effectively govern the protocol. That’s why web3 systems that incentivize the creation and operation of independent clients/applications (client layer) operating on top of shared smart contract/blockchain infrastructure (protocol layer) and independent third parties to create off-chain products and services for stakeholders within the ecosystem (third-party layer) are best positioned to make use of Machiavellian constructs. [See for example the open decentralization models discussed here.]

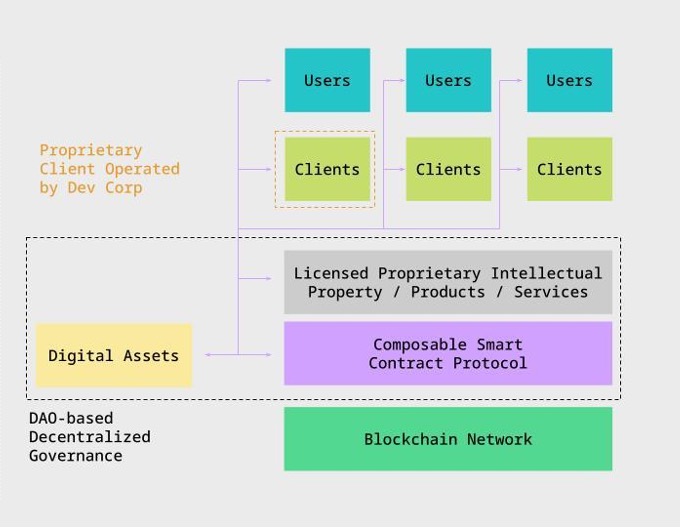

Here is a model of an ecosystem using both of these incentive structures:

The goal of these incentivization schemes is to make it profitable for independent third parties to both operate clients as independent businesses on top of the protocol, as well as to create tools and other shared intellectual property and services for use by the protocol’s clients and users. These elements help contribute to a protocol’s thriving decentralized economy, and — by giving independent actors a vested interest in the success of that decentralized economy — provide fertile ground for designing more effective decentralized governance.

