The crypto industry is maturing. At the end of last year, we proposed 5 metrics to watch closely in 2025 to track the industry’s continued growth and development.

Here’s what the data looks like halfway through the year, what’s driving the trends, and why it matters.

- Monthly mobile wallet users: +23%

- Adjusted stablecoin transaction volume: +49%

- ETP net flows (Bitcoin and Ethereum): +28%

- DEX to CEX spot trade volume: +51%

- Total transaction fees (demand for blockspace): -43%

- *Bonus* Tokens with >$1M in monthly net revenue: 22

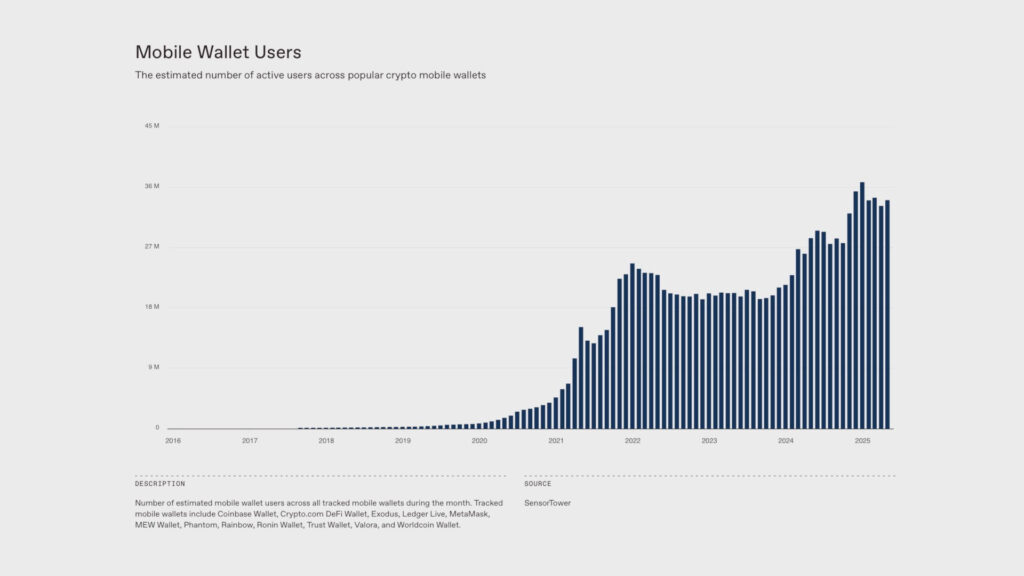

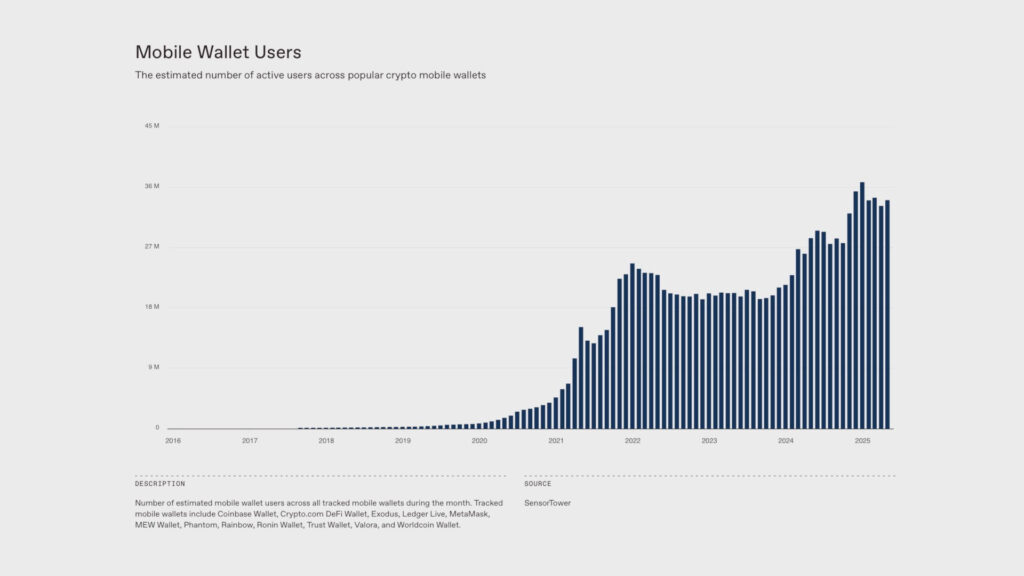

1/ Monthly mobile wallet users: +23%

2025 average: 34.4M monthly active mobile wallet users

2024 average: 27.9M monthly active mobile wallet users

Why it matters:

Wallet infrastructure has significantly improved — we have low transaction fees, new account abstraction protocols (EIP-7702), embedded wallet products (Privy, Turnkey, Dynamic), etc. Now is a better time than ever to build a next-generation mobile wallet.

Relevant news:

- This month Stripe acquired Privy — a leading wallet infrastructure provider.

Source: a16z crypto (as of May 2025)

Source: a16z crypto (as of May 2025)

