Editor’s note: This post originally appeared in our newsletter — a guide to trending topics in crypto with insights and resources from engineers, researchers, and others on the a16z crypto team. Subscribe to see it in your inbox every other week.

In this edition…

- Why fintechs are launching their own blockchains

- A playbook for bringing blockchains to TradFi

- Three phishing schemes hooking crypto users

- The unintended impact of the Tornado Cash verdict

- A breakout week for decentralized governance

The race to win payment rails

Sam Broner and Pyrs Carvolth

After a string of stablecoin announcements, Stripe’s latest push into crypto is reported to be a new blockchain; meanwhile Circle announced the buildout of their L1, called Arc. While it’s clear that every fintech company can spin up their own app-specific blockchain, a killer app and strong distribution are an edge, not a certainty. So what are fintechs building toward, and how will it affect the ecosystem?

We’re getting close to a new paradigm for money — one that gives users control and democratizes access to financial innovations globally — but we’re not there yet. Today, stablecoins are a simpler way to do yesterday’s financial activities, like saving and sending, better. They address the shortcomings of existing systems, but truly native opportunities for stablecoins may require wider distribution, deeper integrations, and another generation of product insights.

There’s good reason for fintechs, banks, and payment companies to build L1s and L2s: moving payment flows onchain can improve their cost structure and simplify last-mile payment infrastructure — the local rails that deliver funds to end users. For a company doing payout in 170 countries, managing last-mile payments is a hassle, so encouraging local entrepreneurs to build on open protocols can reduce cost and make for a better experience.

If fintechs commit (and we think they should), the big players can seed their new blockchains with existing payment flows and rival existing L1s and L2s in payment volume from day one. But it remains to be seen whether they will be able to build a vibrant ecosystem that attracts external businesses.

For the most ambitious companies, there is a genuine opportunity to create the next generation of payments — the biggest, best, and most global yet. A bold and early bet, great ecosystem stewardship, and quality partners could snowball into network effects. One company dominating the next generation of money — stablecoins — feels like a long shot, but crazier things have happened.

How to bring TradFi onchain

We’re seeing increased interest in blockchain technology from more traditional financial firms, as banks, asset managers, and fintechs shift out of research mode and into action. What’s driving this trend? Growth in monthly active crypto addresses is generally tracking internet growth, stablecoin transaction volume is outpacing traditional fiat volume, legislation and regulation are finally catching up, and crypto companies are getting acquired or going public.

Pair that with regulatory clarity, competitive pressure, and the clear improvements to business outcomes that blockchains offer and you get TradFi’s sense of urgency to embrace these technologies as core infrastructure.

To address the question of how to make blockchains matter to TradFi, our team wrote a new playbook. It’s not a comprehensive survey of every use case or protocol. Instead, it’s a guide for moving from zero to one, laying out the critical early choices, sharing emerging patterns, and helping frame blockchains not as symbolic hype, but as core infrastructure that, when used well, can future-proof their businesses and unlock new sources of growth for banks, asset managers, and fintechs…

read more

Don’t get hooked: Three phishing schemes you need to know

Most of us get scam calls or emails — asks for passwords, bank pins, and more — that are easy enough to avoid. And yet, phishing is still the most reported type of cyberattack, with increasingly sophisticated scams ensnaring people who don’t usually fall for them.

That’s why we’re breaking down the real-world phishing campaigns we’ve recently encountered — how they work, and how to protect yourself:

1. The ‘problem with your account’ scam

Looks like a legit alert from Google or another trusted service — but it’s a perfect copy designed to steal your login. To protect your account against this type of attack, create Passkeys with your phone and use them to secure your iCloud or Google accounts.

2. The ‘poison ad’ boobytrap

What if the attackers make the campaign even more convincing than the one outlined above? Hackers can buy fake Google Ads so the “login page” you see is actually theirs. Consider an ad blocker and, again, Passkeys.

3. The dream job gone wrong

A fake recruiter sends you a coding challenge laced with malware. Running code and downloading dependencies is risky and needs to be performed on a separate device or virtual machine, not on a work computer.

For other schemes — from hidden LLM prompts to spies posing as employees — and how to avoid them…

read more

More news and updates

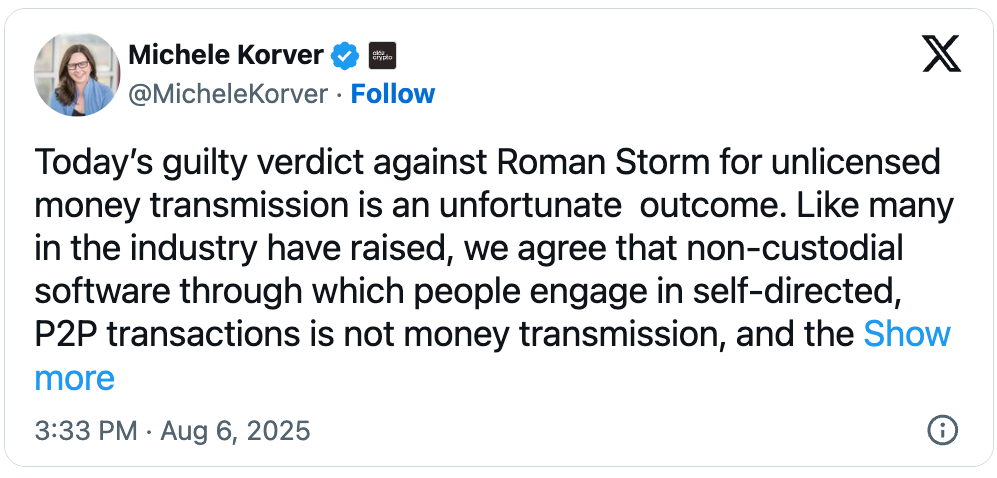

A jury found Roman Storm, co-founder of Tornado Cash, guilty of conspiracy to operate an unlicensed money transmitting business after the protocol was used by North Korean cybercriminals to launder stolen funds. The decision could have a wide-ranging and unintended impact on the blockchain ecosystem. In particular, the fear of facing similar convictions may discourage developers from building privacy-preserving technologies and other crypto infrastructure, should bad actors exploit their projects.

a16z crypto Head of Regulatory Michele Korver shares her take here, with more details on the decision and what comes next: “… the fight is not over. Storm has multiple grounds for appeal. And we will continue to support the fight to protect developers — in legislation, regulatory rule making, and the courts.”

The Uniswap Foundation — which supports the growth and governance of the Uniswap Protocol — shared a proposal to adopt the Decentralized Unincorporated Nonprofit Association (DUNA) structure: a legal framework for DAOs to legitimize their operation offchain, without sacrificing decentralization.

If the proposal passes, Uniswap Governance would be the largest DAO to adopt a DUNA yet — a milestone for decentralized governance and a potential model for other protocols looking to step away from clunkier offshore foundation models. Days later, Towns Protocol, an open source protocol for decentralized messaging, unveiled its own DUNA: Towns Lodge.

No meme, just proud parents

***

— a16z crypto editorial team

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.