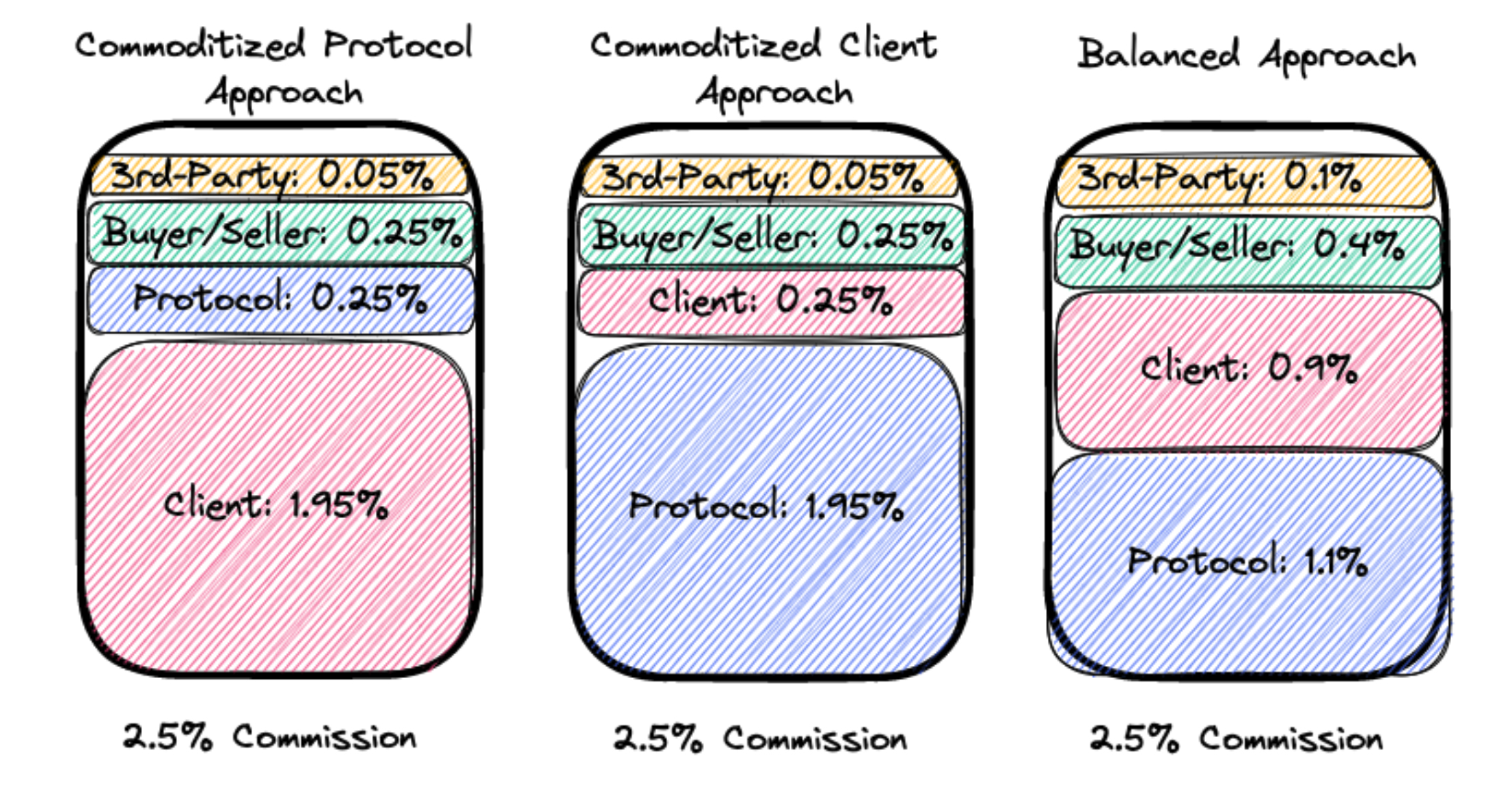

In designing incentives, a DAO must balance the value that accrues to the protocol/ DAO (including token holders) with the value that accrues to the system’s other stakeholders (users, client operators, and third-party product and service providers). A protocol’s token holders may be unlikely to support the commoditization of the protocol layer — where all value accrues to users, clients, and third-party product and service providers — as that would deprive them of any economic gain. Such commoditization would also be antithetical to the protocol’s goal of accruing network effects.

Meanwhile, the commoditization of the client layer — where all value accrues to the protocol (also known as the Fat Protocol Thesis) — is unlikely to result in a rich ecosystem of clients, since builders would not be able to profit from developing clients. Both extremes could jeopardize the entire system’s decentralized economy. Many ecosystems should therefore use a more balanced approach; to illustrate this point, here’s a very simple incentivization scheme for the “Blockzaar” example of a hypothethical web3 marketplace business:

- The protocol is set up to generally incentivize buyers to buy products; sellers to sell products; client operators to operate such clients; and third-party service providers to develop and offer products and services to the ecosystem.

- The value generated by the protocol is a 2.5% commission on all buy/ sale transactions, which could be delivered to stakeholders either through distribution of the proceeds from such transactions or the distribution of governance tokens.

- Buyers and sellers only receive value if they are party to a buy/ sale transaction. Operators of clients only receive value to the extent the transaction was consummated through their client. And third-party product and service providers only receive value to the extent the transaction was consummated through a client using their product or service (in this case, when the client uses the trust and safety services of the third-party provider).

The value represented by the commissions earned by Blockzaar could then be divided among stakeholders as follows:

As reflected in the image above, the balanced approach yields 1.1% of the 2.5% commission to the protocol, 0.9% to the client through which a transaction is initiated, 0.4% to the buyer or seller and 0.1% to the provider of third-party services. As a result, token holders (via the value accrual to the protocol) and other stakeholders are rewarded for the execution of the transaction.

Why should incentives go to stakeholders? There are two additional considerations:

First, a balanced incentive structure may not just be desirable, for certain systems, it may be required. Regulatory actions in the United States have made it clear that systems that facilitate regulated activity will need to find a pathway to regulatory compliance. In the vast majority of cases, it will not be possible to design regulatory compliance into protocols themselves, so such compliance will need to occur at the point where users interact with the protocols — at the client layer for such protocols. As a result, operators of clients for protocols that facilitate regulated activity will need some way to generate revenue from the operation of clients so that they can afford the cost of compliance. And foregoing compliance is not an option: It not only places the operators of clients at risk, the collection of funds from illicit activity could put a protocol’s DAO in legal jeopardy.

So, where protocols facilitate regulated activity, the fat protocol thesis is unworkable, and a balanced approach is necessary.

Second, in any decentralization model that incentivizes a robust client layer, a balance of power among clients must be achieved: If a single client is able to capture a disproportionate number of users, then its outsized power among clients could jeopardize the decentralization of the system. As a result, protocols must be designed to combat the risk of client dominance. To do so, a DAO could seek to throttle incentives for clients that exceed a predetermined client dominance threshold (such as 50% of user transactions). In order to avoid the manipulation of a mechanism like this to censor certain clients, such mechanisms should be as autonomous as possible, with upper and lower bounds on the client dominance thresholds. For instance, for Blockzaar, such a mechanism could only be triggered if a client exceeds 50% of transaction volume, which would result in its commission allocation being reduced from 1.4% to 1.0% – with the 0.4% difference accruing to the protocol.