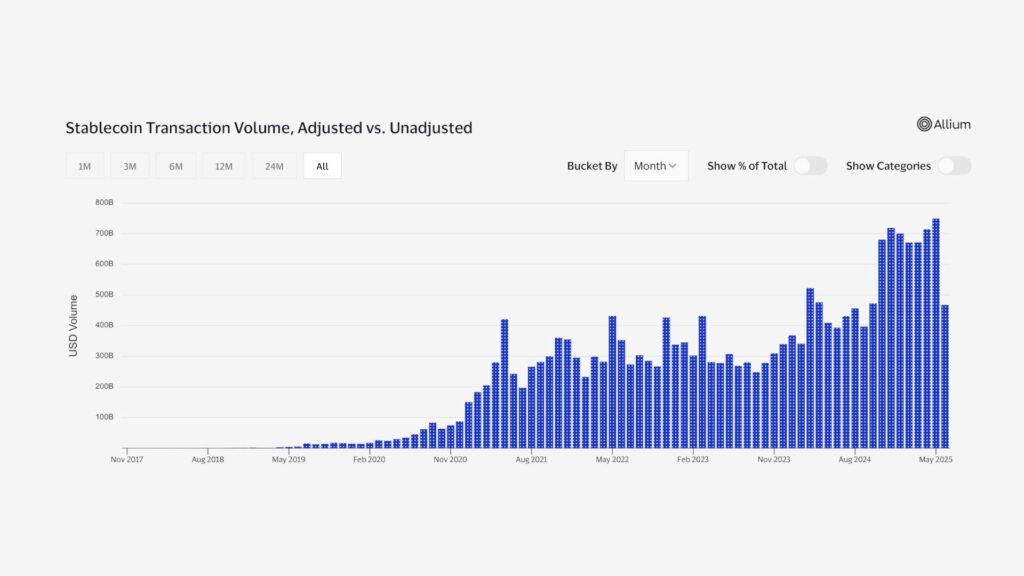

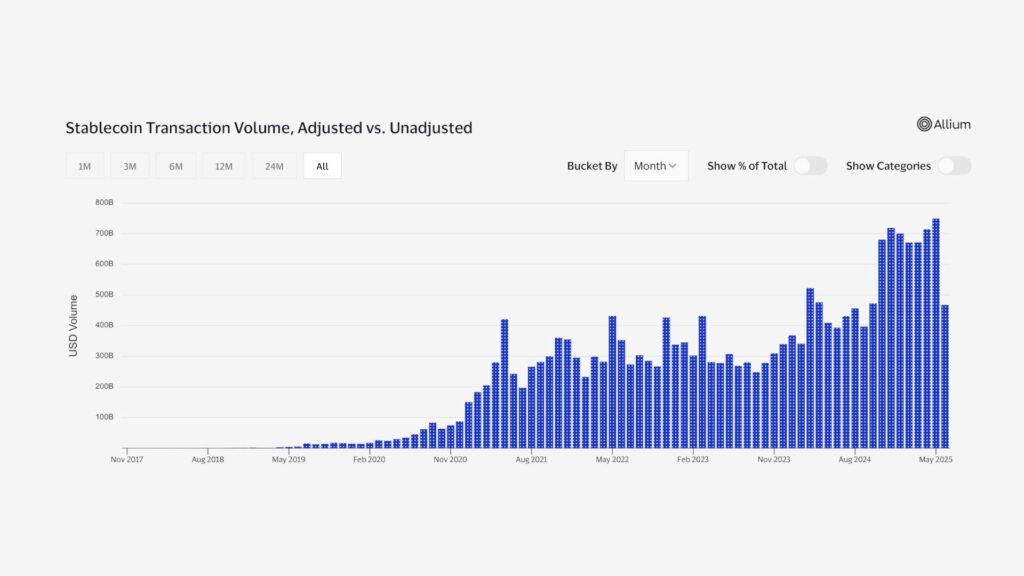

2/ Adjusted stablecoin transaction volume: +49%

2025 average: $702B monthly adjusted stablecoin volume

2024 average: $472B monthly adjusted stablecoin volume

Why it matters:

Stablecoins have found product market fit. We can now send dollars in less than 1 second, for less than 1 cent — making stablecoins a great product for payments. Big financial institutions are embracing this opportunity.

Relevant news:

- USDC issuer Circle went public on the New York Stock Exchange

- Stripe acquired stablecoin infrastructure provider Bridge and announced a handful of new products

- Coinbase released an agentic payments standard with support for stablecoin payments

- Visa and Mastercard enhanced stablecoin support

- Meta is reportedly in talks to introduce stablecoins as a means for payouts

Source: Visa (as of June 2025)

