2024 may well go down as one of the more exciting years in crypto industry history. Crypto activity and usage hit all time highs. Blockchain infrastructure improved dramatically, resulting in lower transaction fees. Stablecoins found product-market fit. The inevitable intersection of crypto and AI became more clear. Bitcoin and Ethereum ETPs were approved. And the legislative and regulatory environments now present the industry with a positive path forward. All of this has teed up yet another exciting year.

As we consider what’s next for crypto, here are five of the metrics we’ll be watching closely to track the industry’s continued progress. (For other indicators, you can also check out our State of Crypto Index, which we released in 2023 to track broader industry innovation and adoption forces.)

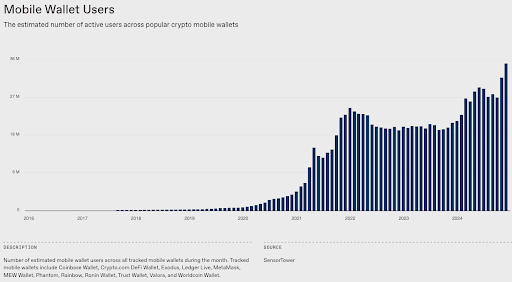

1. Monthly mobile wallet users

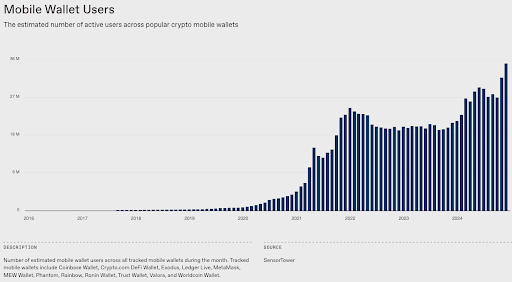

To unlock the next wave of crypto users, we need to move closer toward user experience (UX) parity with web2 applications. Mobile wallets will play a critical role here: There are hundreds of millions of “passive” crypto owners (people who own crypto but do not regularly transact onchain) that could convert into active crypto users. For that to happen, developers need to continue building new consumer applications, and consumers will need wallets to participate.

Mobile wallet users reached an all-time high last month, crossing 35 million for the first time ever. This was driven by growth in familiar names like Coinbase Wallet, MetaMask, and Trust Wallet, but was also driven by some newer players like Phantom and World App.

Consumer wallets present some of the industry’s toughest challenges for builders – finding the right balance between security, privacy, and usability is not trivial. But now that blockchain infrastructure can handle hundreds of millions — or billions — of people onchain, it’s a better time than ever to build a next-generation mobile wallet. We’ll be watching these developments closely in 2025.

Track monthly mobile wallet users here.

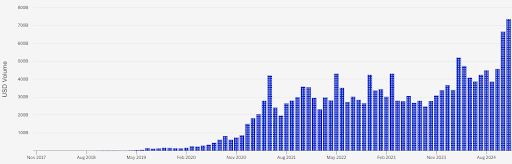

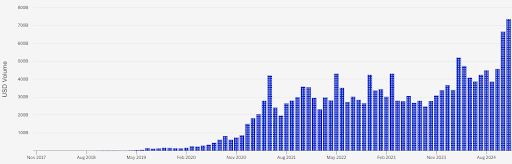

2. Adjusted stablecoin transaction volume

Stablecoin activity picked up in 2024 as infrastructure developments drastically brought down transaction fees. Notably, stablecoins are not just used for crypto trading — they’re used for cross-border payments and remittances; buying goods and services; and as a store of value, especially in countries with rampant inflation. Stablecoins are already the cheapest way to send a dollar, and we expect enterprises will increasingly accept stablecoins for payments.

With these tailwinds, onchain settlement of value should continue to grow in 2025. While we can easily measure this transaction volume using onchain data, isolating the real organic stablecoin usage can be difficult. Transactions can be initiated manually by an end user or programmatically through bots, and some of those onchain transactions don’t resemble traditional settlement.

Fortunately, Visa created a clear and simple methodology to show how stablecoins are being used, while adjusting for inorganic activity from bots and other artificially inflationary practices.

If stablecoin adoption — one of crypto’s most clear use cases — takes off in 2025, this metric will be one to watch.

Track stablecoin transaction volume here.

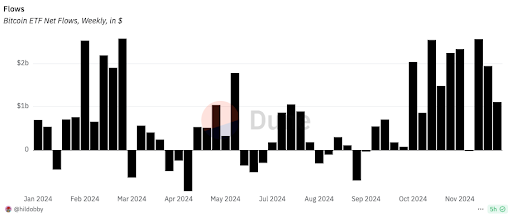

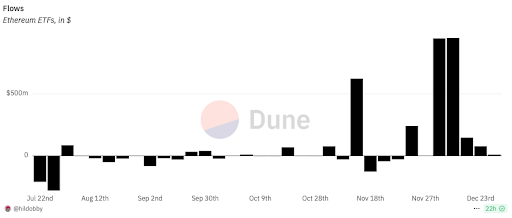

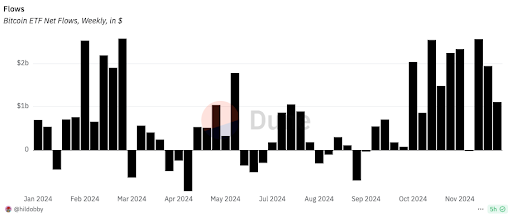

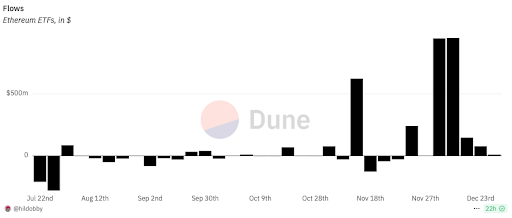

3. ETP net flows (Bitcoin and Ethereum)

The U.S. Securities and Exchange Commission approved exchange traded products (ETPs) for Bitcoin and Ethereum last year; more FAQs on that here. It is an important milestone that makes crypto more accessible to individual and institutional investors. However, activating the distributors – the likes of Goldman Sachs, JP Morgan, and Merrill Lynch, who can get these products into retail investors’ portfolios – is going to take time.