Four guidelines for designing Machiavellian DAOs

Now that we understand the interplay between protocol stakeholders and the protocol’s incentive structure, a protocol’s DAO can be designed to implement four guidelines developed from Machiavellian principles.

Machiavellian guideline #1: Governance minimization

The Machiavellians believed that organizations tend towards autocratic leadership, and that such leadership will ultimately discriminate to perpetuate its own privileges and power. This suggests that DAOs should prioritize governance minimization to protect their credible neutrality as much as possible. In other words, because every human decision impacting the protocol represents an opportunity to discriminate against stakeholders and jeopardize the credible neutrality of the ecosystem, such human-subjective decisions should be minimized.

The general consensus regarding governance minimization (a framework established by others) is that protocol governance should be reduced to unavoidable decisions falling within three categories:

- Complex parameter setting like collateralization ratios in DeFi lending/borrowing protocols, etc;

- Treasury management such as treasury diversification, grant programs, including funding of public goods, and so on; and

- Protocol maintenance and upgrades including changing oracles, deploying upgraded smart contracts, etc..

The number and scope of decisions within any of these categories for a particular DAO will be heavily dependent on the type of protocol it administers.

It’s safe to assume that as protocols grow increasingly more complex in web3, that the number and scope of decisions will similarly increase. However, that does not necessarily mean that decentralized governance at the protocol layer needs to become similarly complex. Rather, DAOs can take advantage of the incentivized decentralization model to combat such trends and drive further governance minimization.

In particular, a DAO can safeguard its credible neutrality by “pushing” many governance decisions to the client layer and/ or third-party layer. For example, decisions that only impact the client-user relationships can be determined by individual operators of clients. While such operators could use decentralized governance to govern their clients, the inefficiencies of decentralized governance could make that impractical.

Fortunately, use of decentralized governance at the client layer is likely unnecessary because rather than participating directly in the governance of the client layer, users can influence the client layer by either accepting individual client operator decisions and continuing to use such clients, or circumventing such decisions by moving to different clients. Similarly, third-party product and service providers can offer their products and services with different features and at different prices and let clients and users select their own preference.

As a result, a robust client layer and third-party layer decreases the need for sprawling decentralized governance while increasing user choice.

This dynamic is comparable to the “fork-friendly” environment that Buterin and others have advocated for as a remedy for ailing decentralized governance — only it does so beyond the protocol layer. Essentially, every client acts as a fork of the other available clients; and every third-party product and service acts as a fork of other available products and services. This dynamic promotes competition, allows for rapid experimentation, and fosters a more diverse array of options for users, all while maintaining the credibly neutrality of the protocol layer.

For example, in web3 social, if a client operator wanted to remove all hate speech from their client, users could accept such censorship by continuing to use such client; or they could circumvent it by switching to clients that did not enact such measures — but such censorship would not apply at the protocol layer, which would remain un-opinionated with respect to speech. This is preferable to the current web2 approach to content moderation, where users are not even made aware of what speech is being restricted, by whom, or why. Web2 social media problems and arbitrary, subjective decisions by a few points strongly towards a better solution: web3 protocols with governance minimization.

Forking at the client layer and third-party layer also avoids several of the critical drawbacks that hinder forking at the protocol layer — including fractionalization of liquidity upon forking of a DeFi protocol; or the fractionalization of a user base/audience in the case of a web3 social protocol. Forking at the protocol layer ultimately depletes the network effects that accrue to protocols, and is therefore undesirable for both protocol developers and early adopters. For Blockzaar, governance minimization and the related concepts I’ve shared could be implemented by a DAO in the following manner:

