Today’s payment landscape is dominated by gatekeepers that charge high fees that cut into the profitability of every business they touch, and justify those fees in the name of ubiquity and convenience — while they stifle competition and limit the creativity of builders.

Stablecoins can do better.

Stablecoins offer lower fees, more payment provider competition, and wider accessibility. Because stablecoins reduce the cost of transactions to nearly zero, they can free businesses from the friction of existing alternatives. Adoption will start with the businesses that are most harmed by the current payment options, a process that would disrupt the payments industry.

Stablecoins are already the cheapest way to send a dollar. In the last month, 28.5M unique stablecoin users sent over 600M transactions. Stablecoin users live in nearly every country and use stablecoins because they provide a safe, cheap, and inflation-resistant way to save and spend. Besides cash and gold, stablecoins are the only widely adopted payment rail that operates without gatekeepers like banks, payment networks, or central banks. At the same time, stablecoins are permissionlessly programmable, extensible, and integrable — anyone can help build the stablecoin payments platform on top of stablecoin payment rails.

This disruption may take time — but it is likely to happen more quickly than many expect. Businesses like restaurants, retailers, enterprises, and payment processors would benefit most from the stablecoin platform, seeing radical improvements to their margins. That demand will drive adoption, and as stablecoin adoption grows, the other benefits of stablecoins — permissionless composability and improved programmability — will bring still more users, businesses, and products onchain. I share more on why and how below, beginning with some background on the payments industry.

Payment players

- Payment rails: Technology, rules, and networks that handle transactions

- Payment processor: An operator on top of payment rails that facilitates transactions

- Payment service provider: An entity that provides access to payments systems to end users or other systems

- Payment solution: A product offering from a payment service provider

- Payment platform: A set of associated payments solutions spanning providers, processors, and rails

|

The backdrop of the payments industry

The scale of the payments industry is hard to overstate. In 2023, the global payments industry handled 3.4 trillion transactions, accounting for a mind-boggling $1.8 quadrillion in value and generating $2.4 trillion in revenue. The United States alone saw $5.6T in credit card payments and $4.4T in debit card payments.

Despite the ubiquity and scale of the industry, payment solutions remain expensive and complex, although payment apps often shield consumers from the experience. For instance, while Venmo, a peer-to-peer payment app, seems simple in its frontend, on the backend, the product hides a maze of banking integrations, debit-card loopholes, and countless compliance obligations. Adding to the complexity, payment solutions often build on one another, and people still use a variety of payment rails: cash, debit, credit, peer-to-peer payment apps, ACH (automated clearing houses), checks, and more.

The four main measures of a payment product are timeliness, cost, reliability, and convenience.

Consumers prioritize questions like, How much will I pay? Merchants ask, Will I get paid? But really all four measures are essential for both.

Waves of innovation have improved the payment experience since, say, the days when a business had to look up fraudulent credit cards in a physical ledger. Each wave of innovation has led to faster, more reliable, more convenient, cheaper payments, which has in turn led to an increase in the volume of transactions and dollars spent.

But many customers are still unserved or underserved by modern offerings. Cards are expensive for the merchant, directly eating into their margins. Despite growing real time payments (RTP) adoption, U.S. bank transfers are still too slow, taking days. And peer-to-peer apps are region and network specific, making transfers between ecosystems slow, expensive, and complicated.

While businesses and consumers have begun to expect more sophisticated features from payment platforms, not all users are well served by existing solutions. In fact, most users are overpaying for payments, and don’t use all the bundled products of payments. Yet they accept the current state of affairs.

Where stablecoins come in

The wedge for stablecoins to disrupt this industry begins where existing payment solutions fail (high cost, low availability, or high friction), and where the bundled products of payment solutions — including identity, lending, compliance, fraud protection, and banking integration — are the least necessary.

Consider remittances, born of desperation. Many remittance users are underbanked and use highly fragmented banking services. Consequently, these users don’t find the native integration between traditional payments and banking services valuable. Stablecoin payments offer instant finality, low cost, and lack of middlemen, structural advantages for any payment user or builder. After all, with stablecoins, sending $200 from the U.S. to Colombia costs less than $.01, but $12.13 on traditional rails. (Remittance users need to send money home regardless of transaction costs, but would benefit substantially from lower fees.)