One way to measure ETP activity is through “net flows”, which represent the amount of BTC or ETH moving into or out of the ETPs. (Excluding pre-existing products like the Grayscale Bitcoin and Ethereum Trusts, which were eventually converted to ETPs.) So far, there have been 515,000 BTC net flows (resulting in $110B in onchain holdings) and 611,000 ETH net flows (resulting in $13B in onchain holdings).

As more institutional investors seek to get exposure to crypto assets, it should translate into increased net flows for the ETPs. Tracking onchain deposits and withdrawals of addresses identified as custodians of the ETPs allows us to monitor this data in real time.

Track ETP net flows here and here.

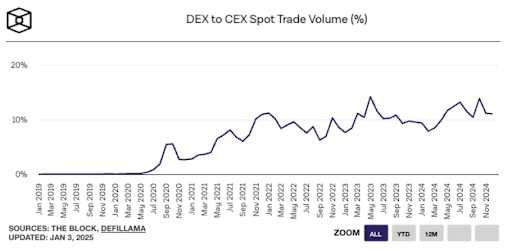

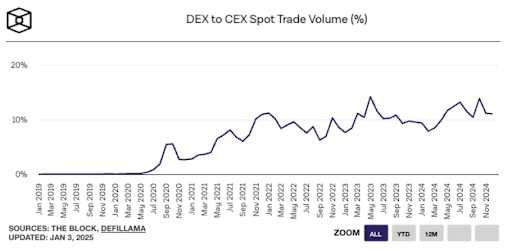

4. DEX to CEX spot trade volume

As more people come onchain, we expect to see decentralized exchange (DEX) usage increase relative to their centralized-exchange counterparts (CEXs) when it comes to trading crypto. After all, a core premise of crypto is decentralized finance or DeFi. The share of spot trading on DEXs has grown steadily to ~11% over the last few years as the DeFi ecosystem has developed, and we expect that trend to continue in 2025.

Recently, DEX volume hit an all-time high — driven by a major uptick in transaction volume on high-throughput chains like Coinbase’s Base and Solana as new users entered the space.

With more new consumer applications coming online, decentralized exchanges could continue to grow in relevance, further contributing to DEX growth.

As we monitor the shifting balance between decentralized, crypto-native activity and centralized crypto trading, this will be an important metric to watch.

Track DEX to CEX spot trade volume here.

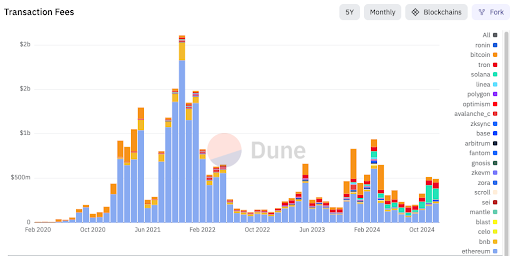

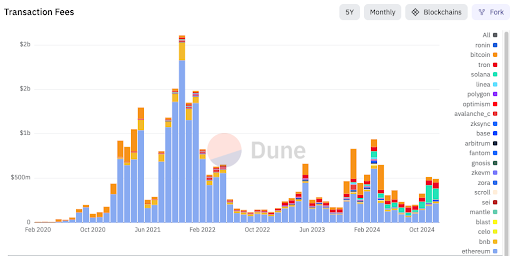

5. Total transaction fees (demand for blockspace)

The total amount of USD-denominated transaction fees shows the aggregate demand — that is, the real economic value — for blockspace on a given chain.

However, this metric comes with lots of nuance, since most projects are explicitly trying to bring down fees for users. Which is why it’s important also to consider unit transaction costs — meaning the cost for a given amount of blockchain resources. Ideally, the overall demand (total transaction fees) grows, while gas fees (cost per unit of resources used) remain low.

For the first time ever, Solana collected more fees than Ethereum in November 2024 (see chart below). Notably, this milestone happened even with Solana’s unit transaction costs being significantly lower; it costs about $5 to send USDC on Ethereum and less than 1 cent to send USDC on Solana. This is a major milestone, and one we’ll continue to monitor.

Many ecosystems and their associated fee markets are maturing, making it a good time to start measuring the economic value facilitated by various blockchains. In the long run, demand for blockspace – measured as the total aggregate USD value of fees paid – may be the single most important metric in tracking the crypto industry’s progress. Why? It reflects engagement in valuable economic activities, and users’ willingness to pay for them.

Track blockspace demand by transaction fees here.

***

We track several metrics for the industry, including in our annual State of Crypto Report — but we’ll be paying close attention to these 5 metrics this year. The industry is well-situated to bring in more users and builders as it broadens investor access; as maturing infrastructure paves the way to compelling new apps; and as more hit products (like stablecoins) emerge. Let’s see what else gets built, and moves the needle on these metrics, this year.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as security, legal, business, investment, or tax advice, nor as an endorsement of any such practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and they should accordingly not be relied upon in any manner. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.