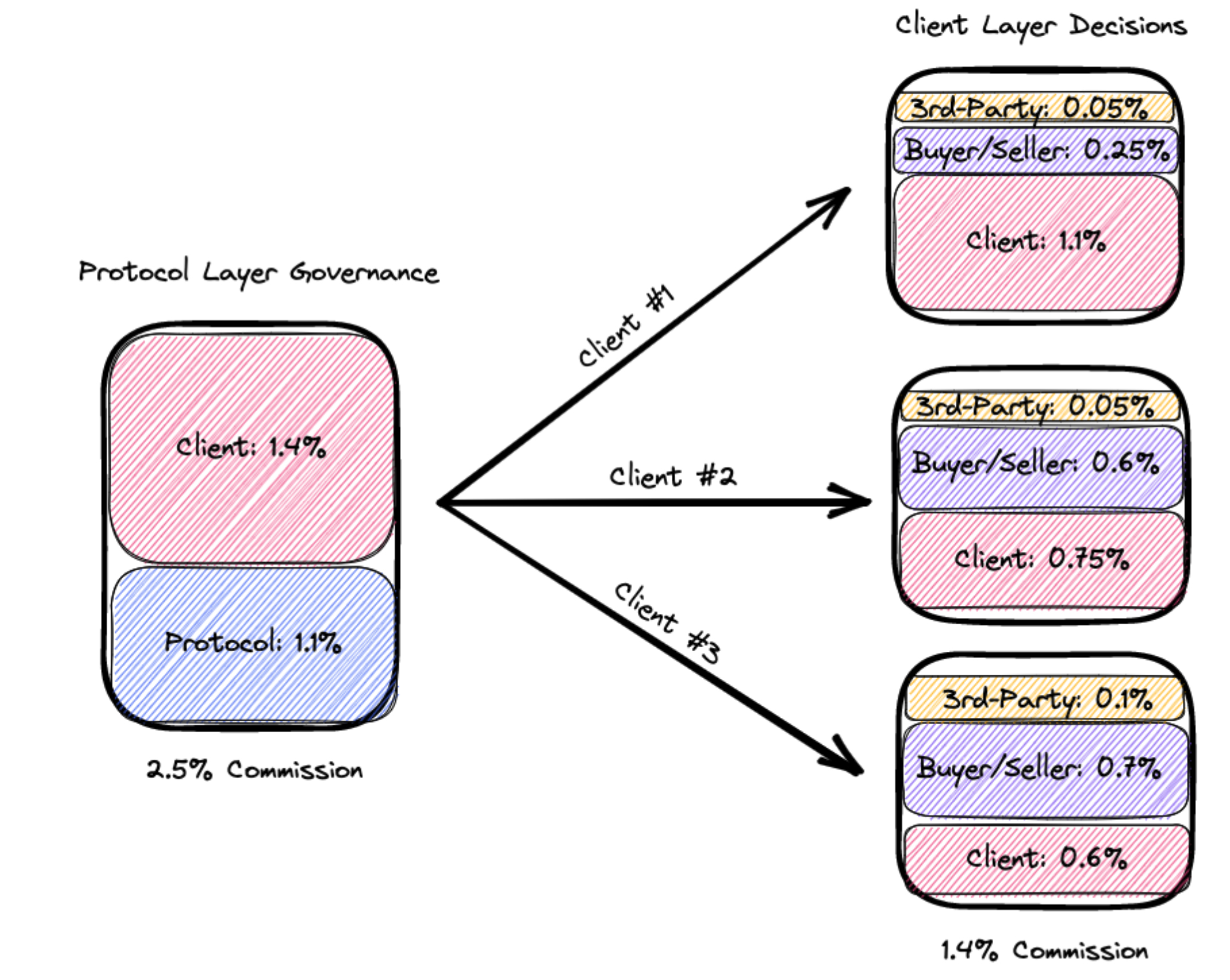

Complex parameter setting. For the simplest version of Blockzaar, the only parameters capable of being changed by the DAO could be the commission rate applied to transactions and the split of that commission rate between the protocol layer and the client layer. As reflected below, the split of the commission rate among clients/ users/ third-party product and service providers could be pushed to the client layer, where each individual client could determine how to split the commission it receives from the protocol with its users and third-party product and service providers:

Treasury management. The simplest governance design for Blockzaar would likely still empower the DAO to engage in treasury management activities. This would include creating grant programs to fund the development of public goods for the marketplace’s ecosystem as well as other third-party products and services for clients and users.

Protocol maintenance and upgrades. The simplest governance design for Blockzaar would likely still empower the DAO to maintain and upgrade the protocol. This would help keep pace with competition, especially given the rate of technological progress within web3.

Overall, if Blockzaar were to implement governance minimization, it could substantially limit the number of decisions required to pass through the decentralized governance process — significantly lowering the governance burden for the protocol. Nevertheless, the protocol could achieve a level of variability and experimentation by fostering a robust ecosystem of incentivized clients and third-party products and services.

Machiavellian guideline #2: Balancing the leadership class

Given the above and the fact that the complexity of web3 protocols is increasing, it is unlikely that even the most extreme governance minimization will be able to eliminate the need for all human input. As a result, DAOs must take additional steps to ensure that the decisions it has to make are made effectively. For instance, in the case of Blockzaar, if a new version of the protocol were to be released, the DAO would need to choose to accept it.

