Over the past year, social tokens — those issued by creators and communities to access exclusive perks and invest in works — have taken off in the world of crypto and beyond. Celebrity artists and athletes like rapper Lil Yachty, Grammy-award winning musician RAC, and NBA point guard Spencer Dinwiddie have all introduced tokens to give fans a stake in their work. And though community tokens are still a burgeoning (and evolving) concept, several interesting examples have emerged: there are tokens dedicated to maximizing yield (aka “yield farming” on DeFi or decentralized finance protocols); token-gated communities such as Friends With Benefits (FWB), which is tied to a private Discord server for creators; and entire platforms for launching token economies.

While their forms and functions vary, the common ethos behind social tokens is that they align participants behind a collective mission through participation or ownership. That community-first mentality is shared by many early adopters in the crypto ecosystem; it’s considered a core component of cryptocurrency resilience and governance. Decentralization means community ownership, and that can only happen, the thinking goes, if the token is owned and operated by said community.

But what purists miss in their devotion to the collective is that all communities start with an individual creator. After all, the yield farming token YFI is the brainchild of Andre Cronje, the founder of Yearn Finance; FWB was hatched by Cooper Turley, who leads crypto strategy at Audius, and Brud CEO Trevor McFedries, the co-creator behind the digital influencer Miquela and friends. Would any of these communities take off without visionary individual creators?

That’s why I believe that creator tokens are not only the best way to start a social token, but that, as the “minimum-viable DAO,” they will achieve mainstream status before community tokens will. In an industry that is often perceived as complicated or aggravating by outsiders, the concept behind a creator token is straightforward: investing in a person — in human capital — rather than a company or group. I should know.

I, token

Last year I “tokenized” myself, meaning I created a tradeable cryptocurrency whose ticker, utility, and goal centered on me. I raised $20,000 in just four days. In contrast to a more cooperative, community-focused ethos, my mission was explicitly self-serving: to raise enough funds to move to San Francisco and launch a crypto startup.

At the time, I was a hopeful entrepreneur attending Ethereum conferences and hoping to break into Silicon Valley. Though I was active in the Ethereum community and had founded a project to issue loans against NFTs, I was seeking a larger, purpose-driven project. Then in March, at the start of the pandemic, I lost all my savings in a single DeFi transaction. But though I was short on funds, I was rich in social capital — I had amassed more than 17,000 followers on Twitter alone. So that week, onstage at an Ethereum conference in my hometown of Paris, I announced the beginning of my private token, $ALEX. The goal was simple: to make enough money to independently afford to hire an immigration lawyer and fly to the U.S.