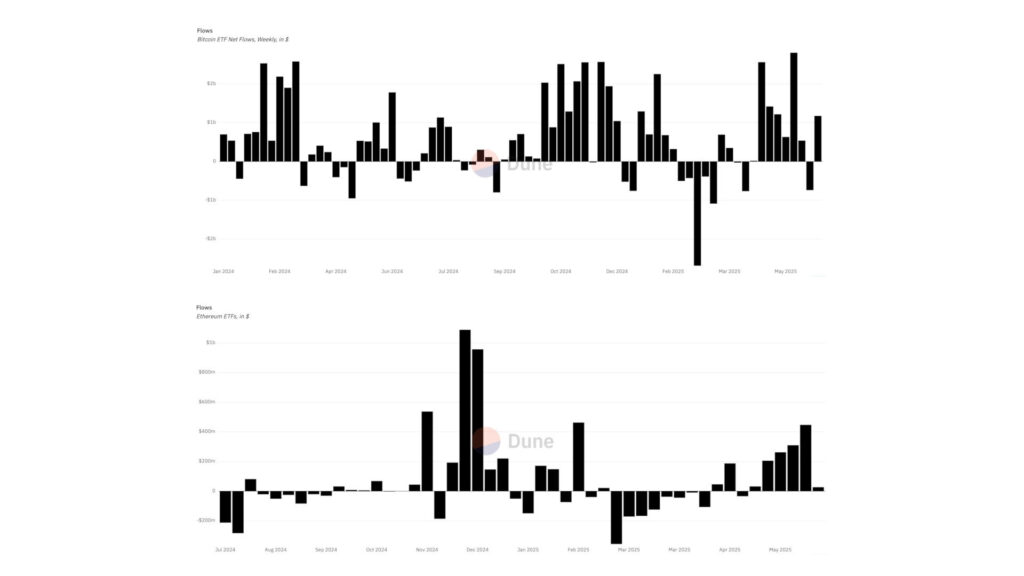

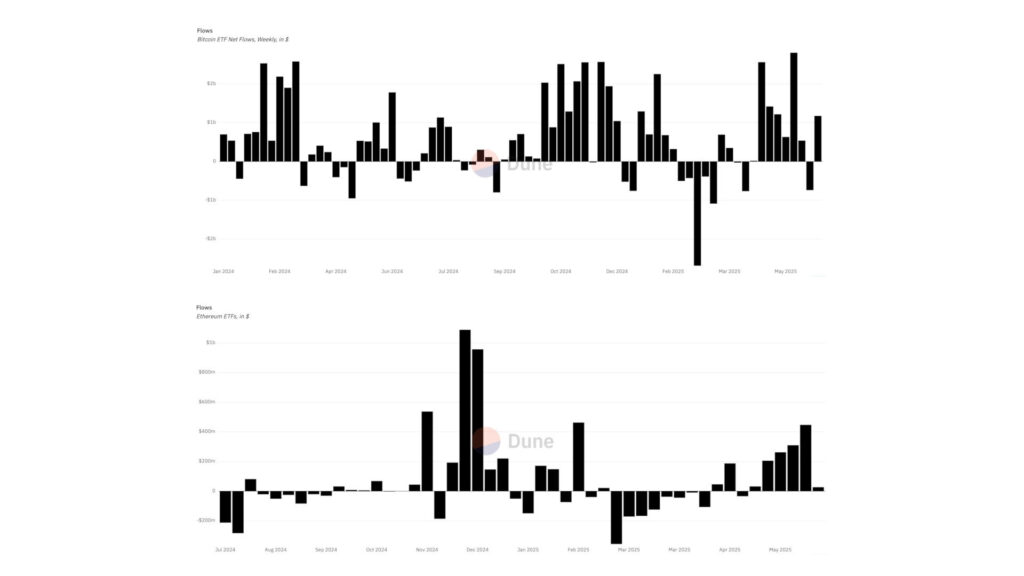

3/ ETP net flows (Bitcoin and Ethereum): +28%

June 2025: $45B total ETP net flows ($42B BTC, $3.4B ETH)

End of 2024: $35B total ETP net flows ($33B BTC, $2.4B ETH)

Why it matters:

Institutional capital entering crypto is a sign of the industry’s overall maturity. As regulations become more clear and the key distributors start to activate, net flows into the ETPs should continue to grow.

Relevant news:

- The SEC recently requested spot Solana exchange-traded fund (ETF) issuers to update their S-1 filings, suggesting that approval could occur sometime in the near future.

Source: Dune @hildobby (as of June 2025)