International business payments, especially for small businesses in emerging markets, also face high fees, slow processing times, and low banking support. For instance, a payment between a garment manufacturer in Mexico and a textile manufacturer in Vietnam would touch four or more intermediaries — local bank, foreign exchange, correspondent bank, correspondent bank, foreign exchange, local bank. Each intermediary takes a cut and creates risk of failure.

Fortunately, these transactions happen between cooperating parties with a recurring relationship. With stablecoins, the Mexican payer and Vietnamese recipient can experiment and remove slow, bureaucratic, and expensive intermediaries. They may need to work to find local ramps and workflows, but ultimately they could enjoy faster, cheaper transactions as well as more control over the payment process.

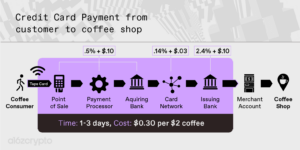

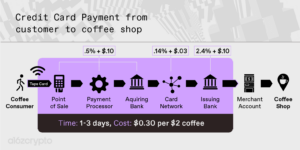

Low-dollar transactions — especially low-fraud, in-person transactions, like those at restaurants, coffee shops, or corner stores — are also a promising opportunity. Given their low margins, these businesses are sensitive to cost, so a 15-cent transaction fee charged across a payment solution makes a substantial difference in their profitability.

For every $2 a customer spends on coffee, only $1.70 to $1.80 goes to the coffee shop, with the nearly 15% remaining going to the card companies — merely for facilitating the transaction. But credit cards are only being used for convenience here: Neither the consumer, nor the shop, needs the additional features that justify the fee. The consumer doesn’t need fraud protection (they were just handed a coffee) or a loan (the coffee was $2). And coffee shops have limited compliance and banking integration needs (coffee shops often use comprehensive restaurant management software or nothing at all). So if there were a cheap, reliable alternative, expect these businesses to take advantage of it.

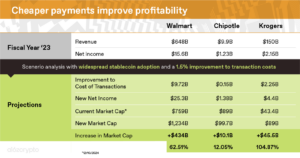

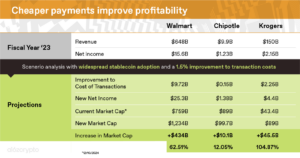

Cheaper payments improve profitability

Current payment system transaction fees hurt many businesses’ bottom lines directly. Reducing those fees would unlock massive profitability. The first shoe has already dropped: Stripe announced that they are taking a 1.5% fee on stablecoin payments, a 30% discount on the fees they charge for card payments. To support this effort, Stripe announced its acquisition of Bridge.xyz for around $1 billion.

Greater stablecoin adoption would significantly improve profitability in many businesses — and not only for small businesses like coffee shops or restaurants. Let’s look at three public companies’ fiscal year 2024 financials to approximate the effect of reducing payment processing to 0.1%. (For convenience, this evaluation assumes that the businesses are paying a 1.6% blended payment processor cost and have minimal on/offramp costs. More on this below.)

- Walmart made $648B in annual revenue, and might pay $10 billion in credit card fees, with $15.5B in profit. Do the math: Eliminate payment fees and Walmart’s profitability, and therefore its valuation, controlling all other factors, could increase by over 60%, just through cheaper payment solutions.

- Chipotle, a growing quick-service restaurant, makes $9.8B in annual revenue. It pays $148M in credit card fees on a $1.2B in annual profit. Chipotle could increase its profitability by 12% — a dramatic number not accessible anywhere else in its income statement — just by reducing fees.

- Krogers, a national grocery store, has the most to gain because it has the lowest margins. Astonishingly, Krogers’ net income and cost of payments may be almost equal. Like many grocers, its margins are below 2%, less than the amount businesses pay to process credit cards. Krogers could potentially double its profits with stablecoin payments.