Accepting that most political systems tend toward autocratic leadership (also as the Machiavellians observed), a DAO should seek to establish a leadership “class” for the ecosystem to more effectively handle the remaining governance matters. But it’s critical to counterbalance the powers among any leadership class by design, so that any emerging leaders are perpetually subject to open opposition.

While DAOs could attempt to use non-token based voting designs — like proof of personhood — to overcome autocracy, the principles outlined by the Machiavellians, which were based on lessons from observing contentious politics, suggest such designs are unlikely to be successful in the long run. Even though proof of personhood could remove the differentiated rights of token holders based on their ownership of tokens, the token holders of a DAO using this approach would likely consolidate into new groups based on new kinds of property rights and new class divisions. So while proof of personhood could mitigate a DAO’s vulnerability to attack, it would be unlikely to eliminate autocracy.

Establishing a system of checks and balances provides a better alternative. Fortunately, incentivized decentralization provides a fertile ground for exploring other tools for balancing power among leadership. Below, I share one potential design for a DAO that utilizes a bi-cameral governance layer — not unlike the U.S. Congress, which is divided into the House of Representatives and the Senate.

(1) Stakeholder council

If a protocol is able to incentivize a robust ecosystem of clients and third-party product and service providers all operating independent businesses, then it stands to reason that such individuals would have a vested interest in the governance of the protocol. Their livelihoods would potentially depend on the subsistence of the protocol. Further, a protocol’s most active users would also be likely to have a vested interest in the governance of the protocol, particularly if their use was in connection with ongoing businesses operated by such users.

Given their vested interests, these stakeholders are likely best placed to engage in the protocol’s decentralized governance. However, with current forms of token-based voting, these stakeholders are unlikely to have enough agency with respect to decentralized governance — thereby minimizing the potential to foster true stakeholder capitalism in these ecosystems.

This challenge can be overcome by using non-token based voting to provide stakeholders from each of the three constituencies with their own stakeholder councils. In particular, non-transferable NFTs (aka soulbound NFTs) could be awarded to certain individuals within each constituency, entitling such holders to propose and vote on matters before the DAO.

In designing any such leadership class, a DAO should:

Sufficiently disperse power among the leadership class such that no individual person or group of related persons could be said to control the DAO. For one thing, the establishment of the leadership class may have negative implications under U.S. securities laws. Multiple members from each constituency selected by the DAO to form the leadership class should be granted authority.

Assess the interests of the various stakeholders to determine where there are competing and aligned interests. While difficult, assessing these interests is more straightforward than assessing the interests of anonymous token holders, as one can start by looking at the on-chain incentives. For example, for Blockzaar, the incentive structure aligns the interests of users, client operators and third-party product and service providers against the interests of the protocol when it comes to the allocation of commissions earned – which as discussed above is a complex parameter setting to be established by the DAO.

Meanwhile, the interests of such stakeholders may not be aligned when it comes to treasury management and/or protocol maintenance and upgrades. For example, users may want the DAO’s treasury to be used for products and services that benefit users, as opposed to those that benefit client operators; and third-party product and service providers may be opposed to such expenditures for fear of greater competition.