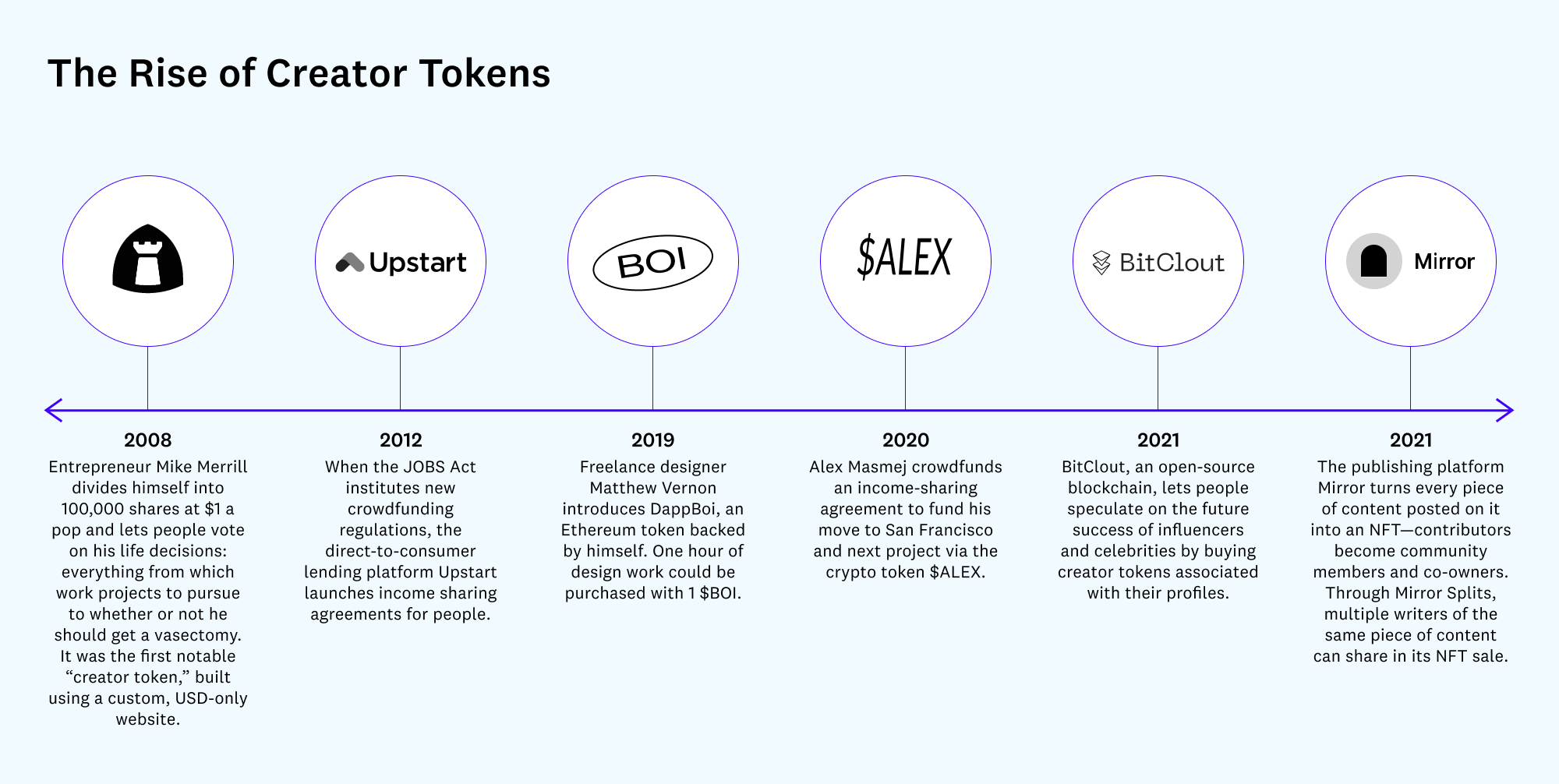

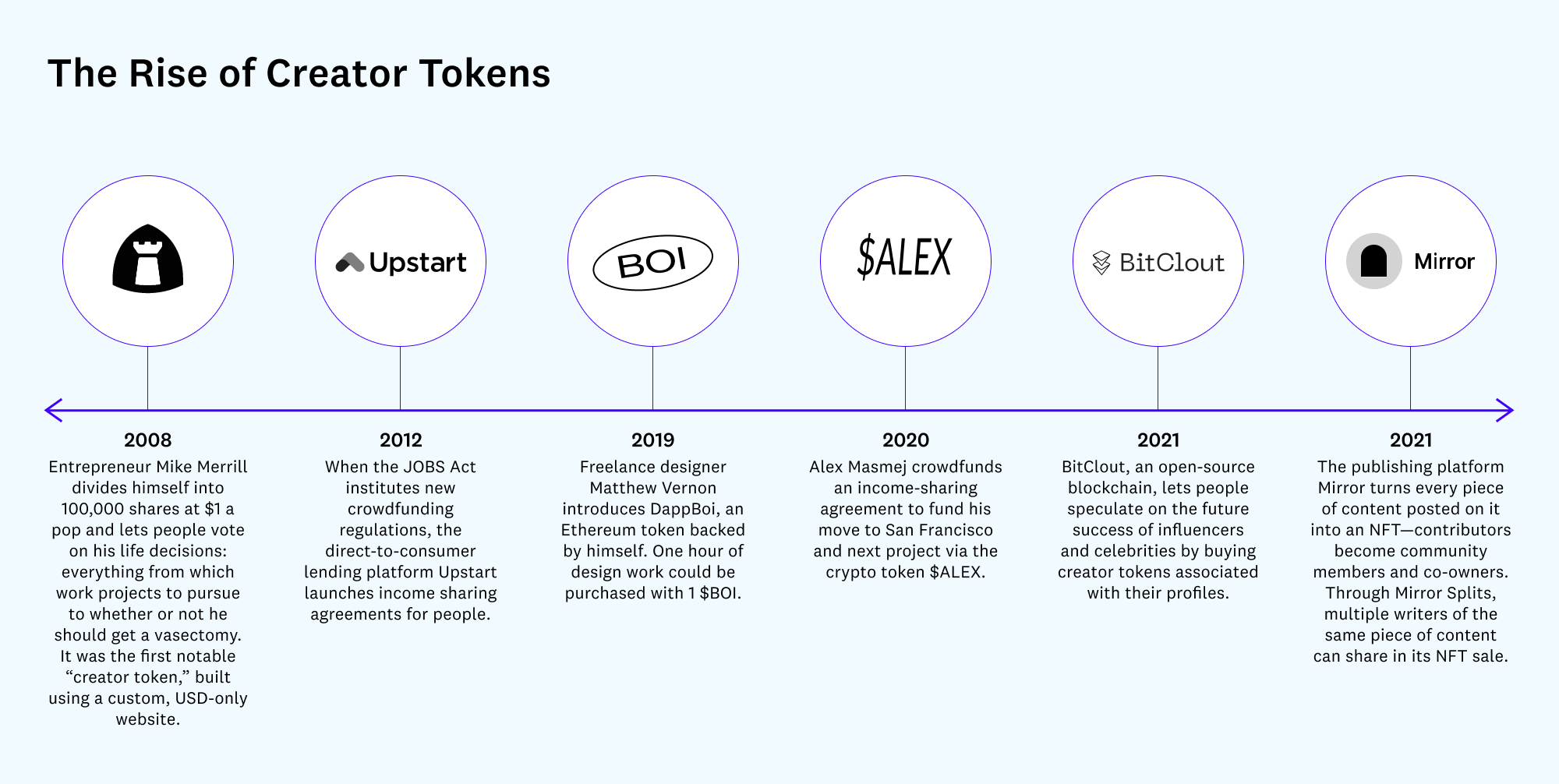

An informal Income Sharing Agreement (ISA), $ALEX was funded by patrons who would receive 15 percent of my income over the next three years, in $ALEX, capped at $100,000. The income airdrop would be distributed to shareholders on a quarterly basis at Uniswap market price. Though I originally accepted 30 $ALEX backers, I later launched experiments for non–ISA holders, including a monthly newsletter, a private Telegram group, and, most successfully, a voting system called “Control My Life” that let people dictate my daily habits. (The latter was inspired by Mike Merrill, the “world’s first publicly traded person,” who let people direct his life decisions.) Others have launched “personal tokens” too, offering their skills and services: The designer Matthew Vernon, for instance, did this a couple years ago with his DappBoi experiment.

In my case, my token holders controlled one habit in my personal life, such as whether I should become vegan or whether I should go on a 3-mile run every day for a month.

I went from the initial idea to meeting my fundraising goal in less than a week with just a blog post and social currency — I used Twitter to distribute a simple Google form. Currently, there are over 600 $ALEX holders, all of whom get access to my exclusive Telegram group chat.

This low barrier to entry is a major reason I believe creator tokens will outpace community tokens and DAOs, at least for the bootstrapping phase. The Power Law principle applies to community involvement, too: the top 1 percent will always be more involved, as leaders are naturally established, and there will be more social tokens that break into the mainstream. While my own “human IPO” took less than a week, community tokens often take months to architect, coordinate, and educate members on the admission and voting process. Of course, critics may argue that this is because building a community requires far more care and planning, which is indeed the case. But even communities that are outwardly viewed as “bottoms-up” and “leaderless” are still sparked by an initial creator’s efforts and built upon their central authority.