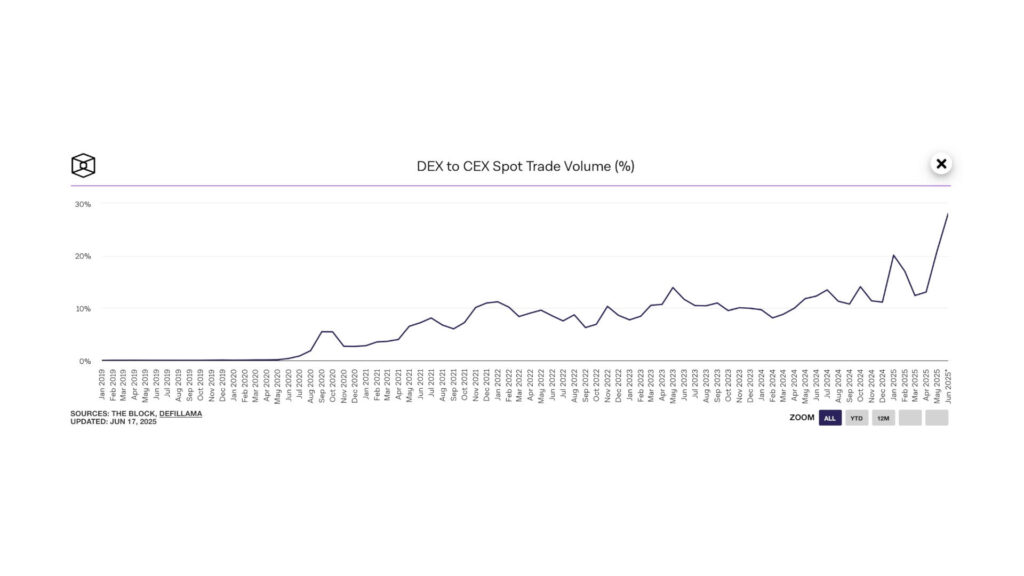

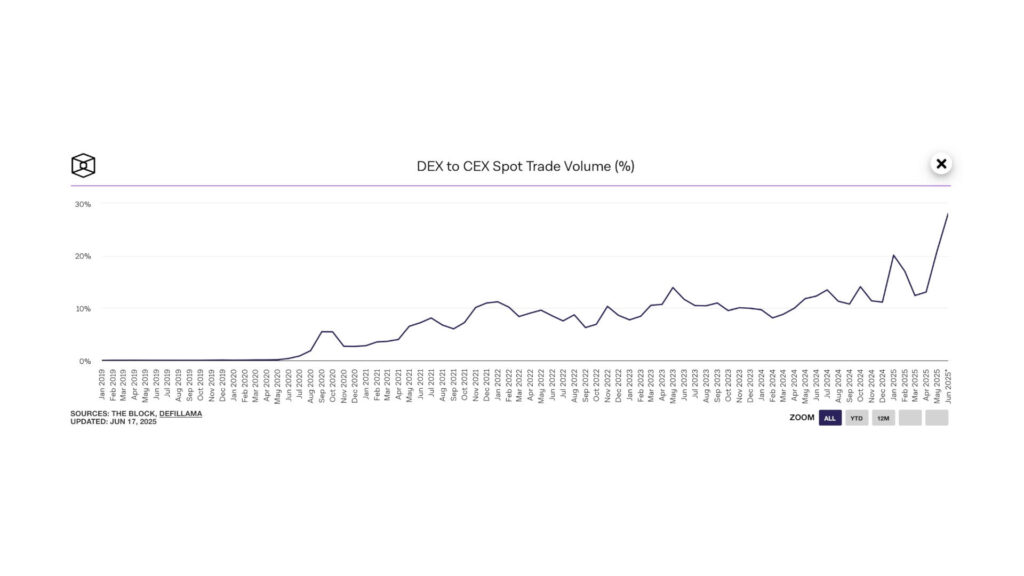

4/ DEX to CEX spot trade volume: +51%

2025 average: 17% monthly DEX-to-CEX volume

2024 average: 11% monthly DEX-to-CEX volume

Why it matters:

As more people come onchain, we expect to see decentralized exchange (DEX) usage increase relative to their centralized-exchange counterparts (CEXs) when it comes to trading crypto. The increasing ratio highlights the overall development of the DeFi ecosystem.

Relevant news:

- Coinbase just announced native DEX trading directly from the Coinbase app, making thousands of new assets available to trade.

Source: The Block (as of June 2025)