How will Walmart, Chipotle, and Krogers reduce transaction fees through stablecoins? First, consider this an idealized scenario: Consumer adoption won’t happen all at once and there will still be meaningful fees, especially for on and off ramping, until stablecoins have sufficient adoption. Second, retailers and payment processors are aligned against high-fee payment solutions. Payment processors are also a low margin business, giving up most of their margin to card networks and issuing banks. When payment processors handle a transaction, the majority of their fee is passed through to payment networks. So when Stripe handles an online retail checkout flow, they take 2.9% of the total transaction and a $0.30 fee, but they give Visa and the issuing bank more than 70% of that fee. As more payment processors like Block (fka Square), Fiserv, Stripe, and Toast adopt stablecoins to improve margins, they will make stablecoins more accessible to even more businesses.

Stablecoins have low fees, and no network gatekeeper to pay. This means that the revenue that payment processors make on stablecoin transactions is much higher-margin. Higher margins will likely motivate payment processors to support and encourage stablecoin usage for more businesses and use cases. But as the payments processors begin adoption, expect to see stablecoin payment fees compress over time: Stripe’s 1.5% fee will likely be competed down.

The next step: Broad consumer adoption

Today, stablecoins are new, permissionless rails for sending and storing money. Entrepreneurs are already building solutions that turn stablecoin rails into the stablecoin platform. As with previous innovations, adoption will happen gradually, starting at the edge of consumer needs, and in forward-thinking businesses, until the platform is mature enough to meet the needs of everyday users and cautious businesses. Three trends will push more mainstream businesses towards stablecoin adoption.

1. Increasing back office integration through stablecoin orchestration

Stablecoin orchestration — the ability to monitor, direct, and integrate stablecoins — will soon be integrated into payment processors like Stripe. These orchestration products allow businesses to handle payments at a substantially lower cost than current mechanisms, without substantial process or engineering changes. Without realizing it, consumers may end up with a cheaper product because invoices, payroll, and subscriptions would have a structurally lower cost by default.

Many of these stablecoin orchestration businesses are already onboarding clients who want instant finality, low-cost, and widely available business-to-business or business-to-consumer payments. By integrating stablecoins through the back office, businesses will benefit from stablecoin’s advantages — without interrupting or reducing the quality of service that users expect from payment providers, while stablecoin adoption increases.

2. Improving onboarding and increasingly shared incentives for businesses

Stablecoin businesses are getting more sophisticated about bringing end users onchain by sharing incentives and improving onboarding solutions.

Ramps have continued to get cheaper, faster, and more ubiquitous, enabling users to start using crypto more easily. At the same time, more consumer applications are supporting crypto, allowing users to benefit from an expanded stablecoin ecosystem — without needing to adopt new apps or user behaviors. Popular apps like Venmo, ApplePay, Paypal, CashApp, Nubank, and Revolut all allow their customers to use stablecoins today.

And companies have more incentive to use these onramps to integrate stablecoins and keep money in stablecoins. Fiat-backed stablecoin issuers like Circle, Paypal, and Tether are sharing their profits with regular businesses, much like how Visa shares profits with United and Chase for signing up credit-card users. These kinds of partnerships and integrations benefit stablecoin issuers by creating larger asset pools to draw yield from. But they can also benefit businesses that are successful at converting users from credit cards to stablecoins. These businesses would now be able to earn a portion of the yield generated on the money flowing through their products, a business model typically reserved for banks, fintechs, and gift-card issuers who make money on user float.

3. Increasing regulatory clarity and availability of compliant solutions

Businesses are more likely to adopt stablecoins when they feel confident about the regulatory environment. While we still haven’t seen comprehensive global regulation of stablecoins, many jurisdictions have published rules and guidance for stablecoins, permitting entrepreneurs to begin the hard work of building compliant, user-friendly businesses.

For example, the European Union’s Markets in Crypto-Assets Regulation (MiCA) establishes rules for stablecoin issuers including prudential and conduct requirements. Since its stablecoin provisions entered into force earlier this year, the regulation has already substantially altered the European stablecoin market.