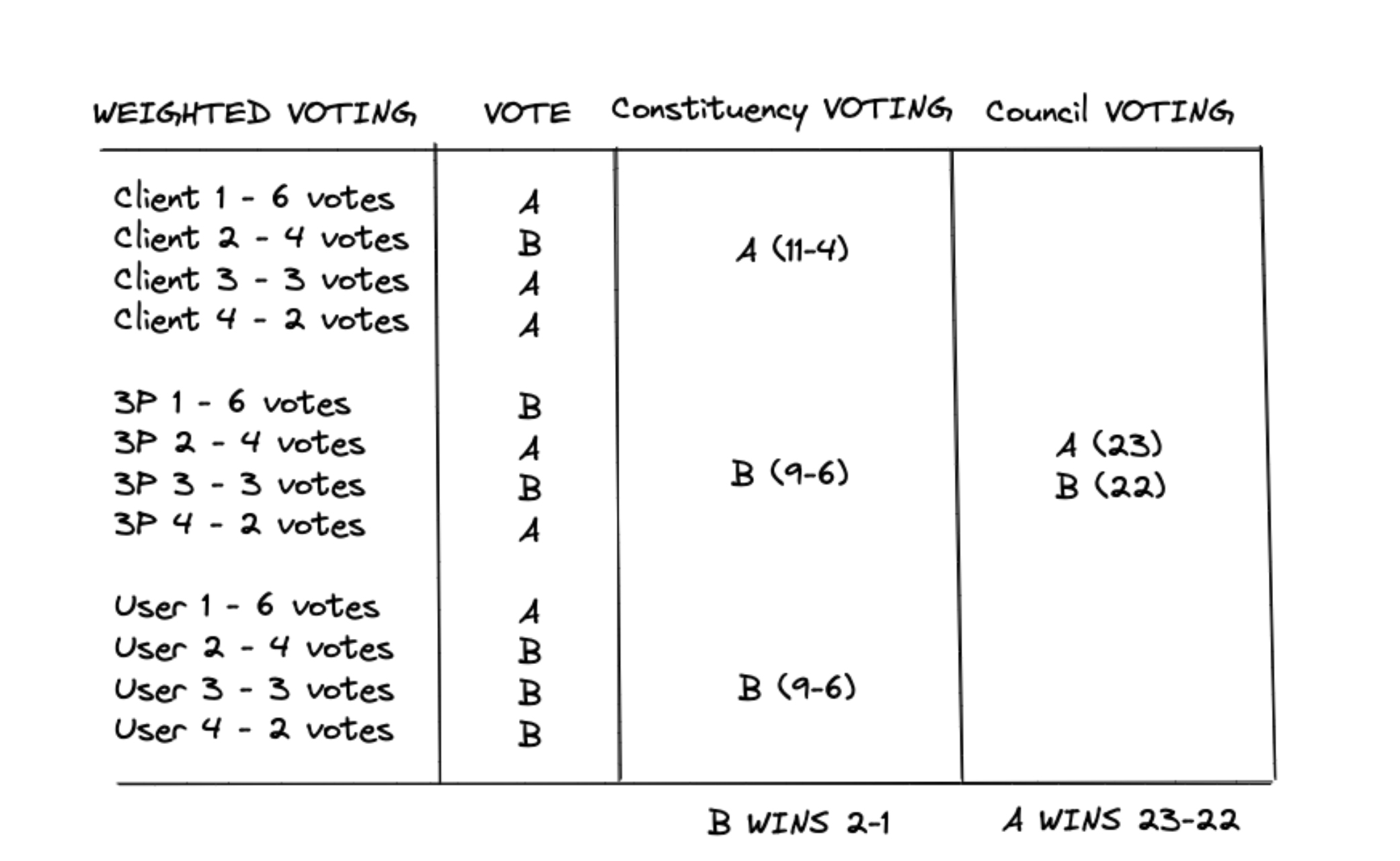

Balance the voting power of stakeholder representatives based on the interests of the respective constituencies. This can be accomplished through weighted voting, with the top performer in each constituency receiving the most votes, thereby promoting competition and rivalry among stakeholders. In addition, a single council vote or separate constituency voting can be used, as reflected in the figure below:

Any stakeholder council would be subject to the risk of hostile takeover if the same or affiliated parties controlled multiple clients and/or third-party product and service providers. However, such risk could be partly addressed through requirements that all such parties have distinct taxpayer identification numbers in the U.S. or by using some form of a proof- of-personhood protocol.

(2) Delegate council

The power of the stakeholder council should be checked by token holders, who inherently have a vested interest in the governance of the protocol, and one that may be opposed to the stakeholders represented by the stakeholder council.

A DAO could control for common problems (such as low participation, uninformed voters, etc.) that result from direct democracy by implementing representative democracy, most likely in the form of a delegation program. Among other things, delegates should be separate and distinct from any members of the leadership class and be properly compensated for the role that they play in the system’s governance.

Together, the stakeholder council and the delegate council would have the power to approve proposals brought before the DAO. One or both councils could be the initial governance layer responsible for creating new proposals, with the other layer then having either negative authority (a proposal approved by one council goes through unless vetoed by such council) or positive authority (a proposal approved by one council only goes through if approved by such council).

While this setup is similar to the dual house structure Optimism (for instance) uses, the key differentiator is that the Blockzaar DAO’s stakeholder council (like Optimism’s Citizen’s House) would be systematically populated by the top-producing stakeholders in the system. These stakeholders are more likely to have a vested interest in the propagation of such systems as compared to good actors without obvious incentives. Because the livelihood of the stakeholders is ultimately dependent on the protocol, they are much more likely to take the governance of the protocol seriously than good actors who are simply participating in decentralized governance out of a spirit of civic duty. Such an arrangement would help to make DAOs function more like an industry consortium than a homeowners’ association.

This concept of relying on self-interested factions — rather than on disinterested or high-minded social designers — has been explored in other areas, including institutions of constitutional and international law, with self-interested factions being the overwhelming victor.