Why did I do this through crypto and not by crowdfunding or a more traditional ISA? Because of the speed, the global reach, and the lack of fees. In five days, strangers from all around the world sent a total of $20,000 to my Ethereum wallet. Though I am a French citizen, my audience isn’t primarily French, so extra fees and currency conversions would have made traditional avenues more costly. And let’s address the elephant in the room: at 23 years old, most of my peers are taking out student loans, which often buries them in debt regardless of how much money (or not) they make later. I believe a crypto ISA really is the best choice, not only from a technological standpoint but also in terms of financial alignment: People are now incentivized to see me succeed.

Personal and clout-based creator tokens are often criticized for being dystopian, like a social credit score or review system for people, particularly since decentralization (and therefore community ownership) is the desired endgame. But the vision behind creator tokens and community tokens are not, in fact, at odds. While the idea of a “human IPO” may seem like a stunt at first glance, I believe it is a harbinger of what’s to come. With my seemingly superficial “Control My Life” experiment, for example, the Ethereum developer Austin Griffith and I were among the first to adopt the sign-to-vote “snapshot” governance that is now used in major DeFi protocols. Through this method, users of a protocol can vote on governance decisions without paying the Ethereum network’s expensive gas fees — this allows crypto projects to more effectively gauge community sentiment when making decisions.

If you look close enough, every successful community — from creator fanbases to thriving open source projects — is initially sparked by a lone leader who embodies a set of values that then attracts others. Crypto may have added economic incentives to accelerate and finance this process, but the natural attraction to a leader remains.

I believe community tokens should start small, with one or a few founding creators, similar to the way a magnetic founder rallies users around his or her company’s mission. Projects often expand and scale, but you need singular focus and cohesion early on. This is why I argue that the gateway to community tokens is the individual, not the community itself.

- The Creator Phase: This is the phase where the solo creator ties themselves to a simple use case with a strong hook, whether an income sharing agreement, exclusive content rights (unlockable for holders), or voting rights. The artist Connie Digital, for instance, rewarded his community with $HUE for a shout-out on a virtual billboard; the rapper Lil Yachty issued exclusive surprise boxes and virtual parties to $YACHTY holders.

- The Community Phase: Once a project matures, a founding creator can choose to empower his or her community, rewarding contributors for their efforts and/or making them active participants. More contributors lead to more investment in the project and more use cases that engage community members over time.

To give one example, FWB’s initial use case was access to a Discord server maintained by its creators. Its “Season Two” plan introduced a larger set of leaders who curate content from the community, in addition to hosting group chats. This is not uncommon in open source projects and other strong communities, but with tokens, incentives are aligned with economics.

As I note above, transitioning from a creator to a collective requires having community members who are sufficiently committed — who can help educate, pass down information, proactively submit feedback and more. If this engagement doesn’t happen organically, then the creator could create paid jobs with crypto incentives that encourage people to take on more active roles. The creator leadership slowly shifts to encompass more people, and the mission statement broadens so that it no longer relies on a single person, ultimately fulfilling the purist crypto vision of a Decentralized Autonomous Organization (DAO).

The act of summoning community members is not new, but the ability to align incentives while doing so — and expand from there — presents all sorts of possibilities. Consider, for instance, an index of young founders on Pioneer, the online network platform for “outsiders”: musicians could create community-owned labels and bands; newsletter writers could create community-owned media publications (and are already doing so); and so on. It’s just one of many examples that illustrate how lowering the barrier to entry allows people to align their goals and interests. Since anyone anywhere can form and support a creator’s community, this model is especially alluring to outsiders without existing connections or similar resources.

* * *

Communities — both crypto and cultural — are built on individuals. The language of “community” tends to homogenize a group of people who are more than the sum of their parts, but those parts are where it’s at. That’s where we need to start if we want social tokens to enter the mainstream. I believe it’s the future not just for creators, but for many social networks, where the individual is at the center of every node.