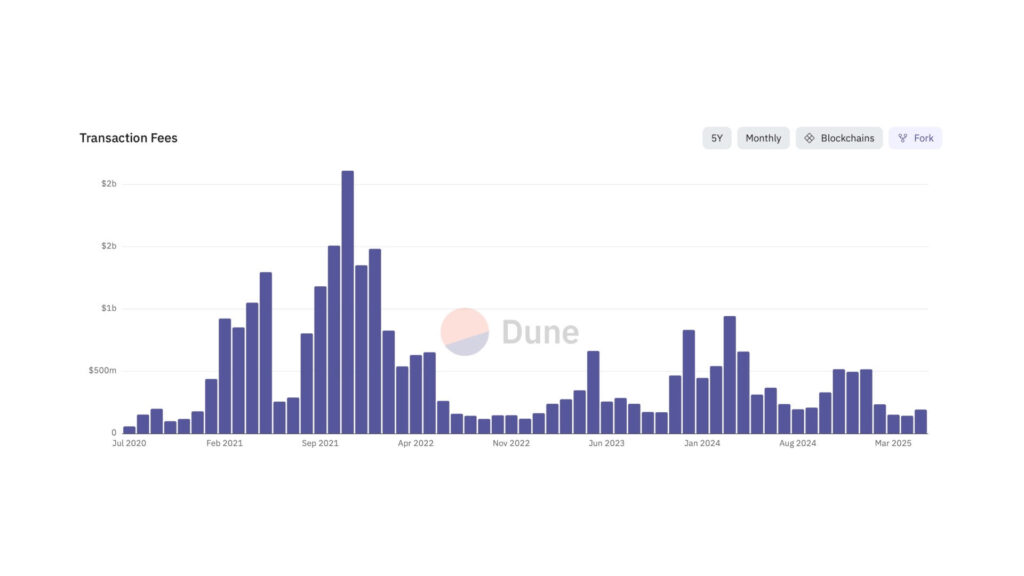

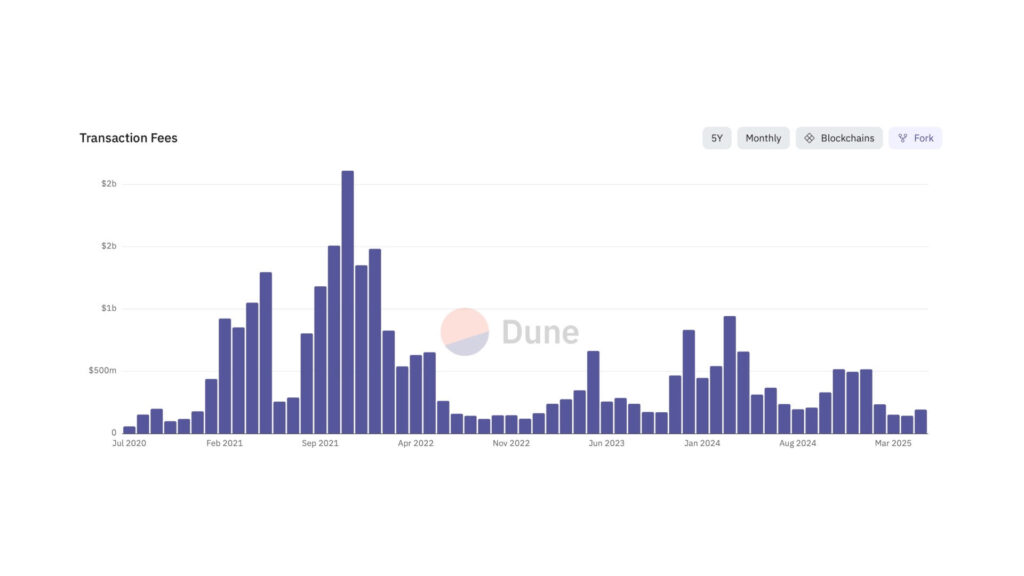

5/ Total transaction fees (demand for blockspace): -43%

2025 average: $239M monthly transaction fees

2024 average: $439M monthly transaction fees

Why it matters:

The total amount of USD-denominated transaction fees shows the aggregate demand — that is, the real economic value — for blockspace on a given chain.

However, this metric comes with lots of nuance, since most projects are explicitly trying to bring down fees for users. Which is why it’s important also to consider unit transaction costs — meaning the cost for a given amount of blockchain resources. Ideally, the overall demand (total transaction fees) grows, while gas fees (cost per unit of resources used) remain low.

Relevant news:

- Recently, we’ve seen lots of debates on X around the importance of this metric (and related metrics, like REV).

Source: Dune (as of June 2025)

Source: Dune (as of June 2025)

+++

Here’s one more bonus metric I’ll be watching: the number of tokens with >$1M in monthly net revenue. As of June 2025, there are only 22 (source: Token Terminal).

With the new regulatory environment and upcoming market structure legislation, the path is finally opening up for tokens to complete the economic loop. This should result in more projects accruing value directly to tokens in the form of revenue, leading to a much healthier token economy.

***

Daren Matsuoka is a data science partner at a16z crypto, where he supports deal flow and portfolio companies. Prior to a16z, he was a Data Scientist at SVB Capital where he developed and managed a proprietary data and analytics platform.

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.