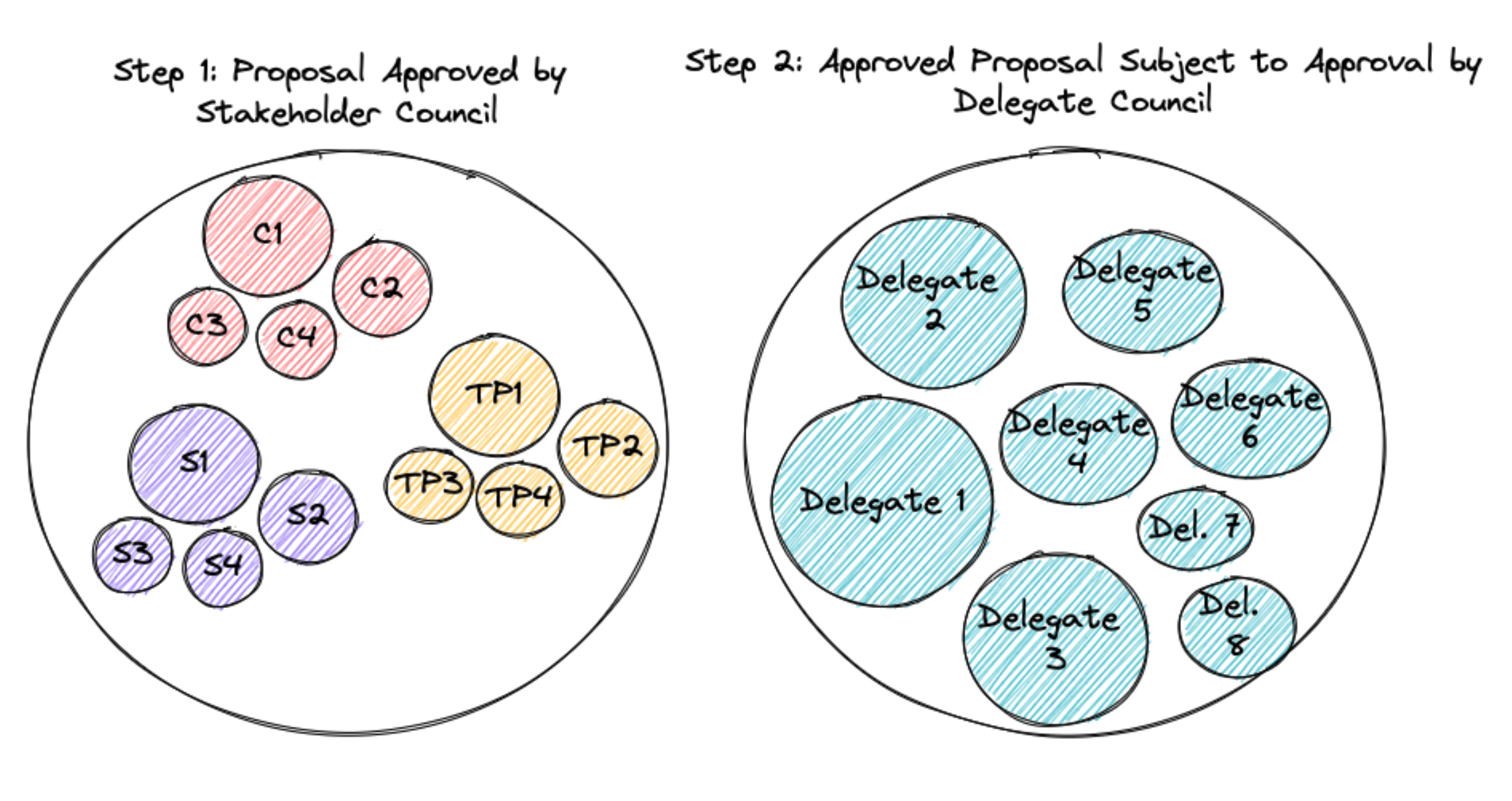

For Blockzaar, the DAO’s leadership class and governance structure could be set up as follows:

- The stakeholder council is composed of: (1) the operators of the top four clients (as measured by transaction volume); (2) the third-party product and service providers that created the top four products and services (as measured by transaction volume of clients using such products and services); and (3) the top four sellers (as measured by transaction volume).

- The voting power of the leadership class is weighted and broken into three separate series by constituency (as reflected in the image above). The leadership class votes as a single council.

- The delegate council is composed of 8 delegates selected and approved by token holders, with proportional voting power based on the number of tokens delegated.

- The DAO defaults to no changes in governance happening, so any proposal approved by the stakeholder council does not take effect unless it is approved by the delegate council.