While the U.S. currently lacks a stablecoin framework, policymakers on both sides of the aisle increasingly recognize the need to develop effective stablecoin legislation. Such regulation would need to ensure that issuers fully back their tokens with high-quality assets, have their reserves audited by third parties, and enforce comprehensive measures to counter illicit finance activities. At the same time, legislation would need to preserve the ability for builders to create decentralized stablecoins that mitigate user risk by eliminating intermediaries, taking advantage of the benefits of decentralization.

These policy efforts would allow companies in all industries to consider shifting from legacy payment rails to stablecoin infrastructure. And while compliant solutions are not sexy, each stablecoin adopter helps prove to incumbent businesses that stablecoins are a reliable, safe, regulated, and improved solution to classic payments problems.

As stablecoin adoption increases, the network effects of the platform will grow stronger. While it may be years before stablecoins are used at the point of sale or as an alternative to bank accounts, as the number of stablecoin users grows, stablecoin-centric solutions will become more mainstream and more appealing for consumers, businesses, and entrepreneurs.

Tailwinds: Why stablecoins will keep improving

In the midst of adoption, the product itself will keep getting better. The web3 community is celebrating stablecoin adoption for good reason: Stablecoins are climbing the Value to Innovation S-curve because of many years of investment in infrastructure and onchain applications. Stablecoins will become even more attractive to users as infrastructure improves, onchain applications get richer, and the onchain network grows. This will happen in two ways.

First, hard engineering work on crypto infrastructure made stablecoin payments below 1 cent possible. Future investment will continue to make transactions cheaper and faster. At the same time, stablecoin orchestration and improved onboarding will only be possible because of better wallets, bridges, ramps, developer experience, and AMMs.

This technology base provides entrepreneurs with an increasing incentive to build on stablecoins, delivering an improved developer experience, a rich ecosystem, broad adoption, and the permissionless composability of onchain money.

Second, stablecoins unlock new user scenarios through the permissionless composability of onchain money. Other payment platforms have gatekeepers that force entrepreneurs to work with extractive networks, for instance, the costly intermediaries in a credit card transaction or international payment. But stablecoins are self-custodial and programmable, lowering the barrier for making new payments experiences and integrating services that add value. Stablecoins are also composable, allowing users to benefit from increasingly powerful onchain applications and increased competition. For example, stablecoin users are already benefiting from DeFi, onchain subscriptions, and social applications.

***

Stablecoins can usher in a world of free, extendable, and instantaneous payments. As Patrick Collison, CEO of Stripe, has noted, stablecoins are “room-temperature superconductors for financial services.” They will allow businesses to pursue new opportunities that could not otherwise survive the burden of incumbent payment rails or the friction of traditional gatekeepers.

In the short term, stablecoins will create a structural change in financial products as payments become free and open. Incumbent payments companies will seek new ways to monetize, either by taking a cut of yield or by selling services that are complementary to this newly commoditized platform. As these legacy businesses recognize the changing landscape, entrepreneurs will create new solutions that will help these businesses take advantage of stablecoins.

In the longer term, as stablecoins are adopted and the technology improves, startups will seize the opportunities that are native to a world with free, frictionless, and instantaneous payments. Those startups will be founded today, unlocking new and unexpected scenarios and further democratizing access to the opportunities afforded by the global financial system.

***

Acknowledgements: Special thanks to Tim Sullivan, Aiden Slavin, Eddy Lazzarin, Robert Hackett, Jay Drain, Liz Harkavy, Miles Jennings, and Scott Kominers for their thoughtful feedback and suggestions that made this post possible.

***

Sam Broner is a partner on the investing team at a16z crypto. Prior to joining a16z, Sam was a software engineer at Microsoft, where he was on the founding team of the Fluid Framework and Microsoft Loop. Sam also attended MIT’s Sloan School of Management, where he worked on Project Hamilton at the Federal Reserve Bank of Boston, led the Sloan Blockchain Club, directed Sloan’s first AI Summit, and won MIT’s Patrick J. McGovern award for creating an entrepreneurial community. Follow him on X @SamBroner.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investment-list/.

The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures/ for additional important information.