This example governance system for Blockzaar can be illustrated as follows:

Machiavellian guideline #3: Continual upheaval

The Machiavellians believed that systems should not only have constant opposition, but allow new leaders to force their way into the leadership class — thereby creating churn, and avoiding a static balance of power. According to the Machiavellians this churn must be forced, as the leadership class will always push against it in order to preserve their position and privilege.

Enabling broad participation by community members is already a hallmark of the web3 ethos, and often extends to DAO leadership, where community members often rise to become formal DAO contributors. However, community members are often limited in their ability to acquire true power in token-based voting systems — given the financial hurdles associated with acquiring such power.

Nevertheless, DAOs that wish to embrace this Machiavellian principle — the need to subject the leadership class to constant upheaval — could introduce churn among the leadership class in several different ways, including:

Establishing a term limit for stakeholders on the stakeholder council. For instance, the performance criteria established by the DAO for the promotion of stakeholders to the stakeholder council could be re-measured on a periodic basis, thereby refreshing the stakeholder council with the best performers over the prior period.

Enabling token holders to remove and replace delegates at will, with delegate terms otherwise ending on a periodic basis, at which point they must be re-delegated to.

Empowering token holders to directly elect some of the stakeholders (client operators, third-party product and service providers and users) on the stakeholder council, thereby establishing that prior performance alone is not the only way to be promoted to the stakeholder council.

Machiavellian guideline #4: Accountability of leadership

If large groups of people are indeed inherently unable to properly hold their leaders accountable (as the Machiavellians predict), DAOs should seek to implement measures that enhance greater accountability throughout their ecosystems.

By implementing the first three guidelines above, Machiavellian DAOs could have greater accountability than current DAOs; in particular:

- Given the smaller number of participants among the leadership class (as compared to the broad population of token holders generally), each member of the leadership class will be better positioned to hold the other members of the leadership class accountable for their voting history. This is especially likely to occur as between members of the stakeholder council on the one hand and members of the delegate council on the other, given the inherent tension between such councils.

- A robust client ecosystem means that users can simply stop using certain clients in favor of others, thereby keeping client operators (including those that are promoted to the leadership class) more accountable to user demands. Similarly, a robust third-party product and service provider layer would enable both users and client operators to hold such providers accountable given their ability to shift to alternative products and services.

- Regularly removing delegates and expiring terms provides members of the stakeholder class with an opportunity to lobby token holders to in turn hold delegates accountable for prior votes.

DAOs could also increase the accountability of their stakeholder and delegate councils if client operators, third-party product and service providers, and users were required to “lock” a set number of governance tokens. They would do so by locking them in a smart contract prior to their admission to the stakeholder council, with those tokens only being released upon the completion of some term. However, it may also be difficult to implement such a mechanism given that members of the stakeholder council may not trust their fellow stakeholders enough to risk their own assets. As a result, if any staking mechanism were introduced, it would likely also need to permit “rage quitting” by stakeholders, similar to what Moloch DAO has implemented.

If implemented well, lockup mechanisms would help to promote greater incentive alignment among the stakeholder council, and token holders more broadly.

* * *

A commonly cited issue with the ruling elite in the American corporate system is that a company’s stockholders, directors, and officers often have unchecked power. As a result, we see C-suite compensation far outpacing employee compensation, or we see boards conducting stock repurchase programs rather than reinvesting those resources for the health of the organization, and a host of other issues.

While this centralized power has enabled these companies to sometimes more efficiently act, their mistakes and errors in judgment have resulted in countless missteps with no recourse or inclusion of other stakeholders in those organizations. Blockchains, smart contracts, and digital assets enable web3 systems to be designed differently. Prioritizing governance minimization by DAOs would help them to remain credibly neutral, which should enable them to grow their burgeoning ecosystem of client operators, third-party products, and service providers and users.

Empowering these stakeholders with a meaningful role in the governance process gives DAOs a real chance at achieving the “stakeholder capitalism” that appears to be out of reach for traditional equity/corporate forms. As a result, we should push web3 systems to adopt incentive structures that promote actions that improve their systems — making them more productive and better for all stakeholders — rather than incentive structures that only optimize value for a limited number of owners.

Again: web3 should triumph over web2 through decentralization, which reduces censorship and promotes liberty, which in turn enables opposition to power, and therefore drives greater progress. By incentivizing competition, empowering rivals, and utilizing non-token based voting, DAOs can help accelerate this cycle.

But only if we embrace and lean in to the realities of such systems.

Read part one, “Machiavelli for DAOs: Principles for Fixing Decentralized Governance” here.

Editor: Sonal Chokshi

Acknowledgements: Thank you to Ali Yahya, Andy Hall, Porter Smith, Robert Hackett, Ross Shuel, Sonal Chokshi for their helpful comments/ feedback on this piece

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.